Interventional device manufacturer Boston Scientific exercised its option to acquire shares held by the principal stockholders of interventional device developer Rubicon Medical of Salt Lake City.

The action triggered Natick, MA-based Boston Scientific's obligation to commence a cash tender offer for the other issued and outstanding shares of Rubicon's common stock at a price of $1.50 per share. Boston Scientific now owns approximately 53.6% of the firm on a fully diluted basis, and will commence a cash tender offer for the remaining outstanding shares of the company, Rubicon said.

The total price payable by Boston Scientific will be approximately $71.7 million with up to approximately $83.7 million in additional earn-out payments if all postacquisition milestones are achieved, according to Rubicon.

In related news, Rubicon said it has received the CE Mark for its Rubicon Filter.

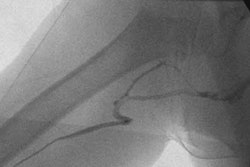

The Rubicon Filter is designed for use in medical procedures to allow the capture and removal of any dislodged embolic material downstream from a blockage in the bloodstream. The product is a guidewire-based filter that is deployed without the use of a catheter, making it smaller and easier to navigate through blood vessels, Rubicon said.

By AuntMinnie.com staff writers

April 15, 2005

Related Reading

Rubicon inks SurModics deal, December 17, 2004

Rubicon completes European enrollment, February 5, 2004

Rubicon moves facility, expands workforce, December 9, 2003

Rubicon names Woolf as CFO, November 18, 2003

Boston Scientific adds to Rubicon investment, October 30, 2003

Copyright © 2005 AuntMinnie.com