Cardinal Health rolled out the welcome mat at its new Center for the Advancement of Molecular Imaging in Phoenix on July 18 to promote the development of nuclear medicine (NM) imaging agents to treat complex conditions such as cancer, heart disease, and neurological disorders.

The $11 million, 25,000-sq-ft facility is designed to help pharmaceutical companies and academic research institutions accelerate the development, testing, and commercialization of new radiopharmaceuticals and PET imaging agents, as well as the manufacturing and dispensing process for the imaging agents.

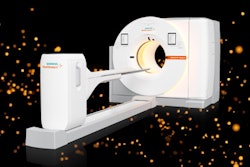

Cardinal Health's 25,000-sq-ft research center features laboratory space for confidential radiopharmaceutical and PET biomarker development. All images courtesy of Cardinal Health.

Cardinal Health's 25,000-sq-ft research center features laboratory space for confidential radiopharmaceutical and PET biomarker development. All images courtesy of Cardinal Health.

"Nothing drives an industry like new product introductions," said Benson Yang, Cardinal's vice president of pharma and academic collaboration and the head of the center.

"There has been a tremendous amount of interest from research companies around PET biomarkers for the early diagnosis of disease and, hopefully, to stage efficacy of therapeutic trials," he said.

The center will house standalone laboratory space to allow Cardinal's partners to conduct confidential radiopharmaceutical and PET biomarker experiments. It will also provide access to quality and regulatory guidance to earn clearance from the U.S. Food and Drug Administration (FDA) for new imaging agents.

Center participants

So far, participants include Eli Lilly, GE Healthcare, Bayer HealthCare Pharmaceuticals, and Lantheus Medical Imaging. It isn't the first time Cardinal Health has worked with its competitors. The company has an existing agreement to distribute GE's Myoview cardiac imaging agent.

Yang described the collaborative arrangement as being similar to a contract manufacturing model, with the individual companies retaining their intellectual property rights to the burgeoning products. "It is very clear it is still their proprietary product," he added.

The center also will allow pharmaceutical companies and academic institutions to monitor the production of their drugs at any of Cardinal Health's PET manufacturing sites during multisite clinical trials.

The facility was under development for a year and opened with 20 employees. Cardinal recruited R&D scientists and product development professionals to advance commercialization and validation work. The infrastructure also had to meet Good Manufacturing Practice (GMP) guidelines, regulatory assurance functions, and other technical services, Yang said.

Growth

Ultimately, the plan is to increase its staff to 30 to 35 people on the campus, which includes a research and production facility and a collaboration lab where products will be developed. Also on campus is Cardinal's global training facility for its Nuclear Pharmacy Services business.

The center will house dual cyclotrons, which can be used to produce large quantities of radioisotopes.

The center will house dual cyclotrons, which can be used to produce large quantities of radioisotopes.

"There is an unprecedented amount of R&D dollars going into PET biomarkers," Yang said.

He cited Lilly's acquisition of molecular imaging developer Avid Radiopharmaceuticals in December 2010 for an upfront payment of $300 million as one indication of the financial commitment some companies are making in this segment of nuclear medicine.

"PET biomarkers have become a terminology that is not just nuclear medicine-related," Yang said. "There's the idea of 'smart care' or personalized medicine, whereby these drugs -- because they are at the molecular level -- can differentiate disease at a very different place than ever before."

He noted that the nuclear medicine community has been in a "kind of crisis of confidence" in the wake of the global molybdenum-99 shortage in 2009 and 2010. Nuclear medicine "is in a vulnerable spot right now," he said. "The thing that can really rejuvenate the industry is the idea of new PET biomarkers."