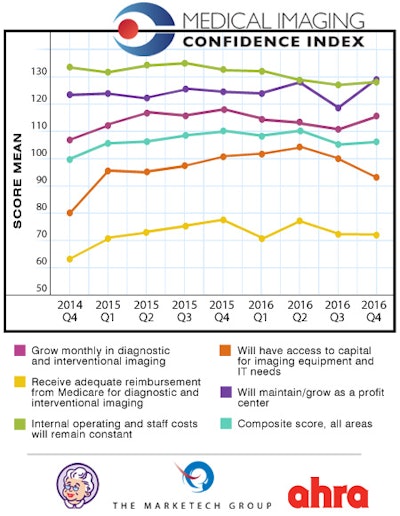

As radiology heads into the finish lap of 2016, radiology administrators remain pessimistic that they will receive adequate reimbursement from Medicare for diagnostic and interventional radiology services, according to fourth-quarter numbers from the Medical Imaging Confidence Index (MICI).

From a basket of five questions covering key aspects of radiology operations, imaging managers showed the lowest level of confidence that they would get adequate reimbursement from Medicare. The topic has consistently scored at the bottom in past MICI surveys as well.

The MICI is derived from survey responses of imaging directors and hospital managers who are members of the AHRA, the association for medical imaging management. Members of the MICI panel answer questions about five important trends faced by radiology administrators in the upcoming quarter to develop a barometer of their sentiment about near-term business prospects. The MICI survey is produced by the AHRA and market research firm the MarkeTech Group.

For the fourth-quarter data, MICI gathered 150 survey participants from across the U.S., with 9% based in the Pacific region, 7% in the Mountain region, 14% in the West North Central region, 21% in the East North Central region, 13% in the Mid-Atlantic region, 15% in the South Atlantic region, 8% in the East South Central region, and 13% in the West South Central region.

Participants were asked to rate their optimism about the five topics, and a single composite score including all five categories was also tabulated. Scores ranged from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

MICI scores for the fourth quarter of 2016 and their relationship to the eight previous quarters are shown in the chart below.

When it comes to scores for individual components of the index, administrators showed the most optimism that their facility will maintain/grow as a profit center, with a score of 129. Next up was confidence that their internal operating and staff costs will remain constant, with a mean score of 128.

Imaging managers were less optimistic with respect to their facility's ability to grow monthly in diagnostic and interventional imaging, with a score of 115.

| MICI Q4 scores by topic | ||

| Topic | Mean score | Interpretation |

| Will maintain/grow as a profit center | 129 | High confidence |

| Internal operating and staff costs will remain constant | 128 | High confidence |

| Will grow monthly in diagnostic and interventional imaging | 115 | High confidence |

| Will have access to capital for imaging equipment and IT needs | 93 | Neutral |

| Will receive adequate reimbursement from Medicare for diagnostic and interventional imaging | 72 | Low confidence |

| Composite score across all areas | 106 | Neutral |

Administrators were neutral on their outlook for accessing capital for imaging equipment and IT needs, with a score of 93. The MICI composite score across all five topics was 106, also representing a neutral outlook.