The evolution of the imaging IT market in the U.S. over the past decade has been messy. Previously clear definitions for PACS and RIS have blurred, and healthcare providers have struggled to keep up. Consequently, the sector is in a state of uncertainty and flux as it slowly travels the path toward enterprise imaging.

Radiologists have found that their influence over decision-making for new software has dwindled, a trend that's intensified with new market competitors offering disruptive alternative business models and products. Based on our recently released research on the imaging IT and archiving and management IT software market, here's our view of the market today and, ultimately, where we're headed.

Stephen Holloway from Signify Research.

Stephen Holloway from Signify Research.Definitions, in context

First, let's get on the same page from a definition perspective. Perhaps the biggest challenge facing vendors and providers alike is a lack of industry standardization on product definition in imaging IT. It was easy when radiology was a standalone island unto itself. However, with digitization occurring across all departments and entities, a standalone definition makes little sense.

Instead, we should consider not only the core functionality, but also the wider context of the solutions and their interfaces, e.g., the broader model of implementation. The expansion of imaging into the wider healthcare enterprise, combined with the requirement for integration with nonimaging data, demands this. As such, it is no longer the model of imaging IT that should be discussed, but the model of clinical content management.

Our view of the most common models of clinical content management in the U.S. today is described in the following table.

| Clinical content management models | ||

| Model | Core offering | Implementation |

| Standalone | Core clinical software offering (e.g., radiology PACS, RIS, advanced visualization), image exchange, viewer, etc. | Single purpose, from single vendor, e.g., sold into radiology department; no enterprise input or interface |

| Best of breed ("deconstructed PACS") | Combining standalone clinical software modules into a unique, customized software solution | Varying degrees of implementation; usually multivendor; healthcare provider commonly resources and coordinates implementation and integration of solutions |

| Enterprise imaging | Combined platform approach to imaging IT (e.g., integrated PACS, RIS, advanced visualization, viewer, archive, workflow tools) | Single-vendor offering; commonly implemented as an upgrade to existing PACS, especially with incumbent vendor |

| Vendor-neutral archive (VNA)/independent clinical archive (ICA)-enabled | Use of VNA or ICA to combine DICOM and non-DICOM content from multiple standalone software systems; increasingly includes workflow tools and clinical review | Single vendor for VNA/ICA aspect but partnership for diagnostic software; used also as "stepping stone" to enterprise imaging/best-of-breed models following provider merger and acquisition consolidation or network expansion |

| Enterprise content application and viewing | Expansion of enterprise content management (ECM) solution, usually driven by electronic medical record (EMR), into handling clinical content (both DICOM and non-DICOM) | ECM commonly defined by EMR incumbent vendor; does not offer full diagnostic radiology capability so partnership with specialist vendor is common |

Each of the above models of clinical content management has a dominant focus behind it. Providers today must therefore choose which "flavor" suits their needs most -- be it top clinical functionality, interoperability of diverse clinical content, or a desire to have a single-vendor, integrated platform.

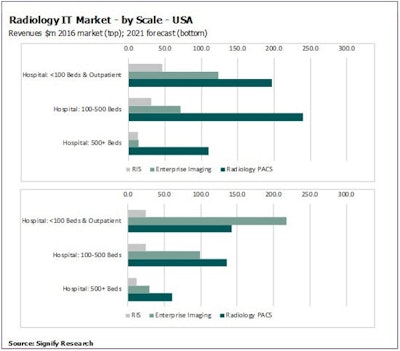

Each to their own, and why scale matters

Our research findings also pointed to two often overlooked yet fundamental points:

- The scale of the provider is a major determinant of imaging IT strategy.

- There is no "one size fits all" product offering on the market today.

While it may sound simplistic, too often in imaging IT, single solutions have been pushed to multiple provider size types. Academic medical centers have far different priorities (e.g., best-of-breed clinical features, breadth of clinical content) than small community hospitals (e.g., cost, core functionality, interoperability).

When looking at the market from a scale perspective, we observed some clear trends of implementation dependent on scale. "Best-of-breed" models of implementation are pretty much limited to academic medical centers and the like that are willing to invest the significant resources (e.g., staffing, administration, funding) and time to create a customized, multivendor solution for their needs.

