One of the nuggets found in the recently proposed 2014 Medicare payment rates for hospitals is a change that would slash reimbursement for the technical component of CT and MRI scans by as much as 38% and 19%, respectively.

Radiology advocates are rushing to protest the proposed cuts, which they believe are based on a flawed analysis of the costs involved in delivering imaging services. For example, the cuts establish the costs of delivering both x-ray and CT at the same level -- just above $80 per imaging procedure.

Shifting cost analysis

The cuts are found in the 2014 Hospital Outpatient Prospective Payment System (HOPPS), issued on July 8 by the U.S. Centers for Medicare and Medicaid Services (CMS). They are based on a proposal by CMS to shift how it accounts for the costs a hospital incurs in delivering imaging services.

In the past, CMS used a single dollar amount, or cost center, to represent the costs involved in delivering both MRI and CT when calculating HOPPS payments. Under the new proposal, the agency has developed separate cost centers to represent the different costs it believes are involved in the provision of CT and MRI scans. And, surprisingly, the new cost centers would effectively lead to double-digit cuts in reimbursement.

The policy change would produce reimbursement cuts for CT and MR exams as follows:

| Rate cuts under 2014 HOPPS proposal, by imaging procedure | |

| Imaging procedure | Cut |

| Miscellaneous computed axial tomography | -38.1% |

| CT without contrast | -34% |

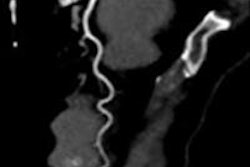

| CT and CT angiography without contrast composite | -33.9% |

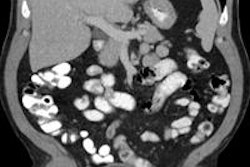

| Combined abdomen and pelvis CT without contrast | -32.9% |

| CT and CT angiography with contrast composite | -29% |

| Combined abdomen and pelvis CT with contrast | -28.8% |

| CT angiography | -27% |

| CT with contrast | -27% |

| CT without contrast followed by contrast | -26.3% |

| Cardiac CT imaging | -24.8% |

| MRI and MR angiography without contrast | -19.3% |

| MRI and MR angiography with contrast composite | -18.9% |

| MRI and MR angiography without contrast composite | -18.5% |

| MRI and MR angiography without contrast followed by contrast | -18.2% |

| MRI and MR angiography with contrast | -14.9% |

"This new cost center accounting would implement cuts on top of cuts -- and imaging has already been hit with 12 cuts since 2006," Orkideh Malkoc, director of reimbursement policy for the Medical Imaging and Technology Alliance (MITA), told AuntMinnie.com.

What's the deal?

The new separate cost center accounting is coming from CMS' Hospital Inpatient Prospective Payment System (IPPS) final rule, published in the Federal Register on May 10. The agency explored establishing separate cost centers for CT and MR in its 2009 IPPS and HOPPS proposed and final rules, basing its discussions on an analysis of the costs and charges of CT and MRI scans performed in 2007 by Research Triangle Institute (RTI).

Despite concerns expressed by imaging advocacy groups, the agency finalized this cost center proposal in the 2011 IPPS and intended to use it to determine payments for 2013. But due to challenges in implementing the new cost report forms, CMS decided to defer implementation until now. The IPPS final rule for 2014 includes the new accounting.

Because this accounting change is more specific -- going from a general one-line entry for radiology to three lines: radiology, CT, and MRI -- it would seem to be a better way to establish payments for advanced imaging. But that's only if the data are good, according to Malkoc: CT and MR services are capital-intensive, and accurate cost estimates depend on providers assigning actual equipment depreciation and lease costs directly to the cost centers, rather than using a traditional method of allocating average capital costs based on square footage.

"There are a few ways to capture equipment cost as well as direct costs associated with the service: through a formula that divides costs by a service's actual square footage in the hospital; through a direct allocation method, which calculates specific costs for each piece of equipment; and via a dollar value allocation method," Malkoc told AuntMinnie.com. "The square footage method for calculating CT and MR costs doesn't take into account the actual cost of running the equipment."

If finalized, the new imaging cost centers proposed in the 2014 HOPPS rule would result in a 27% drop in the estimated costs used to determine CT payments, a 15% drop in the estimated costs used to determine MR payments, and a 20% increase in the estimated costs used to determine payments for other diagnostic imaging modalities, according to Malkoc.

Using these cost centers would result in payment rates that do not reflect the differences in diagnostic power between imaging tests, as well as a hospital's investment in advanced imaging technology. For example, in an analysis that MITA performed with the 2011 CMS data from hospitals that reported CT and MR costs separately, the estimated cost of a CT scan of the head/brain was $84 and an x-ray of the skull was $82 -- despite the obvious cost differences involved in operating CT and x-ray machines.

Trickle-down effect

Due to rules in the Deficit Reduction Act (DRA), cuts in HOPPS reimbursement for CT and MR would trigger further reimbursement cuts in the Physician Fee Schedule (PFS). In June, a coalition that includes MITA and the American College of Radiology sent CMS a letter requesting that the agency withdraw its proposal to use separate cost centers for CT and MR in the IPPS rule and to avoid it in the HOPPS rule.

"The DRA limits PFS technical component payments to the level of the corresponding [HOPPS] payment for the same service," the coalition wrote. "As a result, we estimate that the use of separate cost centers would reduce technical component payments under the PFS by 6% for CT and 3% for MR. Neither CMS nor RTI has analyzed the impact of this policy on the nonhospital setting, despite this important indirect impact on the PFS."

What's needed? MITA and others are urging CMS not to use the new imaging cost centers unless the data reflect the complexity of costs for capital-intensive services.

"A full analysis of the practical impact of this policy demonstrates that it would result in incongruous and inaccurate Medicare reimbursements for CT and MR services in both the hospital and nonhospital settings -- jeopardizing patient access to these services," the coalition wrote.

CMS is pursuing policy of which it may not fully appreciate the effects, according to Mike Mabry, executive director of the Radiology Business Management Association (RBMA). RBMA is part of the coalition that sent the letter to CMS.

"They're trying to implement data they have, but they're not aware of the repercussions," Mabry told AuntMinnie.com.