NEW YORK CITY - GE Healthcare today upped the ante in its war on cancer, assembling a star-studded field of public health advocates and venture capitalists to announce a new round of investments to accelerate innovation in cancer detection and therapy.

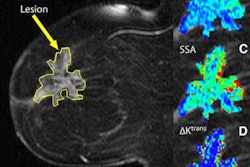

GE said it would invest $1 billion of its total R&D budget over the next five years to expand its activities in advanced cancer diagnostic and molecular imaging technology. The investments range from R&D for new metabolic imaging agents to better clinical diagnostic agents.

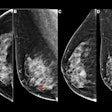

A key part of the GE initiative called the Assembling Tools to Fight Cancer challenge is serving as a vehicle to fund five breakthrough ideas for detecting and treating breast cancer. The project will give $100,000 awards for ideas that can be commercialized into products for breast cancer detection, diagnosis, or treatment. Winners will be announced in the first quarter of 2012.

This challenge, along with up to an additional $95.5 million in capital funds, will be invested globally into promising start-ups and ideas, according to the company. GE Healthcare is providing 50% of the funds, with the remainder coming from venture capital firms Kleiner Perkins Caufield and Byers, Venrock, Mohr Davidow Ventures, and MPM Capital.

Sue Siegel, a general partner at Mohr Davidow Ventures, pointed out that ideas submitted to the challenge will be openly accessible on its website. She said that the affiliation with Susan G. Komen for the Cure will increase awareness by entrepreneurs who otherwise might not know of the initiative and the opportunity to bring great ideas to market.

The global demand for new products to change a cancer diagnosis from the equivalent to a death sentence to more like that of a chronic disease is very real, Siegel noted, and represents a sound financial investment, both for investors and for global economic stability.

"In the U.S., only 1% of cancer-related healthcare expenses are spent on diagnosis; 70% is spent on treatment from clinical decisions based on diagnostic test results. Is there something wrong here?" she asked.

The venture capital firms involved bring complimentary areas of expertise, including therapeutics, health IT services, diagnostic tools, and molecular diagnostics. Other speakers said that this knowledge, plus knowledge from dealing with the complex regulatory processes of countries throughout the world, can create successes needed to drive healthcare costs down and improve the cure rates of cancer.

Dr. Bob Kocher, a partner at Venrock, and Risa Stack, PhD, a partner at Kleiner Perkins Caufield & Byers, both discussed how developing and commercializing healthcare technology is very complex, and from a venture firm's perspective, it's 100 times harder than bringing other types of products to market.

Obtaining regulatory approval, meeting regulatory requirements once a product is on the market, waiting for clinical responses, convincing customers -- physicians, provider institutions, and patients -- to try new products, and analyzing data are all important challenges. But speaker panelists said that this is an area of great financial opportunity as well as hope for better healthcare throughout the world.

Jeff Immelt, GE chairman and CEO, said that of the $6 billion it had pledged in 2009 to spend on its healthymagination initiative, $1 billion over the next five years would focus on cancer research and therapies. This investment, with its emphasis on personalized medicine, would enable the healthcare division to grow faster. It's good for patients, it's good for economies, and it's good for companies and investors, he said.