In contrast, mid- and large-sized hospitals and health networks need to balance clinical capability, cost, and interoperability. As a result, they have generally opted for "VNA/ICA-enabled" solutions or enterprise imaging models. The VNA/ICA option offers a centralizing of imaging and nonimaging content in a central repository without the need to completely replace legacy PACS and other clinical IT systems. Many use this as a short- to midterm fix, especially within health networks undergoing significant consolidation.

Enterprise imaging is in most cases a stepwise addition and/or centralizing of diagnostic imaging functionality into a single-vendor, single-platform solution. Although it's not exclusively incumbent-led, this approach is most commonly driven by an upgrade from an incumbent PACS vendor to limit migration challenges from a new vendor. Wider influences also may play a role here, as the choice of imaging modality or clinical hardware can play a part with bundled tendering.

Smaller providers have less need for complex interfacing or top-end clinical features, so penetration of best-of-breed and enterprise imaging has been far less. Perhaps here there has also been the most innovation, however. Providers in this market have been more willing to shift to hybrid or hosted architecture models to limit future hardware and administration costs.

Moreover, with margins tight, a focus on workflow efficiency and federated case-load management tools have become a priority and are now seeping into products for larger providers too. Business models have also started to change in this provider segment; managed services -- often tied to cloud architecture -- are slowly becoming more commonplace, breaking the mold of traditional capital-expenditure-heavy imaging IT. A mixture of standalone, enterprise imaging, and VNA/ICA-enabled models is taking hold as a consequence.

The juicy middle

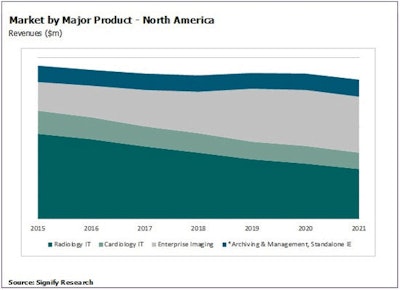

Looking forward, we project that the above differentiation by provider scale will continue and become more pronounced. As you can see from our data figures, enterprise imaging is set to significantly gain share in terms of market revenue. Why? Because it is the path of least resistance for most providers. Many have also become well used to the single-vendor, "one-throat-to-choke" mindset of single-vendor solutions given their recent enterprise EMR implementations.

It is no surprise that the largest imaging IT vendors, such as GE Healthcare, IBM Merge Healthcare, Philips Healthcare, Agfa HealthCare, Carestream Health, and Siemens Healthineers have all made significant pushes toward the enterprise imaging model. They usually offer a solid balance of clinical breadth and support with imaging and clinical hardware expertise at aggressive price points. As we also continue to see the start of more risk-sharing and long-term managed service contracting, these vendors will become more embedded and incumbent in healthcare providers' networks.

Wider adoption of enterprise imaging does come at a cost, though. Few of these solutions can offer real interoperability, especially for non-DICOM data; native format ingestion, communication, and return to source in native format capability is beyond most enterprise imaging offerings, as they are based on extension of traditional DICOM PACS software. Few vendors also have much experience with higher maturity offerings for archiving and management -- such as Cross-Enterprise Document Sharing (XDS)-enabled data repositories. This means the potential for true enterprise imaging across health networks is limited to core DICOM applications or limited by the proprietary nature of incumbent PACS solutions.

A missed opportunity?

In summary, the imaging IT market in the U.S. has been through a tumultuous period. Provider consolidation, rapid legislative change, limited radiologist resourcing, and new competitor entries have shaped, reshaped, and disrupted the status quo. This has created a marketplace with few common models of implementation, unclear definition, and little clarity for future direction.

Provider needs are increasingly scale-dependent, driving a multitiered marketplace. Market innovation has been limited only to those at the extremes. Combined with challenging market conditions, the majority are seeking the path of least resistance, often overlooking or abandoning the most important issues today: interoperability, connectivity, and return on investment.

Enterprise imaging offerings from the largest incumbent vendors are best positioned to capitalize in this scenario, despite offering limited capability. With most healthcare providers "settling" for enterprise imaging, the client outlook for the U.S. market appears to be on a slow road to mediocrity for clinical content management capability.

Stephen Holloway is principal analyst and company director at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.