In a post-Deficit Reduction Act (DRA) era and with a new administration, the health of the outpatient imaging market has been -- and will continue to be -- challenged. For outpatient imaging service providers, whether independent or hospital-based, continuing "business as usual" just isn't viable anymore.

For centers that want to thrive in this new healthcare environment, there are some key trends to look for over the next five years. M. Shane Foreman, founder and owner of 3d Health, a Chicago-based firm that provides consulting services to healthcare providers, outlined a few of these trends at this month's Radiology Business Management Association (RBMA) imaging center conference in New Orleans.

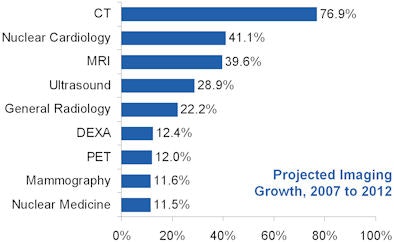

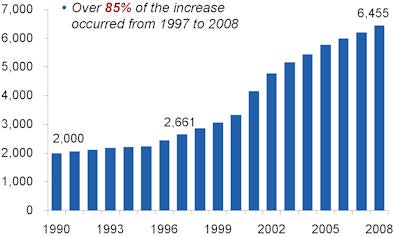

Patient demand, scan volumes will continue to increase

The concern about overuse of imaging comes from some dramatic data, Foreman said. Between the years 2000 and 2006:

- Overall Medicare Part B services grew 8% annually.

- Medicare expenditures for advanced imaging in freestanding centers grew at twice the rate of other imaging services (15.4% versus 7.7%).

- Growth in overall Medicare imaging costs equaled an increase in spending from $6.7 billion to $13.8 billion for freestanding services.

- Private health plan costs increased an average of 18% to 20% for all outpatient imaging.

"Some estimate imaging accounts for approximately 10% of the total healthcare dollar," Foreman said. "Others put the total at close to $100 billion per year."

Why the dramatic growth? Key factors include specialists wanting to grow practice revenue, hospitals trying to maintain and grow profitable services, new technology, the aging of populations, the practice of defensive medicine, and reimbursement expansion, according to Foreman. And a piecemeal approach to these factors won't work.

"We are unlikely to see significant tort reform without comprehensive healthcare reform," Foreman said. "And consumers will continue to identify with and ask for particular tests and technology."

|

| Outpatient volumes are projected to continue increasing. All images courtesy of M. Shane Foreman. |

Government, private payors will get organized

Both government and private payors will continue to get more organized about actively managing outpatient imaging costs, Foreman said, especially on the heels of the DRA's "success." According to the recent U.S. Government Accountability Office (GAO) report on the legislation's effects, Medicare spent $1.7 billion less on imaging services in 2007, the first year-over-year drop in Medicare spending on imaging since 2000. MRI fee reductions ranged from 21% to 40%, while CT fee reductions ranged from 7% to 15%.

Private payors will focus on the radiology benefits management (RBM) model, Foreman predicted, noting that a 2008 report from Washington, DC-based America's Health Insurance Plans (AHIP), a national association that represents health insurers, stated that the use of RBMs leads to a 10% to 20% reduction in expenditures.

Other private payors have begun to focus on network management: For example, UnitedHealthcare has restricted its outpatient image provider network to accredited facilities only, Foreman said. (The Medicare Improvements for Patients and Provider Act of 2008 dictates that outpatient providers must be accredited by the American College of Radiology by January 1, 2012, to receive Medicare reimbursement.)

