ECG Management Consultants

The shortage places many hospitals in a precarious position because diagnostic imaging is both a clinical necessity and a strong financial performer. Although many hospitals feel vulnerable, collaboration strategies offer promising solutions for securing high-quality imaging services.

Demand outpacing supply

In the mid-1990s there was speculation that a shortage of diagnostic radiologists was looming. The past few years provide evidence that the shortage has officially arrived. In 1998, the American College of Radiology (ACR) Professional Bureau, the largest placement service in diagnostic radiology, had 1.3 job listings per job seeker. Two years later, the ratio had grown to 3.8 listings per job seeker, almost a 200% increase. Two major forces are at play: a flat, if not decreasing, supply of radiologists and an increasing demand for diagnostic imaging services. The compounding effect of these forces has created a severe shortage of radiologists.

Supply is flat, at best

To understand the relatively flat -- and in some cases diminishing -- supply of radiologists during recent years, one need look no further than radiology residency programs. Since 1996, the number of radiology programs has increased by 3.6%, from 442 to 458. This growth is due to a significant increase in the number of vascular/interventional programs. Excluding this subspecialty, the number of programs has actually decreased from 372 to 356, or 4.3% [Graduate Medical Education, Appendix II, Table 1, Journal of the American Medical Association, September 4, 2002, Vol. 288:9; historical information from the Accreditation Council on Graduate Medical Education (ACGME)].

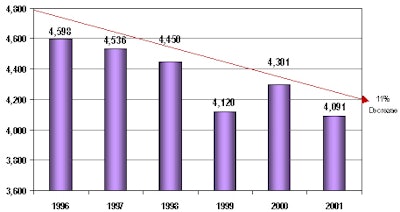

During this same time frame, the number of residents on duty has decreased by over 11%, as shown in Figure 1.

|

| Figure 1 -- Residents on duty in diagnostic radiology |

Further exacerbating this issue is the clear trend among residents and fellows toward greater subspecialty training, through either specialized residency programs or, more frequently, through fellowships. Recent surveys indicate that roughly 30% of radiologists are subspecialists, while the rest are generalists. For many of the smaller community hospitals that can support only a limited number of radiologists, this trend decreases their capability to attract radiologists. Smaller hospitals typically require more general diagnostic radiologists rather than subspecialists.

Increasing demand for imaging services

It has been well documented that the utilization of imaging services has, and will continue, to increase. Two major factors appear to be driving the demand: new technologies and an aging U.S. population. Once considered advanced imaging capabilities, CT and MRI have become relatively routine diagnostic tools.

Recent studies by the ACR -- lead by Jonathan Sunshine, Ph.D., senior director of research -- indicate that MRI, CT, and interventional radiology services have increased, on average, 7.3% annually over the past 12 years. In contrast, plain film and fluoroscopy grew 1.5% annually ("Cardiologists take a big bite out of medical imaging," Diagnostic Imaging Online, October 31, 2002).

Furthermore, technology enhancements continue to expand the potential application of diagnostic imaging, whether it is CT body scanning, cardiac MRI, or molecular imaging aimed at analyzing physiology and biochemistry.

Most projections indicate that the aging U.S. population will have a profound impact on demand for imaging services. The analysis of utilization data by age group clearly illustrates this, as persons 65 and older utilize imaging services approximately twice as much as persons between the age of 45-64 and more than three times that of persons 20-44.

According to the U.S. Census Bureau, the national population is projected to increase by 16% from approximately 280 million to 325 million by 2020. However, the population age 65 and older is expected to leap from 36 million to 53 million, or almost 50%, during the same time frame. Based on current utilization trends among the aged, as the baby boomer population grows older, demand for imaging services will undoubtedly continue to increase.

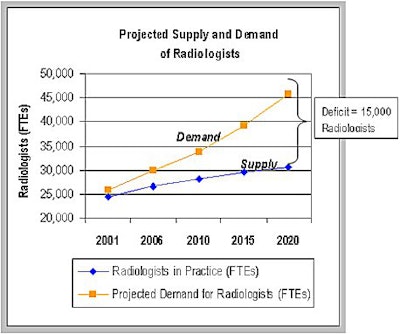

The compounding effect of a relatively flat supply of radiologists and increasing demand for radiology services will likely aggravate the current radiologist deficit. A recent report estimates the current deficit at approximately 5% and projects the deficit could grow to roughly 50% (greater than 15,000 radiologists) by 2020 (American Journal of Roentgenology, May 2002, Vol. 178:5, pp.1075-1082).

|

| Figure 2 -- Projected supply and demand of radiologists |

Even after adjusting for improved productivity due to technology enhancements (voice recognition, PACS) and the proposed reduction of residency training to three years, the long-term projections suggest a deficit of approximately 1,200 radiologists in 2020.

