Outpatient imaging centers are the healthcare facilities of choice for ambulatory patients because they're convenient and easy to use. Hospitals that failed to recognize this consumer preference and didn't establish outpatient imaging centers have been losing market share to standalone imaging centers.

But hospitals are getting a second chance in outpatient imaging thanks to the financial impact of the Deficit Reduction Act (DRA) of 2005, which is hammering many independent imaging centers. Fallout from the DRA is making it easier for hospital systems to recapture outpatient imaging market share, according to a presentation at the American Healthcare Radiology Administrators (AHRA) meeting in July.

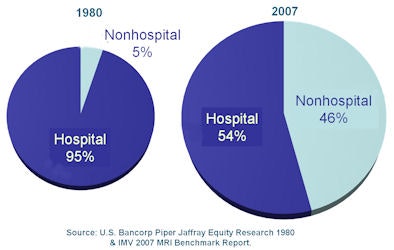

Since 1980, a continuous shift to nonhospital-based imaging has been taking place, according to W. Cannon King, executive vice president of business development at Outpatient Imaging Affiliates, a Nashville, TN-based company that provides turnkey services for the development of outpatient imaging centers by hospitals and physician practices. In 1980, 95% of all diagnostic imaging procedures were performed in a hospital. By 2007, only 54% were.

|

| All images and tables courtesy of Outpatient Imaging Affiliates. |

"If your hospital isn't operating an outpatient facility, you are limiting your ability to service your patients and you are giving away market share," King said. "Outpatient centers are better positioned to meet the service expectations of patients and their referring physicians."

Outpatient imaging services are particularly accessible and convenient for an aging population such as the baby boomers. Patients can drive to the center, park outside its front entrance, walk in, have their procedure conducted at the scheduled time, and leave, King said.

In a hospital environment, even if the radiology department offers hassle-free scheduling and on-time examinations without emergency patient interruptions, patients may be required to use a parking lot blocks away from their destination and then have to pay for the privilege, walk down long corridors in the hospital complex to reach the radiology department, and in the process be exposed to sick and infectious people.

Another advantage for hospitals in establishing an outpatient facility is the fragmented nature of the outpatient imaging market, according to King. Imaging services chains control only 12.2% of all outpatient imaging centers, according to Verispan's 2006 edition of the Diagnostic Imaging Center Market Report from SDI Innovations of Plymouth Meeting, PA.

"It is very probable that your market is just as fragmented," King said. "Take advantage of this opportunity to get a piece of it."

Developing a strategy

If a hospital wants to expand its services by establishing one or more outpatient imaging centers, it needs to develop an imaging services strategy. "What are your goals? If you want to dominate the market, what does this mean? Where does your health system want to be in the next five years? How many centers do you need to establish to reach your goals or dominate the market? How do your existing radiologists fit into these plans? These are the questions you need to initially ask," King counseled.

This may be a great time to make your move, according to King. Factors that have weakened or decimated the financial health of independent centers lacking substantial financial resources include:

- Reduced payments for Medicare patients by the DRA

- Pressure by commercial health insurance companies on independent imaging centers to reduce reimbursement when negotiating or renegotiating contracts

- An oversupply of imaging centers in some regions, resulting in lower volume and declining revenue per center

The closing of independent imaging centers due to bankruptcy has created a more stringent economic climate and raised the barriers to entry for entrepreneurs. "Several years ago, an individual who signed a personal guarantee with a financing company could open an MRI center. This was a good business to be in, but not any more," King said.

A hospital can take advantage of a weakened outpatient provider climate by purchasing failing or failed independent imaging centers at a fraction of their value. Lenders do not want the modality equipment, and this may be a fiscally conservative way to enter the market. The purchase price for a failed/failing center may be based on book value, discounted cash flow, or a multiple of earnings.

Still, the importance of doing a detailed financial analysis cannot be overemphasized, according to King. It is important to investigate the percentage of collections and net revenue. King warned that the management of failed centers may not have maintained accurate or comprehensive records, so this task may be a challenge.

