Because the demand for diagnostic imaging services will continue to rise, the "state of the state" of outpatient imaging in the U.S. will remain positive over the next five years, an imaging consultant predicts. But providers will need to demonstrate the value of the services they offer to get a share of the pie.

M. Shane Foreman, a principal with 3d Health of Chicago, a consulting firm specializing in outpatient medical center strategies and development, discussed key trends at the recent American Healthcare Radiology Administrators (AHRA) annual meeting held in Denver.

Outpatient imaging to escalate

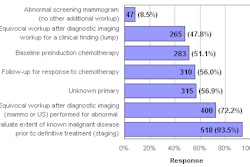

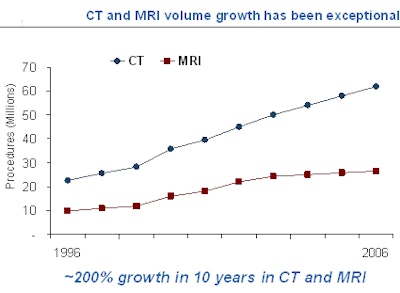

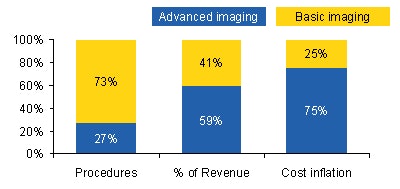

Medicare reimbursement for outpatient imaging grew 60% between 1996 and 2006, from approximately 61 million procedures performed annually in 1996 to approximately 99 million procedures in 2006. During this ten-year period, MRI procedures have doubled and CT procedures have tripled, according to Foreman and his colleagues' analysis of payments by government and private payors.

|

| This graph incorporates data from both inpatient and outpatient imaging facilities and reflects all payors. Data sources: Centers for Medicare and Medicaid Services (CMS) Medicare Physician Fee Schedule (MPFS) utilization files for 2005 and 2006, IMV Market Reports, and 3d Health analysis. All charts courtesy of 3d Health. |

|

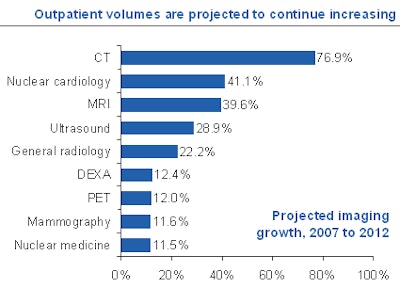

| Data source: Outpatient Profiles, Thomson Reuters (Solucient). |

The analysis attributes this growth to several factors, especially the commercialization of new technologies and new clinical procedures that have gained acceptance, Foreman said. Applications like CT angiography, breast MRI, fusion imaging, molecular imaging, functional imaging, and 4D ultrasound have increased utilization of diagnostic imaging.

"As long as a clinical application utilizing a new technology is supported by reimbursement, its usage will grow," Foreman said. "However, clinical utilization does not become a standard of care until it is reimbursed." He said that PET is an excellent example of a technology that failed to meet growth predictions that he and other strategists made because of limited reimbursement.

"Baby boomers will need diagnostic imaging services in an unprecedented quantity as they age," according to Foreman. "Individuals ages 65 and older have twice as many diagnostic imaging procedures as those ages 45 to 65 and three times as many as those ages 20 to 44."

He expects the baby boomer generation to further increase demand by paying for procedures such as cardiac CT to identify the amount of arterial plaque buildup or for other "wellness" scans, especially as they pertain to cardiac disease and cancer prevention.

New guidelines, such as the American Cancer Society's (ACS) recommendation that women with a 20% or greater risk of breast cancer have an annual breast MRI screening examination, will also increase utilization. If all women who qualify have the procedure, the number of breast MRIs would increase by at least 1 million procedures, experts estimate.

The practice of defensive medicine to avoid malpractice litigation will not diminish. Physicians, especially emergency physicians, will continue to order rule-out diagnostic imaging procedures.

As has been well documented, other medical specialists such as cardiologists and orthopedic surgeons are also promoting increased utilization. And finally, radiology practices and hospitals have become more sophisticated at promoting and marketing specialized services.

New guidelines and aggressive cost management by payors

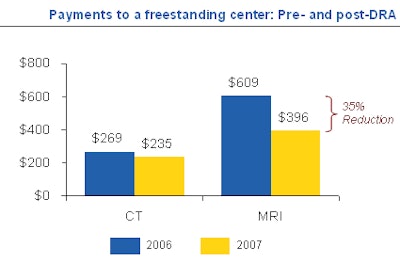

Rising demand and rising costs will motivate both government and private payors to be more aggressive about managing costs, Foreman believes. He attributes the removal of any payment advantage for imaging centers by the Deficit Reduction Act (DRA) to the bubble burst for venture-capitalist funded, profit-only driven imaging centers.

|

| Data sources: Thomson Reuters (Solucient) and 3d Health analysis. |

|

| Data sources: MPFS, Medicare ambulatory payment classification (APC) rates, and 3d Health analysis. |

The implementation of more stringent qualification requirements, such as UnitedHealthcare's requirement as of October 2008 that outpatient facilities be accredited by the American College of Radiology (ACR) or the Intersocietal Accreditation Commission (IAC) and Highmark Blue Cross/Blue Shield of Pennsylvania's requirements that imaging centers have five modalities and a radiologist onsite, is expected to significantly reduce the number of single modality centers and facilities supported by physician-driven self-referrals.

