Private equity money has been flowing readily into healthcare in recent years, and radiology is no exception. But what will be the long-term impact of this investment, and how will it change the specialty? Evidence indicates major changes are already underway.

The value of private equity acquisitions in healthcare climbed from $42 billion in 2010 to nearly $120 billion in 2019, for a total of $750 billion over the last decade, with outpatient practices taking the lion's share, according to a report by economist Richard Scheffler, PhD, et al for the American Antitrust Institute and the University of Berkeley School of Public Health.

"The current financial environment with low interest rates and high liquidity is fueling a robust M&A market in general and healthcare has always been seen as a relatively stable and secure investment," said Dr. Howard Fleishon, chair of the Board of Chancellors of the American Board of Radiology (ACR), told AuntMinnie.com.

Dr. Howard Fleishon.

Dr. Howard Fleishon.Private equity's initial areas of interest were dermatology, emergency medicine, and anesthesia, said Daniel Corbett, chief of business development at Radiology Business Solutions, a national practice management firm based in Flint, MI. Dermatology turned out to be a "cash cow" because of the economies built into that type of work and is now dominated by corporate ownership, he noted. When money talks, Wall Street listens, and entrepreneurial people have been jumping in and gobbling up medical practices, Corbett said.

Radiology is still relatively fragmented compared to other specialties, which investors see as a potential opportunity, Fleishon noted. Technology enabling the decentralized delivery of services -- that is, teleradiology -- is readily available, Fleishon noted.

Healthcare expenditures generally and utilization of radiology specifically are set for continued growth at least for the intermediate term with an aging population and a rise in the size of the Medicare population, Fleishon explained.

Daniel Corbett.

Daniel Corbett.In radiology, private equity firms have been gravitating toward independent groups that are larger and have captured significant market share in medium to large metropolitan areas. Typically, they are interested in radiology groups that have a comprehensive set of imaging services -- including subspecialty imaging -- have good contracts in place, and have a good local reputation, commented Dr. Frank Lexa, professor and vice chair of radiology at the University of Pittsburgh.

As for the motivation of radiology groups that sell to private equity, a buyout often means a hefty check for senior partners, who typically stay on for a few years after the deal minus their ownership.

Private equity got a boost from workforce trends in radiology. Prior to and after the 2008 recession, the stock market was not doing very well; 401(k) plans were diminished and senior radiologists put a hold on retiring, Corbett commented. New graduates didn't have much choice in jobs and served as a ready supply of manpower for private equity firms and other entities consolidating radiology groups, he noted.

Dr. Frank Lexa.

Dr. Frank Lexa.In a special report published in 2019, the newly created task force on corporatization at the American College of Radiology (ACR) noted that private equity is a common structure for investment in radiology practice (J Am Coll Radiol. 2019;16:1364-1374). With this investment model, a private equity firm raises an investment fund, usually from large institutions or very wealthy individuals or families, and either directly invests in private companies or buys out public companies, explained Fleishon and co-authors.

The rise of Radiology Partners

Perhaps no entity has exemplified private equity in radiology more than Radiology Partners. It fashions itself as a national radiology practice, and since its founding in 2012, it has grown to become a dominant force in the landscape for imaging services.

The practice completed perhaps its biggest acquisition yet at the end of 2020, cementing a deal to buy Mednax Radiology Solutions for $885 million and advancing its lead as the largest imaging provider in the U.S. It's a notable deal that signals the shift toward consolidation and raises questions about the endgame for the specialty.

Through the purchase, Radiology Partners gained 500 teleradiologists Mednax had snapped up through its prior acquisition of vRad in 2015. Radiology Partners now boasts more than 3,000 radiologists in its network across the country, equivalent to about 7% of all of those practicing in the specialty, and accounts for 10% of the imaging exam volume, according to CEO Richard Whitney.

Since it was founded in 2012, Radiology Partners has disclosed more than $1.1 billion in financing. Its stakeholders are Starr Investment Holdings and New Enterprise Associates and the provider claims that physicians hold the largest ownership block.

