You're a radiologist. But you're forced by position to manage a multimillion-dollar practice. You may have little interest or training in financial management. While you could do it, it isn't motivating and is just not part of your DNA.

We are all gifted differently, and as much as your patients rely on your medical education, training, and skills for wise counsel, you can grow in knowledge and strength as you rely on others for experience and abilities that are in their wheelhouse.

Don Rodden, principal at HealthPro Medical Billing.

Don Rodden, principal at HealthPro Medical Billing.That's easy to say but hard to do. Radiologists are held in high regard and are almost always speaking "with authority." So depending on someone or something else is a hit to our pride and sense of control.

At a bare minimum, you need to know that your company (practice) is on target, not leaving money on the table, and not taking excessive risks with respect to regulatory compliance. You need to receive current and relevant information in an easy-to-assess format -- information that is dependable and validated. You need measurable metrics that tell you the status of your operations and financial success.

While it's not rocket science, many practice managers and practice management systems still do not effectively connect the plethora of data analytics to digest and communicate in a meaningful way what you need to know to have a pulse on your practice's financial health.

For information to be helpful and actionable, it needs context. For example, telling you how much you received in payments last month without reference points is limited in meaning. But if you know that receipts were up 3.4% over prior periods, but your charges and relative value unit (RVU) volumes were up by 12.8%, there's money missing.

So you ask, "Where do I start? What are the absolute basics I need on a monthly basis to assure me and my partners that I'm on the right trajectory?"

From your process/system, you need to demand consistent, comparable, validated metrics that tell you the five things described below.

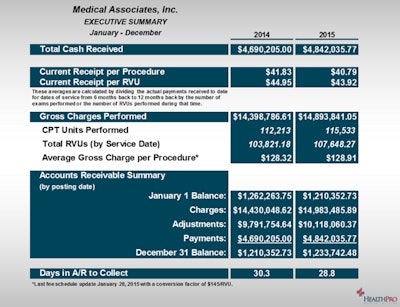

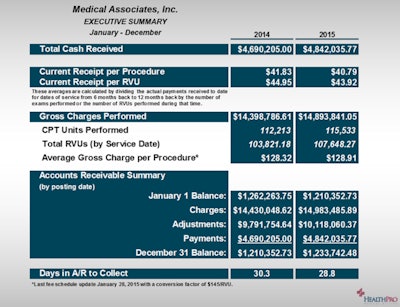

1. Monthly receipts

You need to know your monthly receipts, but you also need to be able to compare these with prior months, with the same month in the prior year, and on a year-to-date basis for both current and prior years.

2. Current receipt per RVU

The only accurate way to measure how much you received from a specific procedure is to file the claim, file any secondary claims, bill the patient for the balance, and send statements until the account is resolved. On average, 90% or so of your revenue will be realized within 30 to 45 days from the date of service, but some specific procedures, particularly the more expensive ones, can take longer to collect.

As such, it makes sense to take dates of service from a few months back, track the specific receipts from those procedures, and determine the actual dollars received per RVU that you performed. For clarity, I'm referring to total RVUs, not just the work RVU component. That is because your income is determined by payors based on the total RVUs. (For further explanation of RVUs, click here.)

By monitoring $/RVU at a high level, you can notice major trend changes. By taking it a step further and having reports that show you the payor trends in $/RVU received, you have a powerful tool to assess whether (a) payors are not paying you what they've contracted to pay you, and/or (b) where your billing process may be dropping the ball.

The key point is that you will have a tool to monitor performance in a matter of one to two minutes. (For more information on this specific report, click here.)

3. Procedure volume-based metrics

Each of the following metrics provides different data elements to reveal high-level perspectives on performance and trends:

- Gross charges billed

- Current procedural terminology (CPT) units performed

- Total RVUs performed

- Average gross charge per procedure

4. Summary of accounts receivable activity

This is a 30,000-ft view of your entire billing-related financial activity. It begins with your beginning period accounts receivable (A/R) balance and is increased by charges billed and decreased by payments and adjustments. By monitoring this monthly and comparing it with prior periods, major irregularities can be observed and questioned.

5. Days in A/R to collect

Days in A/R is a metric to tell you how quickly -- or slowly -- your money is coming in. On average, you should receive your receipts in 30 days or less. (Many receipts will come in within 14 to 21 days, while trailing receipts for denied claims needing to be reworked, workers' compensation claims, patient payments, etc., can take much longer.)

Below is an image of the highest-level executive summary that begins to capture some of these metrics. Behind this data is a substantial amount of detailed monthly data that allows you to drill down and analyze with much more specificity. But even if you only have this highest-level report, you're a long way ahead in beginning to effectively monitor your practice's financial condition.

Image courtesy of HealthPro.

Sadly, some practice managers and billing entities lack transparency of their activity and performance. If your billing process isn't managing every claim, accounting for it to the penny and reconciling the billing system to your bank account, there's a high probability that irregularities exist. It is very easy to mask failing to follow up on denied claims, miss deadlines, and write off activity that should be otherwise collectible.

What you need

Radiologists need two things. A billing relationship they can trust -- but a billing process that provides validation and demonstrates competency and integrity. As Ronald Reagan once said, "Trust but verify."

The above metrics and report are the tip of the iceberg of a plethora of information you can and should have direct access to. Too much is at stake as you manage millions of dollars annually.

For the next top three reports that our radiologists deem essential, email me at [email protected], and I'll be happy to share them with you.

Don Rodden is a principal at HealthPro Medical Billing, a leading revenue cycle management and medical coding company. Don is a past president of the Healthcare Billing Management Association (HBMA) and is currently vice chair of its Government Relations Committee. He has been a consultant to physicians and medical practices for over 30 years.

© HealthPro Medical Billing, August 2016