Common issues for radiologists

To address the shortage in the near term, hospitals need a firm understanding of the issues plaguing radiology groups, beyond the recruitment and retention concerns previously mentioned. The issues include:

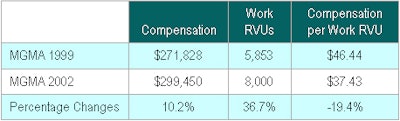

Compensation

Nationally, radiology compensation has risen considerably over the past several years. However, most increases are related to higher productivity and radiologists capturing a portion of facility or technical fee reimbursement through ownership in imaging centers. Increases in professional fee reimbursement have been relatively limited. A summary of changes in compensation and productivity can be seen in Table 1.

|

|

Table 1 -- National median compensation and production trends. [Based on the Medical Group Management Association's Physician Compensation and Production surveys. Survey year represents data from the prior year. Data represents median results for all radiologists (single and multispecialty groups.)] |

To remain competitive in recruitment and to retain existing radiologists, groups are aggressively seeking additional revenue streams. As overall compensation levels increase, groups that are not capturing technical revenue are finding it difficult to remain competitive.

Inefficient operations

With workloads peaking and reimbursement remaining relatively stagnant, efficiency is critical for radiologists to improve productivity and maintain or increase their income. Whether it is scheduling, image quality, film hanging, or capturing the necessary billing information, departmental operations can have a significant impact on radiologists’ workflow and production. Radiologists often feel they have limited control or influence over operations and in implementing changes.

Call coverage

Historically, the main imaging service provided in the emergency department was radiography. Usually, the emergency medicine physician would review the image, eliminating the need to call in a radiologist. The radiologist would then read the image in the morning. However, the emergency department is no exception to the general proliferation of more advanced imaging services. Although x-ray is still a dominant modality, CT and MRI utilization is growing significantly, often necessitating stat reads by radiologists or monitoring for contrast injections.

Increasing competition from other specialties

The proliferation of imaging services has also caused a blurring of which specialties provide these services. For example, many cardiologists now provide nuclear cardiology services, cardiac angiography, and echocardiography. In 1986, radiology’s share of the imaging workload measured in relative value units (RVUs) was approximately 79%. By 1998, its share had fallen to 58%. Meanwhile, cardiology’s share of imaging services rose from 5% in 1986 to 25% in 1998 (Diagnostic Imaging Online, October 31, 2002).

Similar turf battles are occurring related to peripheral vascular services and cardiac MRI.

Implications for hospitals

The radiology shortage will likely continue for a minimum of 5-10 years. To compensate for the shortage, radiologists and hospitals will benefit from improved physician productivity. Many organizations have capitalized on new technology in the form of PACS, voice recognition, and computer-aided detection (CAD). Technology alone, however, is unlikely to satisfy the current shortage.

The implications of the radiologist shortage for hospitals can be severe and revolve around the following major themes:

- Declining stability of the radiology department.

- Increased use of locum tenens.

- Dissatisfied referring physicians.

- Development of competing outpatient imaging centers or services.

- Declining incentives for radiologists to market/expand services as a result of being overworked.

- Increased pressure for capital/technology investment from radiologists.

For many hospitals, it is not uncommon for imaging services to account for 15% or more of total system revenue, and an even higher proportion of contribution margin. Given the significant financial contribution of radiology services, hospital executives must address potential issues swiftly, before they escalate to a level that undermines the organization’s ability to effectively provide imaging services.

Collaboration strategies provide promising opportunities

In general, there are two major avenues for addressing the radiologist shortage: improve radiology productivity and recruit additional radiologists. Our experience has shown that a collaborative approach to business/operational planning and recruitment offers hospitals and radiologists the greatest opportunity for successfully addressing the current shortage. These strategies include:

Provide recruitment assistance

Nothing is worse than offering assistance and not delivering; therefore, focus on areas where the hospital can have an immediate impact. Target directly addressing current issues plaguing the group and differentiating the group (and the hospital) from competitors. Some of the options will require financial resources, but it can be a worthwhile investment. The alternative may be an unstable or disbanded radiology group.