In the case of Mednax, divestiture of its radiology business had come in response to the financial challenges of the COVID-19 pandemic, prompting the company to revert to a focus on healthcare services more at its core: pediatrics and obstetrics.

Richard Whitney.

Richard Whitney.Whitney said that like all imaging providers, Radiology Partners was hit hard by the pandemic. Within a few weeks, the network lost 60% of its volume while grappling with workforce attrition challenges affecting businesses overall. Radiology Partners created an assistance fund to help its radiologists who were in hardship and volume is now back to where it should be, the executive said.

"I think it was very attractive for physicians to be part of a large practice with the resources that we had to be able to navigate together through the impact of the pandemic and make sure the practice remained healthy," Whitney said.

Considerable consolidation

However, as Radiology Partners grows in size, it is drawing more scrutiny about consolidation in general and private equity in particular.

An analysis of Medicare data documented "considerable consolidation of the radiology workforce over a very recent and very short window," Fleishon et al wrote in another article (J Am Coll Radiol 2020;17:340-348). Between 2014 and 2018, small groups got smaller, while big groups ballooned. For example, the fraction of practices with from 3 to 9 radiologists dropped from 10.2% to 6.7% during that period. In contrast, the fraction of groups with from 100 to 499 members grew from 15.7% to 21.8%, up from 15.7%.

Driving factors behind the trend include the following:

- Greater access to capital and technology

- Ability to participate in population-based care and national value-based payment programs

- Standardization of care pathways

- Flexible scheduling, stable salary, and other lifestyle factors

- Greater degree of subspecialization

The upsides of private equity

Private equity backing has advantages, including investment in technology. Radiology Partners says radiologists should be in the driver's seat of healthcare, enabled by technology, such as artificial intelligence (AI). To avoid being commoditized or marginalized and to unlock this potential, they need scale and access to "enormous amounts of capital -- more capital than physicians could invest on their own individually," Whitney said. In 2020, for example, Radiology Partners invested $7 million in AI.

Dr. Tarang Patel.

Dr. Tarang Patel.Private equity could offer some protection in the turbulent world of healthcare: There has been a perception that to thrive, you have to be big and you have to have deep pockets, Lexa said. Being part of a large enterprise could also help radiologists cope with demand for a wide range of subspeciality services, 24/7 reading, and fast results, he added.

"If you're part of a big entity that has a giant geographic footprint and has a lot of radiologists, then maybe you can figure out how to share the coverage," Lexa said.

In any business, centralization brings purchasing power, but that is not a unique benefit of private equity, as radiology groups have often joined together for leverage, commented Dr. Tarang Patel, a Scottsdale, Ariz.-based radiologist who hosts the Doctor Money Matters financial podcast.

Questioning quality

There are also potential downsides, of course. The role of private equity in general is causing alarm in some quarters.

In general, there has been a trend toward eliminating physicians from direct involvement in the business of medicine as administrative roles are outsourced to a variety of external entities. Unlike physicians, the administrators have not taken the Hippocratic oath, Patel said.

"Basically, we're losing some of our ethics in the actual business side of medicine," he said.

In their May 2021 report, Scheffler et al wrote that private-equity funds are by design focused on short-term revenue generation and consolidation -- not on the long-term well-being of patients.

"This in turn leads to pressure to prioritize revenue over quality of care, to overburden health care companies with debt, strip their assets, and put them at risk of long-term failure, and to engage in anticompetitive and unethical billing practices," the authors wrote.

Private equity ownership has been associated with worse health outcomes and higher prices in nursing homes and dialysis centers, the authors noted. Although private equity has been very interested in outpatient centers, systematic evidence is limited on the effect on quality, though there are concerns about misaligned incentives, they acknowledged.

Corbett said that there is a fear that private equity investors will cut and run if they don't get the returns they expected, leaving radiologists scrambling to re-form their groups.

Dr. Nina Kottler.

