Hologic continues to move aggressively to expand its presence in women's healthcare with the signing of a strategic agreement to acquire computer-aided detection (CAD) firm R2 Technology in a $220 million stock swap. The deal comes on the heels of Hologic's announcement last week to purchase interventional technology developer Suros Surgical Systems for $240 million.

"The (R2 agreement) advances a major strategic goal of the company, building upon our established technology road map," said Hologic chairman and CEO Jack Cumming. Cumming and other Hologic executives spoke Tuesday during a conference call discussing the R2 acquisition and Hologic's second-quarter financial results.

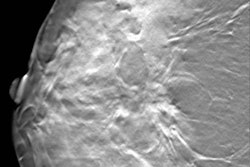

R2 was the first vendor to gain clearance by the U.S. Food and Drug Administration to use CAD with screening mammography, and the firm has more than 2,500 installations of its ImageChecker mammography CAD technology worldwide. Of the 2,500, more than 1,000 are digital CAD systems, according to Hologic of Bedford, MA.

R2 also offers an ImageChecker CT Lung CAD package for use with multislice CT systems. Hologic executives believe that R2's CAD expertise could be matched with work Hologic is doing on mammography tomosynthesis systems.

"This CT CAD knowledge or know-how, or 3D know-how, we think will be very helpful for use in developing tomosynthesis CAD," Cumming said.

Upon closure of the deal, R2 will operate as a wholly owned subsidiary of Hologic, and will remain at its headquarters in Sunnyvale, CA. R2's employees and executives will stay on, Cumming said.

"As a combined force, we emerge stronger and better positioned to respond to the rapidly changing dynamics of the industry," Cumming said.

R2 offers a natural fit with Hologic's sales and distribution channels, said Glenn Muir, Hologic's executive vice president and CFO.

"This will allow us to leverage our U.S. market presence, especially in radiology," Muir said. "We also will be able to improve the international distribution coverage of CAD products with our extensive dealer network. Internationally, our dealer network will now become advocates for the R2 CAD and represent an emerging opportunity in the future as CAD overseas begins to gain acceptance. Together we will be able to offer proprietary solutions and begin co-development of next-generation systems optimized for our image acquisition technology."

The deal also allows Hologic to expand its presence in breast care, from imaging modalities to detection aids, Muir said.

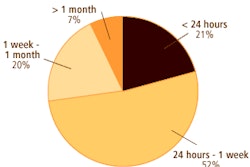

R2 produced 2005 revenue of approximately $45 million, which was essentially unchanged from the previous year, Hologic said. As the market shifts away from analog-based CAD systems to digital units, this shift is expected to help improve margins overall, according to the firm.

"We were attracted in part by a high-growth-margin software business for digital CAD," Muir said. "Over half of the systems R2 sold in 2005 were digital, with gross margins in excess of 90%."

In addition, R2 has a sizeable analog installed base (over 1,500 systems), for which to maintain with service and to migrate to digital over time, Muir said. Hologic also expects to glean value from bringing together Hologic and R2 R&D and engineering resources.

"(Those resources) can be utilized for future product development initiatives, including next-generation full-field digital mammography applications," Muir said.

Hologic expects the transaction will be accretive to earnings in fiscal 2007, excluding the amortization of intangibles related to the transaction. The vendor expects the acquisition will close within two to three months, following completion of a fairness hearing before the Commissioner of the California Department of Corporations. The deal is also subject to customary closing conditions, including R2 shareholder approval and the expiration of termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act.

Hologic will pay a price per share equal to the 10-day trading day average of the closing price per share of Hologic common stock for the period ending two trading days prior to the closing date.

By Erik L. Ridley

AuntMinnie.com staff writer

April 25, 2006

Related Reading

Hologic books record Q2, April 25, 2006

Hologic to buy Suros, April 18, 2006

Vital Images, R2 debut integrated lung CAD package, April 17, 2006

R2 inks HPG deal, April 12, 2006

AIE, Hologic highlight research, March 29, 2006

Copyright © 2006 AuntMinnie.com