Extend recruiting resources

Assistance can come in many forms, from extending the services of hospital human resources departments to coordinating the interview and department tour process. Many radiology groups simply do not have the infrastructure to support a full-scale recruitment process. Leveraging the experience of hospital recruiters can help the group identify potential candidates and significantly reduce its time involved in this process.

Assist in funding recruitment efforts

Understandably, groups are improving their recruitment success by offering greater financial incentives. Joint funding arrangements allow these incentives to be more palatable for the group. Jointly funded recruitment expenses can include payments to physician recruiting firms, reimbursement for physician recruitment travel, sign-on bonuses, and relocation expenses.

Explore nighthawk coverage options

Technology makes it possible for radiologists to review images from remote locations. Many organizations have used technology to enable on-call radiologists to review images offsite, as opposed to reading images at the hospital. To further alleviate the burden of call coverage, nighthawk services have been developed whereby an organization contracts with radiologists for remote evening call coverage. Many nighthawk services are located internationally to take advantage of time-zone differences.

There can be multiple benefits: reduced coverage responsibilities for radiologists, particularly during an undesirable time of day; faster response time because physicians do not have to wait for radiologists to commute to the hospital; and potentially improved customer service because the radiologist on duty is working during their day, as opposed to the middle of the night. Offering potential candidates a position that does not require standard call coverage can be a significant recruitment advantage for radiology groups.

Involve hospital leadership in the interview/recruitment process

With more job opportunities available, candidates are becoming more sophisticated in their evaluation process. Many recruits are looking beyond the group practice and to the group’s relationship with the hospital, the hospital’s commitment to imaging, and organizational strategy. Making senior hospital leadership available during the interview and recruitment process can make a significant positive impression on candidates.

Utilize locum tenens as a last resort

Despite increasing workloads, some radiology groups hesitate to utilize locum tenens because this option can be a financial drain. However, the long-term ramifications of members leaving as a result of heavy workloads can quickly outweigh these expenses. The cost of supporting locum tenens coverage is relatively limited, yet hospitals can provide significant lifestyle benefits to the existing radiology group by underwriting the expense.

Tackle operational concerns

Radiologists’ productivity is inextricably connected with departmental operations, from scheduling to film management to technologists’ performance. Moreover, radiologists’ end product, the clinical report, is highly dependent on department employees and workflows. By working with radiologists to address operational concerns, organizations can improve physician productivity and satisfaction, realize operational efficiencies, and improve the group’s recruitment success.

Experience has shown that by applying a systematic approach that targets both near- and long-term solutions, issues can be quickly identified and addressed. Because this approach relies on radiologists’ input and time, an efficient and rapid process that is results-oriented is critical to maintaining physician involvement and enthusiasm.

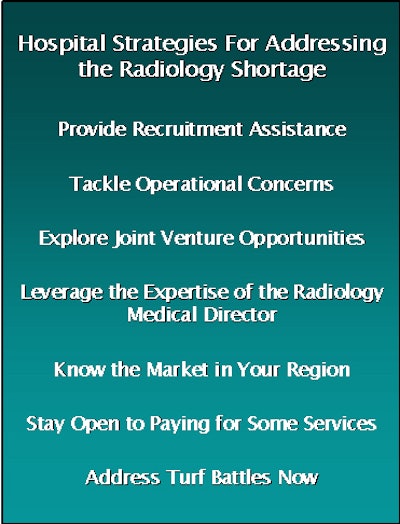

Hospital strategies for addressing the radiology shortage

- Provide recruitment assistance

- Tackle operational concerns

- Explore joint venture opportunities

- Leverage the expertise of the medical director

- Know the market in your region

- Stay open to paying for some services

- Address turf battles now

Explore joint venture opportunities

Outpatient imaging services offer expanded growth potential, a better payor mix, and increased profitably. Therefore, radiologists are highly motivated to capture the technical reimbursement associated with these services. In addition, new recruits view the additional revenue stream as a sign of a group’s strength; increasingly, they will not consider joining groups without this advantage.

