During the past 10 years, the market for compact ultrasound systems grew quickly. These units became the preferred ultrasound form factor for point-of-care applications and found their way into a variety of more traditional applications that benefited from a high degree of portability and maneuverability.

For example, compact ultrasound systems were increasingly used in surgical and interventional procedures, as well as in out-of-clinic primary healthcare -- particularly in rural areas. At the height of the systems' popularity, many customers who had previously purchased cart-based systems switched to compact systems, in some cases due to the lower cost, but in many cases because they were seen as the future direction of ultrasound. However, more recently, growth for the compact ultrasound sector has slowed for the reasons outlined below and described in detail in our recently released market intelligence report on the global ultrasound market.

Market maturation

The U.S. was the earliest adopter of point-of-care ultrasound (POCUS), followed by Western Europe and the developed Asian countries. The growth rate for POCUS in these regions is now slowing as the market becomes more established and the pool of potential new users diminishes. In the coming years, the POCUS market in developed countries is forecast to grow at a low- to midsingle-digit annual percentage rate.

In the developing and emerging countries, the POCUS market is far less established and there has not been the rapid uptake seen in the U.S. This is largely due to the lack of education and training on POCUS in these countries, especially for use in anesthesiology, critical care, emergency medicine, and musculoskeletal applications. Governmental focus on developing basic healthcare services such as general imaging and women's health, which are often better suited to cart-based systems, is also a contributing factor. While the number of conferences and manufacturer-led training sessions is increasing, it will take time to raise awareness and understanding of POCUS.

Although relatively strong growth is forecast for POCUS in the emerging markets, it will not fully offset the slowdown in the developed markets, leading to an overall reduction in the global growth rate.

The rise of handhelds

Handheld ultrasound devices have been available for several years, but the market has not lived up to expectations. Early-generation handheld ultrasound products had several flaws, including poor image quality in comparison with compact and cart-based ultrasound, poor battery life, poor ergonomics, and overheating. The relatively high price, typically in the region of $8,000 to $10,000, has also been a barrier.

Simon Harris.

Simon Harris.The latest handheld products are much improved, however, both in terms of performance, such as image quality and power management, and usability. Specifically, the introduction of ultraportable handhelds has spurred renewed interest in handheld ultrasound. These "system in a transducer" products connect -- wired or wirelessly, depending on the model -- to a smartphone or tablet device, with the scanning software downloaded as an app. Examples are Lumify from Philips Healthcare, C3 and L7 from Clarius Mobile Health, Sonon from Healcerion, and U-Lite from Sonoscanner.

The lower price point of ultraportable handheld devices, typically in the region of $8,000, coupled with the inherent high portability, makes them well-suited to point-of-care applications. Handhelds are also a convenient platform to provide online training for new users of ultrasound. Moreover, new pricing models for handhelds, such as subscription-based pricing plans, may prove popular as they avoid the relatively large upfront investment typically associated with compact and cart-based ultrasound equipment.

Handheld ultrasound devices will continue to gain acceptance in point-of-care applications and, to a lesser extent, traditional applications such as radiology, urology, cardiovascular, and women's health, taking market share from compact ultrasound systems.

A more practical solution?

In applications where portability is not a top priority, cart-based systems are often a more practical solution. They are more comfortable for extended use and offer a wider range of transducers. Recently we have observed that customers who made the switch to compact systems are now re-evaluating their suitability and, in some cases, switching back to cart-based systems. This developing trend has been facilitated by the introduction of small-footprint "hybrid" cart-based systems with intuitive touchscreen interfaces.

Examples include the X-Porte from Fujifilm SonoSite, the Venue 40 and Venue 50 from GE Healthcare, and the TE5 and TE7 from Mindray Medical International. In most cases, these systems can be wall-mounted or used with a table stand, but typically they are used with a slimline cart (pedestal). These systems are best suited for point-of-care applications -- particularly procedural rather than diagnostic ones. In applications that require lots of measurements to be taken, a more traditional user interface may be more practical.

Still a place for compacts

In the coming years, compact systems are expected to remain the preferred ultrasound form factor in the core point-of-care applications (anesthesiology, emergency medicine, critical care, and musculoskeletal) and in traditional applications that require a high degree of portability. However, they will come under increasing pressure from handhelds and small-footprint cart-based systems.

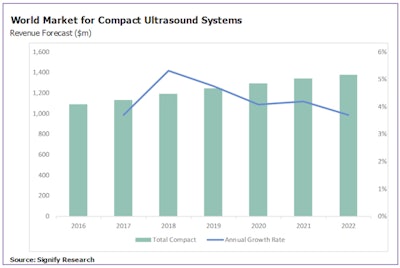

The annual growth rate for the world compact ultrasound market is forecast to gradually slow to around 3% by 2022 -- a far cry from the double-digit growth seen in the 2000s. With developments of single-chip ultrasound solutions gaining pace, offering the potential to further drive down the price of ultraportable solutions, the good times for compact ultrasound may well be over.

Simon Harris is managing director and principal analyst at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K. He can be reached at [email protected].

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.