French contrast agent developer Guerbet isn't exactly a household name in the U.S., but the company hopes this will change with the launch this summer of its MRI contrast agent Dotarem. Guerbet plans to make the agent's safety profile a major component of its upcoming campaign.

Both Guerbet and Dotarem have long pedigrees. Guerbet was founded in 1926 to commercialize Lipiodol, an iodized oil that was found to have opacifying properties a few years after it was invented by Marcel Guerbet in 1901. In the decades after its founding, Guerbet introduced a range of x-ray contrast agents, including Telebrix, Hexabrix, and Xenetix.

The company entered the international MRI contrast market in 1989 with the launch of Dotarem. Since then, sales of Dotarem and other Guerbet MRI agents such as Endorem and Lumirem have grown, such that 40.2% of the company's $525.7 million (403 million euros) in annual revenues now come from MRI, with 50.4% deriving from x-ray and the rest from other products.

But Guerbet has never made the U.S. a major focus of its efforts, apart from its 2002 acquisition from Cook of a nonionic x-ray contrast agent, Oxilan. Today, some 70% of Guerbet's revenues are from Europe, with the remainder coming from the rest of the world.

Other than Oxilan, Hexabrix is the only x-ray agent being sold in the U.S., while Guerbet imports Lipiodol under temporary regulatory certification for drugs that are in short supply. Neither Endorem nor Lumirem are sold in the U.S.

The opportunity

Things began to change in 2006, when reports began surfacing of a mysterious illness, nephrogenic systemic fibrosis (NSF), that was debilitating and sometimes fatal in patients. NSF soon became tied to the administration of some gadolinium-based contrast agents (GBCAs), particularly in patients with compromised kidney function.

As researchers began to understand more about the link between NSF and GBCAs, Guerbet executives realized that Dotarem fell into the category of those MRI contrast agents with better safety profiles, according to Massimo Carrara, general manager of Guerbet USA.

GBCAs consist of a gadolinium ion connected to a ligand (also known as a chelating agent) that holds the gadolinium in a cagelike molecule, preventing the body from being exposed to the gadolinium, which is highly toxic. GBCAs have chemical structures that are either macrocyclic or linear, and are either ionic or nonionic.

A good MRI contrast agent should get the contrast molecule through the patient without breaking apart, Carrara said. If the bond is broken between the chelant and the gadolinium, free gadolinium can be released, causing both acute and chronic toxicity that is believed to be linked with the risk of developing NSF.

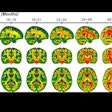

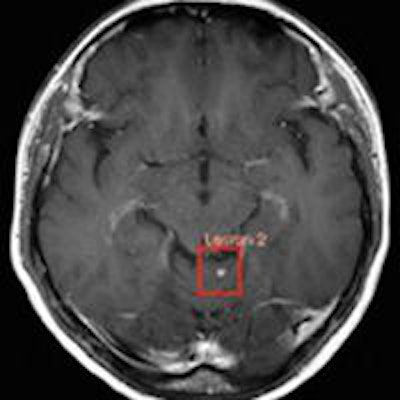

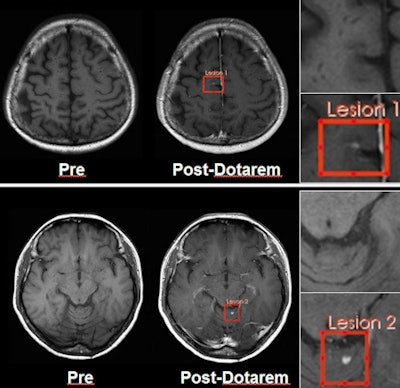

Images show two lesions in a 41-year-old woman with hemangioblastoma disease, acquired on 3-tesla MRI. Images at left are precontrast; images at right are after Dotarem administration. Image courtesy of Guerbet.

Images show two lesions in a 41-year-old woman with hemangioblastoma disease, acquired on 3-tesla MRI. Images at left are precontrast; images at right are after Dotarem administration. Image courtesy of Guerbet.Experience with NSF indicates that the agents are likely to be safest if they have either macrocyclic or ionic properties, and Dotarem has both, Carrara said. Regarding the agent's safety profile, there have been 37 million administrations of Dotarem since it came on the European market in 1989, and there has been no confirmed case of NSF that could be attributed to Dotarem when used exclusively without any other GBCA in a patient.

"The ionicity strengthens the bond of the chelate and makes it very difficult for gadolinium to escape from the molecule," Carrara said. "It's not just the macrocyclic structure, but also the combination with ionicity that makes Dotarem very unique."

It's Dotarem's safety profile that prompted Guerbet to begin planning a U.S. launch of the product. The NSF crisis resulted in stronger growth for the product in other global regions, and the company concluded that it was time to tackle the world's largest contrast market, Carrara said.

Priority review

Guerbet began contact with the U.S. Food and Drug Administration (FDA) in 2009 regarding a central nervous system (CNS) indication for Dotarem. Priority review status was granted based on the firm's goal of securing a CNS indication for children younger than 2 years old -- there is still no GBCA approved for any use in such young children. A new drug application (NDA) for the product was submitted in September 2012.

Massimo Carrara, general manager of Guerbet USA.

Massimo Carrara, general manager of Guerbet USA.

The FDA signed off on the NDA in March, following a unanimous recommendation from an FDA advisory panel on use of the agent in patients older than 2 years. Although the FDA did not approve Dotarem's indication for patients younger than 2, Guerbet is working with the FDA on the clinical data needed to support this application.

Dotarem's labeling covers intravenous use with MRI for brain (intracranial), spine, and associated tissues in adults and pediatric patients 2 years of age and older to detect and visualize areas with disruption of the blood-brain barrier and/or abnormal vascularity. The labeling also includes text noting that "NSF has not been reported in patients with a clear history of exposure to Dotarem alone."

Guerbet has begun building up its U.S. presence in preparation for the first deliveries of Dotarem in the summer, and it has started exhibiting at conferences such as the International Society for Magnetic Resonance in Medicine (ISMRM) and the American Society of Neuroradiology (ASNR). Carrara joined Guerbet in 2012 and is a veteran of the contrast industry, having served stints as an executive with Bracco Imaging and Amersham (now GE Healthcare Bio-Sciences).

Carrara expects that Dotarem will sell for a slight premium over other MRI contrast agents, which Guerbet believes is justified given the product's benefit in special patient populations. Carrara believes that Dotarem's safety profile and established track record will help Guerbet carve out a position in the highly competitive U.S. MRI contrast market.

"We are a new company with incredible experience: That is our value proposition," he said. "It's really about the comfort of having over 37 million patient administrations, a unique molecular structure, and a safety record on one of the most dramatic issues in the industry."

.fFmgij6Hin.png?auto=compress%2Cformat&fit=crop&h=100&q=70&w=100)

.fFmgij6Hin.png?auto=compress%2Cformat&fit=crop&h=167&q=70&w=250)