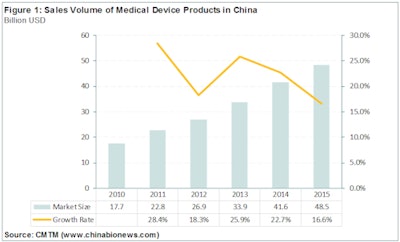

China is one of the largest medical device markets in the world, with a total sales volume of $48.5 billion in 2015. This represents a compound annual growth rate (CAGR) of 22.3% from 2010 to 2015. Growth in the Chinese medical device market is estimated to slow to a rate of 15% in the next few years.

These estimates are based on our long-term tracking and analysis of policies and guidelines, healthcare resources and medical services, and population and disease rates, as well as interviews with experienced industry experts in different market segments. The findings are included in our new report, "China Medical Device Industry Yearbook - 2016.

While there's little doubt that the Chinese medical device market will keep growing in the future, questions remain about the market's growth rate and drivers for expansion.

Images courtesy of Owen Tang.

Images courtesy of Owen Tang.Policies and guidelines

Chinese governments, including both central and local governments, are playing key roles in the country's medical device industry, which includes 14,000 local medical device manufacturers and 186,000 dealers. In recent years, Chinese governments have released a series of policies and guidelines to support the development of the medical device industry, covering medical device registration, manufacturing, distribution, and recalls, as well as hospital procurement.

The medical device industry is one of the 10 key sectors of the Made in China 2025 program, which was released by China's State Council in May 2015 with the aim of promoting manufacturing in the country. The program supports the innovation and industrialization of the medical device industry, which includes medical imaging equipment, medical robots, cardiovascular stents, and mobile health, as well as 3D printing.

Earlier in January 2012, China's Ministry of Science and Technology released the 12th Five-Year Plan for Medical Device Development, designed to support innovative medical device products, especially medical imaging products. A panel discussion for the plan was held in Beijing this summer, covering the topics of development segments, innovative technologies, and key products, as well as policies. It is quite clear that local medical device products will be strongly supported in the next five years.

Population and health expenses

There were 1.375 billion people in China as of 2015, with a natural population growth rate of 4.96%, with 10.5% of people older than age 65. The population of those above 65 has kept growing, at a rate of around 4% in recent years.

Meanwhile, there were approximately 300 million people in China with chronic diseases, including cardiovascular ailments, tumors, diabetes, and respiratory diseases. Among all tumors, lung cancer and breast cancer have the highest incidence in men and women, respectively. With increasing incidence in recent years, control of chronic diseases has become one of the key tasks for the government.

China's total healthcare expenses -- including government, social, and personal spending -- have continued to grow in recent years and reached RMB 4 trillion ($593 billion) in 2015, 6% of China's total gross domestic product, while annual healthcare expenses per person were RMB 2,952 ($438).

Healthcare resources and medical services

There are nearly 1 million healthcare institutions in China, composed of hospitals, grassroots healthcare institutions, and specialized public healthcare institutions. The total number of Chinese hospitals increased from 19,712 in 2008 to 27,226 in 2015, a CAGR of 4.7%. This was mainly due to the growth of private hospitals, which increased from 5,403 facilities in 2008 to 14,049 sites in 2015, a CAGR of 14.6%.

The total number of patient visits in China in the first half of 2016 reached 3.85 billion, a growth of 2.3% over the corresponding period of 2015. Patient visits to public hospitals and private hospitals reached 1.38 billion and 190 million, respectively, representing growth of 4.6% and 18.5% over the period, respectively.

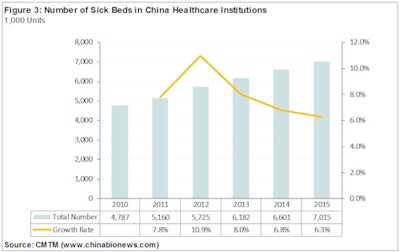

The total number of sick beds in Chinese healthcare institutions increased from 4.8 million in 2010 to 7 million in 2015, a CAGR of 7.9%. Sick beds in hospitals accounted for 76% of all hospital beds, and in 2015 more than 90% of new sick beds were added in hospitals. The ratio of sick beds per 1,000 people increased from 4.83 in 2014 to 5.11 in 2015, and it is expected to reach 6.00 by 2020, according to the government guideline.

China still lacks healthcare professionals, including both physicians and nurses, and there are expected to be 2,500 physicians and 3,140 nurses per million people by 2020.

Players and opportunities

China has been one of the most important medical device markets in the world for many multinational companies such as GE Healthcare, Philips Healthcare, Medtronic, Boston Scientific, and Stryker, which have been actively expanding their China business via a series of strategic actions, including investments, mergers and acquisitions, localization, and partnerships.

Medical imaging scanners, in vitro diagnostics, cardiovascular devices, and orthopedics are the main segments in the Chinese medical device market, which together accounted for more than 60% of the total market size.

As the largest segment of the Chinese medical device industry, the medical imaging market will keep growing, with demand mainly stimulated by county-based hospitals and township health centers, according to Yong Yi, marketing director at Shenzhen-based Wisonic, a manufacturer of color ultrasound imaging equipment, patient monitors, and telehealthcare products. China plans to set up a hierarchical medical system to improve medical services at county hospitals and township health centers, especially in less-developed areas; this will increase patient visits to these healthcare institutions and, accordingly, increase the demand for medical devices such as clinical analyzers and CT, digital radiography, and ultrasound equipment, Yi said.

Medical devices are the hot segment for healthcare investment, with the number of cases increasing in recent years, according to Howard Zhao, managing director at Share Capital. (Share has invested in a series of healthcare companies including Dr. Smile Medical Group, BGI, and WeiMai Medical Equipment, a Beijing-based manufacturer of digital subtraction angiography equipment, as well as JuRong Medical Technology, a Hangzhou-based manufacturer of ultrasound imaging equipment.) With government support and increasing demand on the healthcare system, more new companies have been founded by executives who had worked for leading companies. Most of them are quite ambitious and are familiar with healthcare markets and technologies, Zhao said; the arrival of these firms is bringing better investment opportunities.

There are more than 600 medical device manufacturers and 2,000 dealers in the city of Shenzhen, with an output value of medical device products of RMB 30 billion ($4.45 billion) in 2015 and an annual growth rate above 20%. As one of the key medical device industry clusters in China, there are many leading companies in Shenzhen, including Mindray, SonoScape, Edan, and Landwind, manufactures of medical imaging equipment, medical electronics, and in vitro diagnostics equipment, according to Xiaohua Zhang, general secretary at Shenzhen Association of Medical Devices. Most companies in Shenzhen are privately held, and they are more willing to enter into new market segments to seek development opportunities, Zhang said. Shenzhen is also one of the key cities for exporting medical device products.

With stable growth and great potential, the market for medical devices in China has attracted many kinds of players, including manufacturers, dealers, suppliers, and investors. Facing an increasing older population and incidence of chronic diseases, governments in China are trying to provide medical services via a hierarchical medical system, with low costs and good quality. Under this situation, the Chinese medical device industry will evolve with strong support, strict oversight, and the involvement of a large number of global players. In future articles, we will cover hot topics and potential new markets in more detail.

Based in Shanghai, China MedTech Marketing (CMTM) is the professional information and marketing solutions provider for the Chinese medical technology industry. With two websites, one in English and one in Chinese, CMTM provides research, databases, newsletters, and consulting projects for clients. For questions, please contact founder Owen Tang at [email protected].

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.