Radiology Consulting Group

For other hospitals, the need may be less obvious. A small hospital with no residents or teaching may have a well-managed file room with relatively good film-tracking capabilities. So why bother with PACS? Additional revenue and increased modality capacity constraints provide some of the answers.

The lure of capturing additional market share from service improvements can be modeled to craft an argument in favor of a PACS purchase. Often there is market share that can be taken from the competition if superior service is offered in terms of image and report availability. Once the outstanding market share has been estimated, the potential revenue from even a very small percentage of that share can be forecasted.

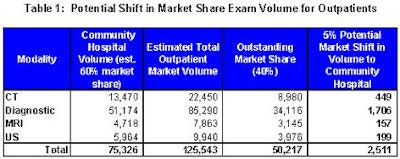

The following example, based on the fictitious Community Hospital, illustrates this point. Community Hospital knows its annual volume, and estimates that it currently captures 60% of the outpatient radiology business in its target market area. Based on these numbers, Community Hospital is able to estimate the total market volume and outstanding market share for radiological services.

Senior administrators then discuss the referring physician community, competition, and the advantage of being the first hospital in the area to deliver images to the referring physicians’ desktop computers. They agree that it's reasonable to assume a potential 5% shift in the outstanding market share to Community Hospital if digital image service is available and effectively marketed to the referring physician base. Table 1 illustrates a sample calculation.

|

Even with a current outpatient volume of only 75,326 exams, a 5% shift of the outstanding market share to Community Hospital would result in an additional 2,511 exams annually.

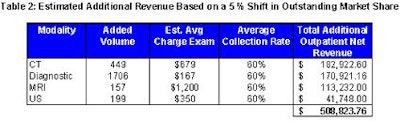

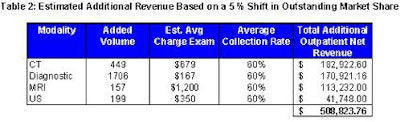

In order to estimate potential revenue, Community Hospital multiplies the potential outpatient exam volume by its charge per exam and then by its average collection rate. The result is the potential revenue opportunity that might be available by effectively marketing a PACS in a competitive market. Table 2 illustrates the calculation for potential revenue.

Table 2 indicates that a 5% shift in market share could potentially lead to over half a million dollars in additional revenue. The model assumes that the mix of exams will remain the same.

|

The next question typically asked is: "What additional resources would be required to accommodate the potential additional business?" The answer lies in the equipment and technologist productivity gains that may accrue from a PACS.

Hospitals that use technologists to process, label, package, and move and/or hang film will achieve the greatest increases in productivity as a result of PACS implementation. The total time required for these activities can be estimated based on a percentage of total work time spent on performing them, or on a per-exam basis.

Increases in equipment capacity can also be estimated. The recouped equipment capacity may not be commensurate with the technologist productivity gains, since adjustments for multitechnologist staffing and other factors may be needed. For example, if two technologists are staffing a CT scanner, patient throughput may be reduced, but may not come to a complete halt as a result of handling films.

Often, the additional capacity recouped by eliminating film handling by technologists will be more than adequate to accommodate the additional market share. This is a potent argument; not only is there potential for an increase in market share and additional revenue generation, but most, and sometimes all, of the revenue can be realized with few additional costs, if any.

This is clearly a soft argument. It is up to the decision-makers at your institution as to whether or not potential revenue should be included in a return on investment (ROI) analysis for a PACS. The positive impact on an ROI may be significantly greater than the effects of film savings or any other expense reductions attributable to a PACS implementation.

If a revenue increase is included, it can turn the ROI positive in a relatively short period of time. Even if potential revenue is rejected as a cash inflow for the ROI, the recouped productivity and capacity that results by eliminating film handling by technologist can still be a good "soft" argument for a PACS. The capability to meet future demand without a commensurate increase in equipment and technologist resources is appealing to most administrators. This is especially true for those institutions that rely heavily on technologists for film-handling tasks and for those areas of the country hit hard by the current shortage of technologists.

If your institution’s decision-makers really believe market share shouldn't be factored into a PACS decision, then ask them this: "If you don’t make a decision to purchase a PACS and a competitor does, is our current market share at risk?"

By Len LevineAuntMinnie.com contributing writer

May 31, 2002

Levine is a senior business systems consultant with the Radiology Consulting Group in Boston.

Related Reading

Components of a successful training program, April 24, 2002

Billing process review can reap revenue rewards, March 28, 2002

Voice recognition technology saves time, money, February 26, 2002

Budget monitoring reveals practice’s financial health, January 24, 2002

Creating a strategic patient safety agenda in radiology, December 28, 2001

This article is one in a monthly series of practice management topics contributed by the Radiology Consulting Group in Boston. The ongoing series addresses topics and issues of concern to radiology administrators and business managers.

Copyright © 2002 Radiology Consulting Group