Thanks to extensive reform to healthcare services and improved local supplier offerings, demand for color ultrasound is surging in China, according to a new report from market research firm InMedica.

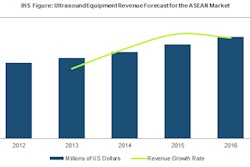

Color ultrasound equipment revenues increased by 10% from 2010 to 2011, and are forecasted to grow by more than 80% by 2015, InMedica said. Most demand is being recorded in the low-end and midrange cart market segments (products less than $60,000), although some growth is also attributable to increased uptake of compact ultrasound equipment, the company found.

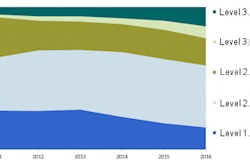

Current demand for color ultrasound systems are being driven mostly large metropolitan (tier 3) and county-based (tier 2) hospitals, InMedica said. Thanks to higher reimbursement rates for color equipment, healthcare providers can realize a better return on investment for these systems than they could with black-and-white units, market analyst Owen Tang said in a statement.

Black-and-white systems are predominantly installed and used in tier 1 health centers and family clinics in China. These institutions benefited, however, from strong investments in 2009 and 2010 as part of the Chinese healthcare reform and many low-end Chinese suppliers are entering the color ultrasound market, InMedica said.

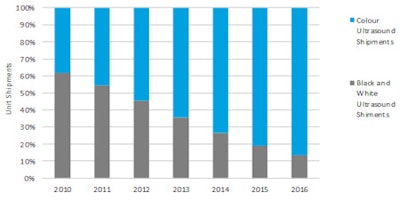

Chinese ultrasound market: Changing outlook by technology

Unit shipments - 2010 to 2016

Image courtesy of InMedica.

Image courtesy of InMedica.

Government support of Chinese black-and-white ultrasound suppliers had prevented multinational suppliers from competing on price in the entry-level and low-end market, but rising demand for higher-specification color systems in tier 2 hospitals is causing a convergence of interest for local and multinational suppliers, and increasing the intensity of competition, InMedica senior analyst Stephen Holloway said in a statement.

As a result, InMedica is forecasting a dramatic shift for the China market, with color ultrasound equipment set to dominate. Double-digit revenue growth is projected from 2013, as the bulk of investment in equipment replacement is implemented, according to the company. Even stronger growth could be provided longer-term by the potential of the tier 1 market.