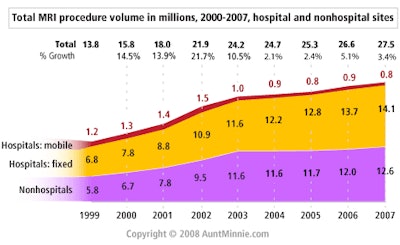

Growth in MRI procedure volume in the U.S. has slowed to single-digit rates in the last four years, compared with the double-digit growth rates the modality enjoyed before 2004, according to a new study published this week by IMV Medical Information Division of Des Plaines, IL.

The IMV study reveals an average annual growth in MRI scans since 2003 of 3%, with 27.5 million procedures conducted in 2007 at both hospital and nonhospital imaging sites, compared to 24.2 million in 2003. For the four years prior to that, MRI procedure volume grew at an average annual rate of 15%.

A combination of factors may have produced these results, including the maturity of the MRI market, changes in reimbursement that include precertification requirements from health insurance companies, and the impact of the Deficit Reduction Act (DRA) of 2005 on independent imaging centers, according to IMV's senior director of market research Lorna Young.

With a defined universe of 7,195 MRI sites in the U.S., the survey queried MRI supervisors, radiology administrators, and chief radiologic technologists from more than 2,350 sites with fixed MRI installations and mobile services. At those sites, the study estimates that there are 7,810 fixed MR scanners and another 800 on mobile routes, yielding a total of 8,610 scanning units.

Of the 7,810 fixed-site MRIs, about 4% of the current installed base consists of magnets greater than 1.5-tesla field strength. Projected purchasing data suggest that on an annual basis, more than 10% of scanners in current installations are larger than 1.5 tesla, with 20% of the market in the future planning to purchase and install 3-tesla scanners.

"Almost 100% of the hospitals over 200 beds have at least one MRI, so the main area of growth for first buyers is in the smaller hospitals which are currently using mobile, if they're using anything at all," commented Young, who said this trend is an indication of the maturity of the market. In 2003, IMV reported 1,440 hospitals using mobile systems, whereas in 2007 just under 1,100 are utilizing this approach. This is not equivalent to the number of mobile vans; rather, it reflects the number of hospitals using mobile MR services.

The IMV data support the idea that while the mobile market is relatively stable, the overall use of mobile MRI has decreased slightly. This finding is probably due to the fact that as the price of a 1.5-tesla scanner drops depending on the specific options ordered, installing a fixed scanner becomes more feasible. Depending on the features ordered, pricing on some 1.5-tesla units can run as low as $1 million, with additional options purchased and installed at a later date.

Another factor possibly contributing to a slowing of the market may be that MRI is a scheduled procedure rather than an emergency imaging study like CT. If there is growth in the number of procedures that a specific hospital performs, it could extend its scheduling hours rather than purchase another MR unit. There is interest in 3-tesla scanners at larger hospitals, either as a replacement or additional unit, but in the case of community hospitals, we've yet to see this trend emerge, Young said.

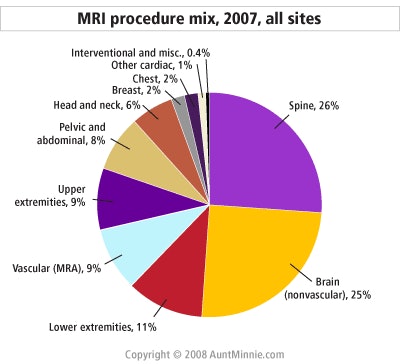

The mix of procedures has remained quite stable over the past five years as well, with neuro (brain and spine) exams comprising more than half of the total.

The gadolinium challenge

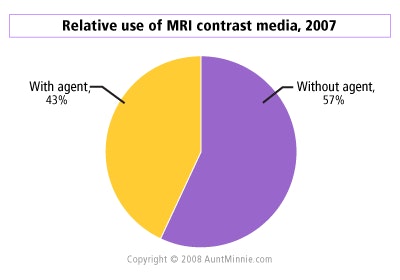

The issue of nephrogenic systemic fibrosis has raised concerns about patients at risk of developing this rare but debilitating and potentially fatal complication, believed to result from the use of gadolinium-based contrast media in individuals with compromised renal function. Those patients believed to be most at risk are individuals who are immunosuppressed, who have received an organ transplant, or who have abnormal serum electrolytes.

The IMV study showed that of the 27.5 million MRI procedures performed in 2007, 43% used a contrast agent as part of the imaging procedure. That percentage has remained stable since 2002, with no significant change up or down. The vast majority of MRI contrast agents being used are gadolinium-based.

While the use of MRI in the management of breast cancer has doubled since 2003, from 314,000 to 645,000 procedures, it still accounts for only 2% of the total number of imaging studies.

In other projected trends, Young explained that while there is a great amount of excitement about MR angiography, it still comprises only 9% of the total procedure mix. Another area of strong interest surrounds pairing MR with molecular imaging; however, those activities remain in the realm of academic centers at the present time.

By Cheryl Hall Harris, R.N.

AuntMinnie.com contributing writer

June 5, 2008

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.

Related Reading

PET drives growth in nuclear medicine market, April 30, 2008

Nuclear medicine market nears $300 million, February 26, 2008

Study: DR catalyst for European x-ray market, January 25, 2008

Report: Nuclear medicine patient visits drop in 2006, October 16, 2007

Study: High growth for global imaging markets, September 7, 2007

Copyright © 2008 AuntMinnie.com