"It is not a coincidence that 10% to 12% of all imaging centers were in arrears in equipment and IT system lease payments," Foreman said. Imaging centers are no longer perceived as an easy revenue source by entrepreneurs and venture capitalists.

Competition to escalate, more hospital centers, consolidation

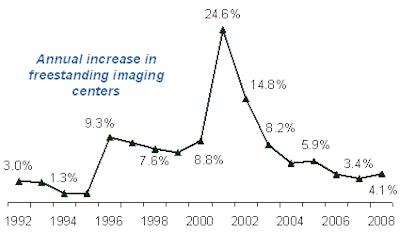

With the DRA reimbursement changes, Foreman expects hospitals to be motivated to open and operate more outpatient imaging centers, in part by establishing partnerships with radiology groups. The overall number of imaging centers may not change substantially, as an increase in facilities by hospitals may be offset by centers that close.

|

| Data sources: Verispan, IMV Market Reports, and 3d Health analysis. |

Foreman expects to see a decline in MRI-only centers and, potentially, a decline in market-saturated areas such as Punta Gorda, FL, and Ocean City, NJ. Competition between hospital provider-based outpatient centers and independent imaging centers will increase, he predicted, especially in market-saturated areas, where the ratio of imaging centers is significantly greater than the national average of 1.6 centers per 100,000 population.

Single modality, single specialty, and/or entrepreneur-owned imaging centers are particularly vulnerable, especially if they do not handle a large volume of procedures. Foreman believes that these centers and rural centers with low volume will be acquired by imaging center chains or hospitals, or they will go out of business entirely. "High volume, efficient imaging centers will be best positioned to operate on thin margins," he said.

Disparity in reimbursement to narrow

Commercial payors will not continue to pay a premium for provider-based imaging centers that are operated just like freestanding centers, according to Foreman. "With increasing demand for outpatient imaging, cost pressure on both government and health insurance companies will force them to continually reassess payment mechanisms," he said. "Payors will step up efforts to leverage evidenced-based medicine and information technology to manage claims."

Demand for published fees for services

"Governments, employers, and health plans believe informed, cost-sensitive consumers will help control healthcare costs by price shopping," Foreman noted. "This pressure will force outpatient imaging centers to make their fees more transparent. Right now it is a difficult, time consuming, and cumbersome process for an individual to compare the actual cost of a procedure."

Improved customer-oriented, value-based service for patients and physicians

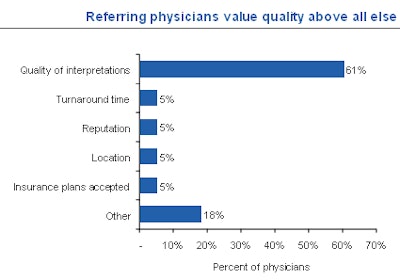

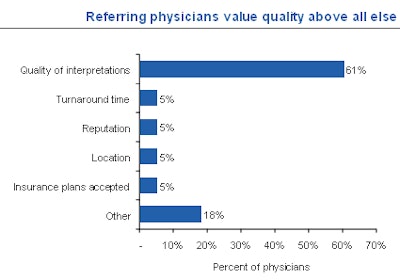

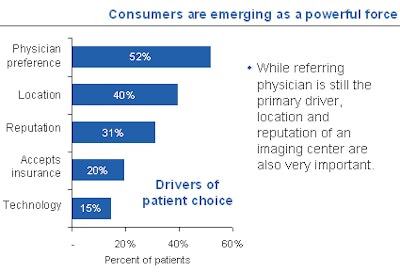

Patients go to the imaging center referred by their physician and typically do not question this choice. Referring physicians base their selection on the quality of clinical service delivered, quality of interpretations, and report turnaround time. But their recommendations are becoming less influential to patients.

Foreman referenced a survey of consumers and physicians conducted by PatientImpact of Evanston, IL, that showed that location and perceived reputation of the outpatient provider were increasingly as important as physician referrals.

|

| Data from PatientImpact. |

|

| Data from PatientImpact. |

"Because patients cannot judge and probably are not aware of the quality of the procedure and the quality and accuracy of the radiology report, patient satisfaction is driven by cleanliness of the facility, the efficiency and ease of the overall scheduling process, and treatment by front desk and technical staff," Foreman said.

He predicted that successful imaging centers will need to tangibly demonstrate value to both referring physicians and patients. They will need to offer high-quality, safe procedures at competitive prices, with turnaround of well-written reports within 24 hours.

Images should be made available to referring physicians via the Internet or on a CD. Patients also should be offered a CD of their images, preferably at no cost.

With respect to healthcare facilities that operate multiple centers, all service criteria need to be consistent and uniform. And service levels must be exceptional. "Patients want same day or next day appointments, extended hours within reason, and convenient locations," Foreman said. "I cannot overstate the fact that patients want to pull up to an imaging center, park, and walk in rapidly. They want to be greeted by courteous staff, imaged by highly qualified staff, and experience minimal delay."

By Cynthia Keen

AuntMinnie.com staff writer

August 14, 2008

Related Reading

2009 MPFS proposal: if you're not an IDTF, you'll be one soon, July 10, 2008

GAO report on overutilization draws industry ire, July 15, 2008

Beware, AMIC says: The DRA could be the least of it, June 10, 2008

DRA's arrival forces imaging centers to adapt, February 1, 2007

Copyright © 2008 AuntMinnie.com