Surging demand for high-field scanners is fueling the U.S. MR market, which generated $1.46 billion in revenues in 2002, up 20.8% from 2001, according to a report recently issued by market research and consulting firm Frost & Sullivan.

Frost & Sullivan projects that MRI scanner revenues will reach $1.97 billion in the U.S. by 2009, with a compound annual growth rate of 4.4%. High-field systems with closed architecture continue to dominate the market in both units shipped and revenue, said Jim Clayton during a Frost & Sullivan market briefing last week. Clayton is a medical imaging research analyst at the San Jose, CA-based firm.

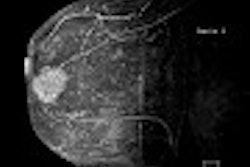

"This segment accounted for over 75% of revenues in the market, and end users opted for higher-field-strength systems in an effort to improve the quality of care they offer patients," he said. "The most interest has been generated by the capabilities and applications of 3-tesla scanners. End users expect these scanners will produce higher-quality images in less time, thus improving patient care."

Product innovation has also contributed to high growth rates, as large vendors strive to release scanners at higher field strengths, he said. As this trend continues, high-field-strength systems will tighten their grip on the market, he said.

Mid-field open systems will be able to take advantage of the open MRI market, Clayton said. The shift to higher-field units has transformed the MR market, however, as competitive pressures are prompting hospitals and imaging centers to adopt these systems in an effort to attract the most customers, Clayton said.

"They believe they will be able to do this because higher-field scanners are expected to improve patient care, since they can generate clearer pictures in less time," he said. "Due to this trend, we will likely see continued decline in the low-field MRI scanner market through (2009). End users that utilize low-field scanners are transitioning to mid-field open and high-field closed solutions."

The news isn't all positive for the high-field sector. Three-tesla scanners will likely become the scanner of choice in the high-field market, Clayton said.

"As a result, OEMs will be faced with the difficult task of meeting market demand for these scanners while minimizing the effect on sales in the more established 1.5-tesla market," he said.

In another industry trend, innovations in MR applications are adding to the attraction of higher-field systems. In addition, new MR technologies, such as parallel imaging, have enabled a migration of applications from high-field closed scanners to mid-field open systems.

"As a result, image quality and processing time are now comparable to 1.5-tesla systems," he said.

These new technologies will also benefit the 3-tesla market, allowing for development of new applications not previously possible due to technological limitations, Clayton said. In addition, a robust applications base is crucial to attract new customers for 3-tesla systems.

"More applications available will allow more procedures to be performed on these scanners, which produces return on investment for the hospital and imaging clinic," he said.

In order to expand their customer base, vendors are increasingly targeting niche markets, such as specialty physician practices and surgical physicians in larger hospitals. For example, orthopedic practices have embraced open MRI systems in recent years in an effort to expand their patient services, Clayton said.

"This trend will be more important for competitors who produce low-field MR systems as unit sales in this segment continue to decline," he said. "However, minimizing this decline will not be easy, as new competitors are introducing innovative MRI scanners at higher field strengths that compete with low-field solutions that are now available in the market."

Coils market

Not unexpectedly, the growth in MR scanner sales is driving growth in the coils market as well. And technological innovation is leading to expansion in this sector as well, Clayton said.

Driven by continued innovation in coil technology, the third-party coils market is expected to show steady growth, climbing from approximately $54 million in 2002 to over $70 million in 2009, Clayton said.

The most significant advance has been the introduction of multichannel phased-array coils, which allow for generation of much clearer images in less time, Clayton said. MR angiography will benefit most, as imaging capabilities from these coils approaches real-time, he said.

In addition to improved capabilities, coil advances have led to an increase in MR applications. This also aids MR users in achieving greater return on investment, Clayton said.

By Erik L. RidleyAuntMinnie.com staff writer

April 22, 2003

Related Reading

MRI vendors to demonstrate incremental advances, November 18, 2002

Copyright © 2003 AuntMinnie.com