Other to-do items include:

- Investigating legal issues that the hospital may assume, such as property leases and bad debt

- Assessing equipment replacement and upgrades, adding RIS and PACS, and any other capital expenditures

Don't overlook the center's referral base, King cautioned, because if it is a small one, the referring physicians may be the buddies of the original owners. They may cease to refer once ownership has changed hands. The broader the referral base, the more stable initial revenue projections may be.

The hospital also should solicit the opinions of the physicians who refer to the center, in part to generate advance goodwill but also to learn if there are concerns about a hospital health system takeover. Some imaging centers have a strong referral base because of their neutrality, especially when referring physicians may be aligned with two or more competing hospital systems. Changes in the referral base need to be anticipated, both from a revenue-generating perspective and to estimate the costs of marketing a new start-up.

The purchase price of an existing or closed independent outpatient imaging center as a multiple of earnings ranges from 2.5 to 12, but a multiple of 3.5 to 6.5 is standard, according to King. If a hospital has more financially lucrative contracts with payors than the independent imaging center has, and if the historic volume can be maintained, the effective multiple of earnings will actually be lower.

Acquisition example

|

||||||||||||

| Note: subtract debt EBITDA = earnings before interest, taxes, depreciation, and amortization | ||||||||||||

Effect of better payor contracts

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Effective multiple

|

||||||||||||||||||||||||||||

Regardless of whether a hospital purchases a failing imaging center or is planning to establish a new one, it is imperative to develop a basic market analysis. Elements for inclusion, which will be incorporated into a business plan and a pro forma, include:

- Defining the service area

- Conducting a detailed demographic analysis of potential patients including the population number, ages, anticipated growth/decline in the geographic service area, and affluence of target population

- Analyzing the competition, including mapping the competitors' locations to determine if there are any potentially underserved areas or areas that are overpopulated

- Asking vendors about the quality of equipment and professional service of competitive centers

- Conducting "secret shopper" telephone calls to learn the quality of customer service and how rapidly a procedure can be scheduled; analyze identified backlogs

- From the perspective of the hospital radiology department, will existing backlogs be reduced? Will the department operate more efficiently? What types and percentage of procedures will be shifted to the new outpatient imaging center, and how will this cannibalization affect the department?

- What additional clinical, technical, and support staffing requirements will be needed? At what cost?

- What do the radiologists think? Will they be able to support the additional estimated workload? Are they willing to do so? Do they wish to participate in a joint venture with the hospital? Or does the contracted radiology practice for the hospital own an existing center, and if so, what are potential contract outcomes upon renewal?

Often overlooked in a market analysis are the opinions of all of the referring physicians associated with the hospital, according to King. "The support of area physicians is the most important factor in the success or failure of a hospital-owned outpatient imaging center," he said.

King recommends that referring physicians be surveyed for multiple factors, such as why they send their patients to the center, their perception of the hospital, and the diagnostic mix of services they need and equipment preferences, such as open versus closed MRI.

|

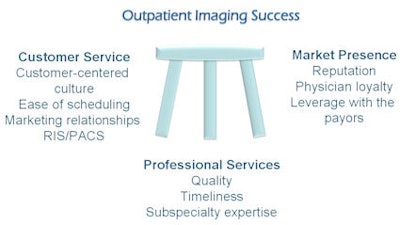

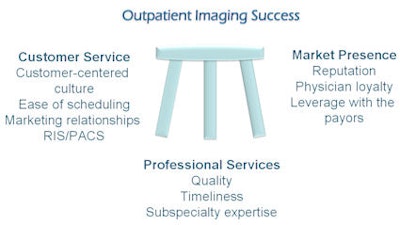

If a hospital system has done its due diligence well, it has an excellent chance of reclaiming a portion of the outpatient imaging market, adding revenue, and providing better healthcare service to the communities it serves. While the standard of quality the hospital maintains must be extended to the outpatient imaging center, the center must be operated on the basis of a three-legged stool strategy, King said.

"That's what's grown the outpatient market with such success," he concluded.

By Cynthia Keen

AuntMinnie.com staff writer

September 1, 2008

Related Reading

Outpatient imaging health predicted strong through 2013, August 14, 2008

Outpatient imaging: Back to the hospital? October 5, 2007

DRA's arrival forces imaging centers to adapt, February 1, 2007

Copyright © 2008 AuntMinnie.com