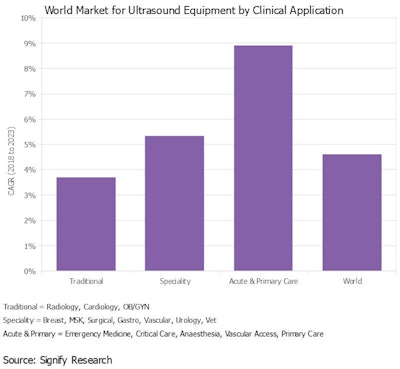

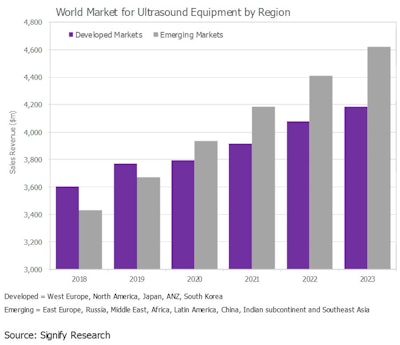

2018 was a record year for the world ultrasound equipment market, with revenues increasing by 6.8%, tipping the market over the $7 billion mark for the first time. Despite the backdrop of global economic uncertainty, the ultrasound market is forecast to continue to grow relatively strongly in the coming years, with the following five trends driving growth.

1. Ultrasound attracts new users

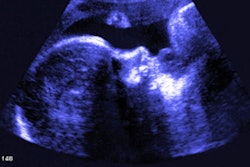

Over the years, the use of ultrasound has gradually expanded beyond radiology, cardiology, and ob/gyn to a wide range of clinical specialties, including surgery, musculoskeletal, and gastroenterology, to name a few, expanding the customer base and driving additional revenue growth.

This trend started out in developed countries, but more recently it has spread to developing markets, particularly India and China, where specialty departments at larger hospitals now often have their own budgets to buy ultrasound scanners.

Additionally, ultrasound is gaining acceptance in acute and primary care settings as both a screening and diagnostic tool, as well as for procedure guidance. With the use of handheld ultrasound gaining pace (see trend No. 4 below), this trend will accelerate in the coming years.

All images courtesy of Signify Research.

All images courtesy of Signify Research.2. New clinical applications evolve

Along with the growing customer base, the use of ultrasound with existing customers is expanding, typically as a lower-cost and/or radiation-free alternative to other imaging modalities, such as MRI and CT. The global shift to value-based care as a replacement to the traditional fee-for-service approach will support this trend.

For example, ultrasound is playing an increasingly important role as a screening tool for women with dense breast tissue. In acute care, ultrasound is increasingly being used for lung imaging to diagnose conditions such as pleural effusion, pulmonary edema, and pneumothorax. In another example, the use of shear-wave elastography is expanding beyond hepatology (e.g., liver fibrosis) to other body areas, including the breast, prostate, thyroid, and spleen. Musculoskeletal imaging is another relatively untapped market for ultrasound, including orthopedics, rheumatology, and sports medicine.

3. New markets emerge

The ultrasound market in developed regions, such as Western Europe, North America, and Japan, is largely saturated, and the outlook is for low-single-digit to midsingle-digit growth. While these markets will continue to account for the lion's share of the world market, developing markets continue to represent a growth opportunity. In 2019, the fastest growth is forecast for Southeast Asia, Brazil, China, and India.

That said, ultrasound market growth is slowing in many of the emerging markets, particularly China, largely due to slowing global economic growth.

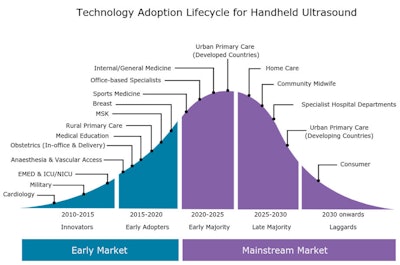

4. Handheld ultrasound picks up steam

As we discussed in a previous insight ("Handheld Ultrasound Market Poised for Next Wave of Growth"), the handheld ultrasound market is growing rapidly as the latest generation of ultraportable devices gains acceptance among a diverse range of customer groups, from emergency medicine physicians and intensivists to internists, office-based specialists, and -- looking forward -- primary care physicians.

The expanding customer base of handheld systems, coupled with the increased availability of affordable handheld scanners, is forecast to boost global sales of handheld ultrasound by more than 50% in 2019. By 2023, the global market for handheld ultrasound is forecast to exceed $400 million.

5. Artificial intelligence to transform market

Artificial intelligence (AI) will have a transformative effect on the ultrasound market as AI addresses some of the key limitations associated with ultrasound; namely, the shortage of trained sonographers and the relatively steep learning curve, high operator dependency during image acquisition and interpretation, poor image quality for certain exam types, and relatively lengthy exam time compared with other modalities.

The first wave of ultrasound AI applications are entering the market and are mainly for image optimization (noise reduction) and automation of time-consuming and repetitive tasks, such as anomaly detection, image labeling, and feature quantification. However, the greatest impact of AI will be on guided ultrasound (ultrasound navigation), which will provide real-time support during image acquisition (i.e., probe placement and anatomy detection).

The first AI-enabled guided ultrasound systems are expected to be released in the second half of 2019. These systems are expected to expand the user base by making ultrasound more accessible to novice users, particularly in acute and primary care.

Simon Harris is the managing director and a principal analyst at Signify Research, a health technology market intelligence firm based in Cranfield, U.K. He can be reached at [email protected].

Signify's "World Market for Ultrasound Equipment -- 2019 Edition" provides a data-centric analysis of current and projected demand for cart, compact, and handheld ultrasound systems. It features analysis of 30 geographic markets, with breakdowns by clinical application and product mix. The report is based on a robust primary research method, including sales data reported by vendors of ultrasound equipment.

The comments and observations expressed do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.