While the ability of digital breast tomosynthesis (DBT) to image the breast has lived "up to the hype," a new KLAS study found that the high cost of upgrading to DBT technology should be weighed against declining reimbursement for breast screening.

In addition, report author Monique Rasband wrote that some customers said their PACS would not accept tomosynthesis studies, which created workflow concerns. Radiologists had to leave their offices or reading rooms and go to the tomosynthesis workstation to read a study.

"Despite these challenges, many are saying it is worth the effort, because they are able to so clearly identify lesions they may not have been able to see before," Rasband said.

In the broader market for full-field digital mammography, the report found that Hologic, heads all digital mammography vendors, with "strong digital mammography product and excellent service." Hologic was the first company to receive clearance for a DBT unit, its Selenia Dimensions 3D system.

GE Healthcare is in second place in terms of market share, followed by Fujifilm Medical Systems USA and Siemens Healthcare, all of which "perform above the medical equipment average," the study concluded.

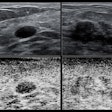

Reimbursement problems dogged other breast imaging vendors, such as Aurora Imaging Technology, Dilon Diagnostics, SonoCine, and U-Systems, which are covered in the study. Their customers reported problems getting reimbursed for screening patients, according to KLAS.