In the next 60 to 90 days, Hologic will be submitting a premarket approval application (PMA) to the Food and Drug Administration using data generated from Trex’s charge-coupled device (CCD)-based unit. The FDA will certainly be familiar with the Trex system, having reviewed the unit for nearly two years, culminating in a 1999 decision that found the system not equivalent to analog mammography systems. Although it marketed the Trex Digital Mammography System in Europe for several years, Trex was unable to get the system through the FDA’s challenging 510(k) process.

Of course, Hologic's digital x-ray portfolio includes amorphous selenium flat-panel detectors from its Direct Radiography subsidiary, and that technology will play a prominent role in the company's digital mammography roadmap. Once the CCD-based system is cleared, the vendor plans to submit a supplementary application for amorphous selenium flat-panel detectors as an option to the unit, according to Steve Nakashige, president and COO.

"We’re marrying DRC technology to Trex systems," he said. "We plan to capitalize on the CCD digital system data [Trex subsidiary] Lorad had in the works and develop a machine based on this technology initially, then convert as quickly as possible to selenium detectors cleared in a supplement to our application. We hope this will shorten the lead time to market."

Hologic hasn’t decided whether it will continue to supply both CCD-based and selenium detectors once both technologies are cleared, Nakashige said. In any event, the new strategy may help clear up any misunderstandings in the market about Hologic’s plans for commercializing a digital mammography system.

After stating its plans to acquire the troubled x-ray and mammography giant last August, Hologic initially indicated that it would focus its digital mammography research and development efforts on DRC’s flat-panel detectors, rather than Trex’s CCD-based technology. A few days later, however, the company clarified that it would evaluate the two technologies before making a final decision.

In addition to refining its digital mammography strategy, Hologic has been busy making organizational and product decisions since completing its $55 million acquisition of Trex Medical’s U.S. assets on September 15. It has cut employees from both Trex and Hologic employee pools, Nakashige said, and has announced the pending move of its Fluoroscan subsidiary from Chicago to the Bedford area. This will consolidate Hologic’s plants on the East Coast.

Hologic plans to continue working with Trex’s mobile x-ray, nondestructive testing x-ray, digital R/F, electrophysiology, and general radiology products, adding digital technology from DRC to these systems when appropriate. The company will not move forward with the 4000M CCD-based digital chest x-ray system Trex was marketing for Imix, however.

Hologic has also retired most of the Bennett and XRE product lines. The company will continue to work with some Continental technology, such as a photomultiplier tube (PMT) it would like to digitize, Nakashige said.

Hologic’s aggressive move into the digital domain is buoyed by the company’s confidence in the readiness of the market for digital technology.

"Most hospitals are now open to digital," he said. "There are two camps: the customers that already have a PACS, and those that don’t yet have PACS but want upgradeable products for when they make that move. But both administrators and physicians are impressed by the improved productivity and image quality of digital products."

Hologic used the 2000 RSNA meeting to emphasize its commitment to digital technology in general and women’s health in particular. The company highlighted a new bone densitometry unit, Delphi, which allows physicians to perform a quick, low-dose visual vertebral assessment to locate spine fractures during routine bone density exams.

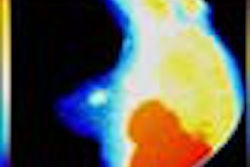

Delphi’s resolution has been improved as compared to Hologic’s QDR 4500C by the addition of detectors and finer x-ray beam collimation. Its fan-beam technology works to produce a single, high-resolution image of the entire lateral spine in 10 seconds, with less than 1% of the dose of standard lateral spine films. With vertebral assessment as part of bone density exams, Hologic believes that physicians can find spinal fractures that would have gone unnoticed, and consequently make better therapeutic decisions.

In addition to Delphi, Hologic's RSNA booth showcased two of its general radiology units updated with both Trex and DRC components: Epex, for general applications, and Radex, for outpatient chest and peripheral imaging. Hologic’s goal is to install 20 or more Epex and Radex systems per quarter this year, adding to its 10 existing installed sites. The company expects the DRC unit to break even this year, Nakashige said.

By Kate Madden Yee

AuntMinnie.com contributing editor

March 2, 2001

Related Reading

Hologic reports mixed Q1, cites Trex integration, February 6, 2001

Hologic revenues grow, but loss widens due to Trex acquisition, November 16, 2000

Hologic completes Trex acquisition, September 18, 2000

Hologic clarifies position on Trex’s digital mammo system, August 22, 2000

Hologic to sharpen focus on women's imaging with acquisition of Trex, August 15, 2000

Copyright © 2001 AuntMinnie.com