Two corporate giants are joining forces in an aggressive bid to make big-data analysis a reality for managing population health. IBM has signed an agreement with Siemens Healthineers that makes its Watson Health artificial intelligence technology available to Siemens customers.

The companies on October 11 announced a five-year alliance that makes Watson Health technology available throughout Siemens' installed base of global customers. Siemens will offer consulting services and IBM Watson data-analysis tools for population health management and patient engagement through its Digital Services business unit, which specializes in data analytics across multiple industries. These offerings will carry "powered by IBM Watson Health" branding to signify their pedigree.

The impetus for the deal is the growing trend toward value-based healthcare as governments and healthcare systems strive to deliver better care with fewer resources, and as providers seek to unlock data that up to now have been confined to department-based silos. Value-based care requires the kind of robust data analysis that only powerful computer tools like Watson can provide, according to August Calhoun, PhD, senior vice president of healthcare services at Siemens.

"You can deliver more care to more people if you can deliver it more efficiently," he said.

From Jeopardy! to geriatrics

IBM's Watson supercomputer began as an interesting side project on artificial intelligence and machine learning that originally won fame for beating a human on the Jeopardy! game show. But the emerging need for big-data analytics convinced IBM that Watson had a future as an actual business that could be applied to multiple industries.

IBM formed Watson Health in April 2015 as the first industry-specific business unit to commercialize the Watson technology. Since then, it has followed up with a series of acquisitions and partnerships to advance Watson Health as a viable commercial entity, such as its purchase of PACS firm Merge Healthcare last year and the acquisition of Truven Health Analytics in early 2016.

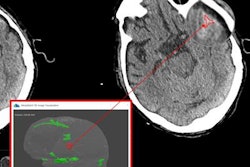

The deal with Siemens is a milestone on that path. Siemens operates in a variety of healthcare segments, but it's perhaps best known as a manufacturer of big iron medical imaging devices such as x-ray systems and MRI, CT, and PET scanners. These systems generate massive volumes of complex data that are ripe for analysis -- analysis that wasn't possible on a population-based level until Watson came along, according to Calhoun.

Almost contemporaneous with the rise of artificial intelligence tools like Watson, healthcare systems around the world have begun moving away from the fee-for-service model, widely seen as inefficient and wasteful, toward a paradigm based on the value of the services being delivered. In the U.S., the U.S. Centers for Medicare and Medicaid Services (CMS) in 2017 is going to require that providers begin moving toward new payment models in which they can demonstrate the value of the care they deliver.

The problem is that many healthcare providers don't know how to do that. And that's where IBM and Siemens can help.

"Customers are dealing with difficulties, and the new payment systems from CMS are driving active interest in population health," Calhoun said. "Our customers are asking us to provide these solutions."

The details

Siemens has already begun transferring knowledge and personnel from its existing Digital Services business to support the IBM Watson Health alliance, according to Calhoun. Most of the company's activities in data analysis have been on the department level, so this will be shifted to support the new population health emphasis. Siemens will also leverage its existing R&D activities to dovetail with the IBM collaboration.

How will population health data analysis work on a practical level? Despite the heightened interest in population health, many healthcare providers have been intimidated by what is required to implement high-level data analysis in practice, such as for determining which patients are at highest risk and require the closest follow-up, which lab tests should be emphasized, and which imaging tests should be prioritized. Other use cases could be for determining which patients are most at risk of complications that could result in readmission, which ones use the emergency room most often for their care, or who needs an email reminder for appointments.

With respect to radiology, the agreement will be invaluable to providers due to the large amount of data generated by medical imaging systems and the potential of that data for guiding patient management decisions when used with other information.

"The images are already highly clinically valuable, but they are even more valuable when you put them in a clinical and operational context," Calhoun said.

IBM sees Siemens as the perfect partner for helping the company make its vision of applying Watson to population health come to fruition, according to Lisa Rometty, vice president and general manager for global markets at IBM. The company has already begun selling its Care Manager application for monitoring patients with chronic conditions, as well as assets like Phytel population health management and Explorys analytics software that it gained through corporate acquisitions. Solutions sold jointly by the companies should be in use in the first quarter of 2017.

"It is very much a way for us to take what we believe is best-in-class population health management with a fantastic partner and the vast network and team they have to accelerate efforts to generate the value we seek," Rometty said.