Dr. Nina Kottler.Radiology Partners says it's not fair to say that all private equity firms are the same and to stereotype them as bad. Private equity is just a financing mechanism, Whitney said. The provider stresses its focus on value-based healthcare and envisions radiologists in the driver seat, having a large impact on screening and diagnosis for a wide range of diseases. Such a transformation will not come quickly, and Radiology Partners selected its private investors carefully, ensuring they support this long-term mission, Whitney said.

Dr. Nina Kottler, associate chief medical officer (CMO) of clinical AI at Radiology Partners, noted the strong involvement of radiology as leaders. In March, 13 radiologists were promoted to new associate CMO positions across the organization. Physicians are playing roles at all levels of governance, Kottler said.

"One of our core tenets is that we are one practice, but we're locally led," Kottler said.

Teleradiology accounts for about 25% of the business, according to Whitney.

Impact on jobs, autonomy

Interviewees for this article cited loss of ownership opportunities for young radiologists just entering the specialty as one of the downsides of the private equity model.

Traditionally, young radiologists would get hired at a particular salary with a partnership track over a certain number of years, then get a huge salary increase when they become part-owners. With private equity firm acquisitions, senior partners get a big pay-off, while younger radiologists in the firm get a salary and lose the partnership track. They might also get stock in the private firm, but that stock has unknown value, Corbett said. Due to nondisclosure agreements, it might not be apparent to a radiologist applicant that a private practice has been sold or is on track to be sold.

Radiology Partners notes that 60% of its physicians have an ownership stake in the company, and many of the rest are on track to become partners and owners. Approximately one-third of the company's ownership is held by physicians, and as a group this share is larger than the firm's largest outside investor.

"For the ACR, a major concern has been the exclusion of associates on partnership tracks within independent practices when private equity acquisitions are being considered," Fleishon told AuntMinnie.com.

An ACR survey conducted in 2019 showed that more than 80% of early radiologists had a negative view of corporate radiology entities and preferred to join an independent practice (J Am Coll Radiol 2020;17:349-354).

After a practice is sold, remaining radiologists can expect reduced salaries and a heavier workload because that is how money is extracted from the practice, said Lexa. However, that is not unique to private equity ownership. Cost-cutting can be brutal as profits are maximized to meet short-term goals when radiologists are working for other types of outside owners, such as academic practices, not-for-profit systems, and venture capital firms, Lexa said.

"Private equity ends up being the boogeyman because it has had a very high profile, but this could happen with any of these models," he explained.

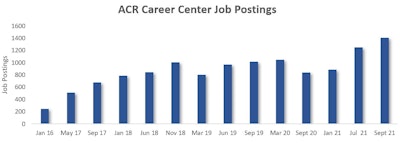

Young radiologists currently have more leverage when applying for jobs. The stock market took off in 2019, enhancing the value of retirement plans, and the pandemic struck at the end of the year. Both factors spurred radiologists to retire and there is now a shortage. The number of openings posted on the ACR's Career Center website reached a peak of 1,504 in September, noted Corbett, who has been tracking the figures over the years. Radiologists in the class of 2022 have been getting "unbelievable offers," Corbett said.

The number of job openings for radiologists posted on the ACR Career Center website peaked in September, with 1,504 available posts. Image courtesy of Dan Corbett.

The number of job openings for radiologists posted on the ACR Career Center website peaked in September, with 1,504 available posts. Image courtesy of Dan Corbett.As of November 21, after fellows signed contracts, the number of openings on the ACR website dipped to 1,389. Of those, 319 were corporate radiology jobs, including 207 posted by Radiology Partners, Corbett noted.

"I think it's going to be very hard for private equity to retain and recruit new people if they follow the traditional private equity business model of not having to pay as much over the long run," Patel said.

Depending on personality and career goals, working for a salary at a large national network could still hold appeal for some young radiologists. Meanwhile larger forces in healthcare favoring consolidation will continue to be at work.

The number of radiologists in genuine, independent, private practice has decreased substantially, and private equity has played a prominent role in accelerating that loss, Lexa said. Lexa added that he wouldn't like to see radiology private practice wither away in the face of an oligopolistic model.

"In the end, we will get the radiology landscape that this country wants or deserves," Lexa said. "And we'll just have to see what happens with that."