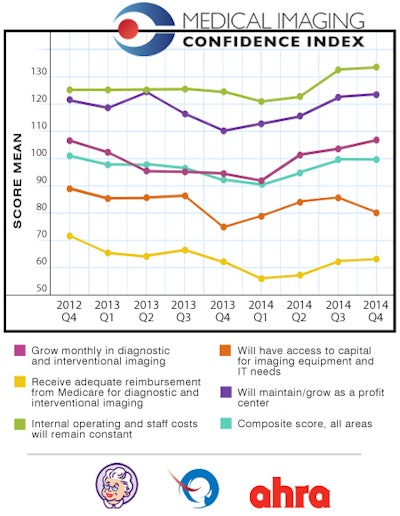

It's been said that acceptance is the fifth and final stage of loss. If that's the case, then radiology administrators appear to have accepted that the golden days of medical imaging are over, and they are moving on into the specialty's new reality, according to fourth-quarter numbers from the Medical Imaging Confidence Index (MICI).

Most of the MICI's five elements were stable compared with previous quarters, with some even edging up a bit, although some of the most recent changes may not have been statistically significant. Notably, administrators' confidence that they will receive adequate Medicare reimbursement -- historically one of the lowest components of the index -- has actually edged up from its nadir in the first quarter of 2014, according to Christian Renaudin, PhD, founder and CEO of the MarkeTech Group, which compiles the MICI data.

"This has always been really low over the years ... but this is coming back up a little bit," Renaudin said in an AuntMinnie.com Hangout to discuss the numbers. "We were at the lowest point in Q1, people were totally depressed, and now we are coming back."

Forward-looking index

MICI is a forward-looking index designed to provide an early view of trends as they develop. It is derived from the responses of imaging directors and hospital managers who are members of the AHRA medical imaging management association. Members of the MICI panel are asked about five key trends typically encountered by radiology administrators and what they expect in these areas in the upcoming quarter.

For the fourth-quarter data, MICI gathered 133 survey participants from across the U.S., with 10% of respondents based in the Pacific region, 5% in the Mountain region, 12% in the West North Central region, 22% in the East North Central region, 13% in the Mid-Atlantic region, 20% in the South Atlantic region, 9% in the East South Central region, and 9% in the West South Central region.

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also tabulated. Scores range from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

| MICI Q4 scores by topic | ||

| Topic | Mean score | Interpretation |

| Will grow monthly in diagnostic and interventional radiology | 108 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 64 | Very low confidence |

| Internal operating and staff costs will remain constant | 134 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 80 | Low confidence |

| Will maintain/grow as a profit center | 122 | High confidence |

| Composite score across all areas | 100 | Neutral |

Despite the higher scores, AHRA CEO Ed Cronin said he would be cautious before making the statement that radiology administrators have suddenly turned optimistic.

"Maybe it's not so much optimism but acceptance of a new reality," he said in the Hangout. "I don't think anyone expects we're going to go back to the way things were before all this healthcare reform came into force. I think it's a recognition that there's a new dynamic and everybody has to adapt."

Administrators need to find new ways to deliver value to patients and provide quality service at a price that is acceptable to patients and payors, he believes. They will also have to balance efficient department operation with patient satisfaction -- a perennial challenge.

Adopting a more consumer-oriented focus will also be a requirement. Many individuals have high deductibles under the new health plans created by the Affordable Care Act and are more price-conscious than before.

Renaudin agreed, pointing to a number of comments that MarkeTech researchers received from members of the MICI panel on their financial status. It seems that while hospitals larger than 300 beds are very confident, smaller facilities don't share that sentiment. There's going to be a growing discrepancy in the months to come between smaller and larger facilities, he said.

"We are now in the marrow of the bone," Renaudin said of the comments of one MICI participant from a smaller hospital. "There is no more to save or cut."

That said, imaging managers and administrators are resilient, and the economic times are forcing them to be more efficient and more collaborative. And medical imaging is still a billion-dollar industry -- the funds are just being distributed in a different way than in the past, Cronin noted.