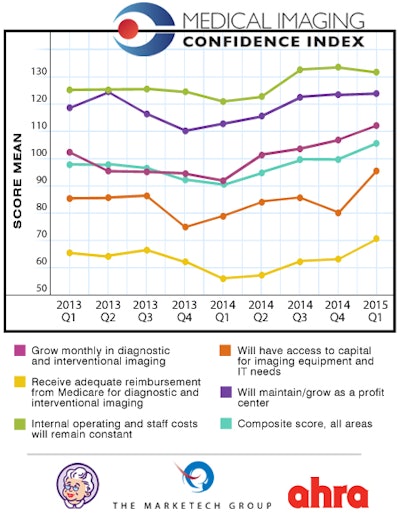

Radiology administrators in the U.S. continue to show a more positive outlook on their future business prospects, if the latest numbers in the Medical Imaging Confidence Index (MICI) are any indication. New first-quarter 2015 MICI numbers show improvement in nearly all categories.

The improvement in the MICI numbers continues a trend that began in the second quarter of 2014, when a steady run of pessimistic sentiment bottomed out and began shifting upward. However, certain trends remain across all surveys, with radiology administrators having the lowest confidence in getting adequate reimbursement from Medicare, while remaining most optimistic that their internal operating and staff costs will stay constant.

MICI is a forward-looking index designed to provide an early view of trends as they develop. It is derived from the responses of imaging directors and hospital managers who are members of the AHRA medical imaging management association. Members of the MICI panel are asked about five key trends typically encountered by radiology administrators and what they expect in these areas in the upcoming quarter. The MICI survey is produced by AHRA and market research firm the MarkeTech Group.

For the first-quarter data, MICI gathered 175 survey participants from across the U.S., with 10% based in the Pacific region, 7% in the Mountain region, 12% in the West North Central region, 22% in the East North Central region, 16% in the Mid-Atlantic region, 13% in the South Atlantic region, 7% in the East South Central region, and 13% in the West South Central region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also tabulated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

| MICI Q1 scores by topic | ||

| Topic | Mean score | Interpretation |

| Will grow monthly in diagnostic and interventional radiology | 112 | High confidence |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 71 | Low confidence |

| Internal operating and staff costs will remain constant | 132 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 96 | Neutral |

| Will maintain/grow as a profit center | 124 | High confidence |

| Composite score across all areas | 106 | Neutral |

The results are statistically significant in the "access to capital for imaging equipment" category for Q1 2015 versus Q4 2014. The numbers are also statistically significant for all categories when comparing Q1 2015 with Q1 2014.