Joint ventures offer radiologists and hospitals a vehicle to enhance market competitiveness, align incentives, and increase revenue, while maintaining autonomy. Structured properly, joint ventures do not have to result in lost revenue for the hospital; they can be a win-win situation for both the hospital and the radiology group.

Leverage the expertise of the radiology medical director

Diagnostic imaging is a technology-rich and capital-intensive service. Therefore, selecting the appropriate technology application, whether it is PACS, voice recognition, or other software, and purchasing the right imaging equipment can have significant financial ramifications. Too often, insufficient radiologist input is received, making downstream physician buy-in more difficult to obtain.

During a provider shortage, this issue takes on even greater importance because new technologies and imaging equipment have a profound effect on how radiologists practice, their level of productivity and efficiency, and what services they can market to referring physicians. By tapping into the expertise of radiologists from the beginning, organizations can target products that will improve physician productivity, while also enhancing the probability of user buy-in.

Know the market in your region

It is not uncommon for radiologists to assert that they are undercompensated, citing anecdotal information about radiologists' salaries at other hospitals or offers being made in a neighboring community. If the hospital does not understand the market for radiology services, meaningful discussions about compensation issues will be very difficult.

The most effective way to know the market is to collaborate with the radiologists to conduct a survey of radiology groups and hospitals in the region. The survey should address compensation, benefits, time off, RVUs by provider, support provided by hospitals, and so forth. The survey can be formal or informal, but it should provide both the hospital and the radiologists with accurate and timely information so that valid comparisons can be made. Ultimately, if the radiologists are not able to earn competitive compensation for competitive productivity, it will be difficult to recruit, and the existing physicians could soon seek better opportunities.

Stay open to paying for some services

It has been common practice for radiology groups to provide services without a payment from the hospital. Historically, revenue from professional fees has been the source of compensation for the radiologists. The relationship generally worked well, serving the needs of both the hospital and the radiologists. In the past several years, however, radiology has become increasingly specialized, and hospitals have a greater need for specialized on-call coverage for services such as invasive procedures, neuroimaging, and trauma centers.

In cases where the hospital’s need for expanded services exceeds the professional fees associated with those services, it is appropriate to offer payment to the doctors. These pressures have led more hospitals to subsidize the radiologists, and most observers believe that this trend will accelerate. Therefore, it is important that hospital management remains flexible and demonstrates that the growing demands on radiologists will be recognized financially when appropriate.

Address turf battles now

Whether it is cardiac imaging or interventional procedures, competition in traditional radiology service areas is mounting. The turf battles being established have consequences for radiologists, other medical staff, and the hospital. Various strategies can be employed to stave off or quell these battles, such as:

- Renegotiating exclusivity parameters in current contracts.

- Initiating a collaborative medical staff process for determining issues regarding credentialing and exclusivity.

- Partnering with radiologists to appease other business needs (for example, imaging center joint ventures).

However, the strategy that will not work is ignoring the turf battles. This will only delay the inevitable, as the issues will continue to grow.

Complex issues surround imaging services. The current deficit of radiologists places significant workload pressure on imaging providers, but also allows radiology groups to wield negotiating leverage. By partnering and engaging in collaboration strategies, hospitals and radiologists can achieve greater financial success for both parties, while also improving the quality of diagnostic imaging services.

By Kevin P. Forster

AuntMinnie.com contributing writer

March 26, 2002

Kevin Forster is a senior associate with ECG Management Consultants, a national consulting firm serving hospitals, health systems, and physician groups. He holds a bachelor of arts degree from Emory University in Atlanta and a master's of business administration, as well as a master's of health administration, from the University of Washington in Seattle. He can be contacted at 206-689-2200, or at [email protected].

Related Reading

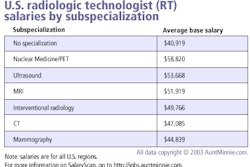

SalaryScan survey: Subspecialization pays off for radiology professionals, March 13, 2003

Radiologists tough to recruit, survey finds, February 25, 2003

Radiology recruiting demands planning and preparation, December 23, 2002

Radiologists find new recruiting incentives in tight employment market, December 12, 2002

Radiology job market looks rosy in coming years, October 15, 2001

Copyright © 2003 ECG Management Consultants