CMS will work to maintain a level playing field

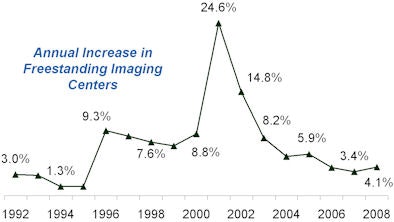

CMS will maintain what seems to be a newly leveled playing field for reimbursement across all sites of service, Foreman said, pointing out that favorable reimbursement contributed to freestanding imaging center growth, but that growth in new centers has slowed.

|

|

And it's not only the DRA that's having this slowdown effect that CMS will work to sustain, Foreman said. Many markets are approaching the saturation point (Punta Gorda, FL, and Ocean City, NJ, have more than seven imaging centers per 100,000 people), and hospitals have become more sophisticated outpatient imaging competitors, offering provider-based freestanding centers that compete with independent diagnostic testing facilities (IDTFs) and forging agreements with radiology groups to offer freestanding options to their communities.

Hospital-based centers will prevail

Hospitals and health systems have been able to make the case that they should receive advantageous reimbursement because they take all comers, regardless of ability to pay, and because they have a deep investment in their on-campus facilities. As such, hospitals have been relatively unaffected by the DRA compared to freestanding providers.

"Based on our experience at 3d Health, commercial provider-based payments can be up to twice or more the rate per procedure as IDTF payments," Foreman said. "The average provider-based MRI payment is $1,200, while the average IDTF MRI payment is $700."

But eventually the gap between provider-based and freestanding imaging services will close, according to Foreman. With increasing demand for outpatient imaging, cost pressure on payors will force them to revisit payment mechanisms for outpatient imaging and to make decisions about who is to be affected more, freestanding versus provider-based centers, by changes to these mechanisms.

"Commercial payors will not continue to pay a premium for provider-based imaging services that have a cost structure identical to freestanding centers," he said.

DRA will spur consolidation

By the third quarter of 2007, 10% to 12% of imaging centers were behind in their lease payments for technology and equipment, Foreman said. In the wake of the DRA, larger, well-capitalized operators have begun to acquire these weaker firms, in a trend toward consolidation that could continue for some time. For example, Los Angeles-based freestanding imaging center operator RadNet and private equity firm The Gores Group, along with healthcare network Novant Health of Winston-Salem, NC, all made acquisitions post-DRA.

Specific imaging centers will survive

Who will manage to survive in this post-DRA market? A few specific types of imaging centers, according to Foreman:

- Hospital-owned imaging centers with sophisticated on-campus facilities, as well as high-volume freestanding centers

- Hospital-radiology joint-ventured imaging centers with access to provider-based reimbursement

- Multispecialty physician-owned centers with sufficient captive volume

- Large radiology group-owned chains with an effective management model

Those in a precarious position are single-specialty, single-modality imaging centers; entrepreneur-owned centers, particularly those that are single modality; and low-volume centers in saturated urban markets or small, rural markets.

And as the market contracts, the level of competition in outpatient imaging will only increase, Foreman said.

"As reimbursement tightens, competition for imaging volume is becoming intense," he said. "Imaging centers are no longer able to profit by filling 40% or 50% of machine capacity."

Customer focus will increase

Consumers' and referring physicians' expectations around the patient experience will continue to increase, and those expectations will dramatically influence a center's ability to thrive in its market, according to Foreman. He listed eight criteria to consider when developing a freestanding imaging center:

- Ease of patient access. Same day or next day appointment availability; more than 80 hours of operation per week that include weekend days; participating provider with major payors; scheduling staff is able to provide prices for services and work directly with patients on preauthorizations.

- Service offering. Center is designed for safety and comfort of patients; all imaging modalities are available during operating hours.

- Facilities and technology. Center is modern and spa-like; equipment is state-of-the-art with current software platforms; referring physicians are able to access patient imaging through a variety of modes.

- ACR accreditation in all modalities offered.

- Women's imaging. Dual-energy x-ray absorptiometry (DEXA), mammography, and ultrasound are performed in a separate space dedicated to women; mammography is digital.

- Radiology group. Subspecialty-trained radiologists; reports are read within one to two hours and radiologists are onsite during all operating hours; radiologists actively cultivate relationships with referring physicians.

- Patient experience. Employees are friendly and competent; amenities such as Internet, telephones, work areas, coffee, water, and magazines are available; patient wait time is less than 10 minutes; check-in can be completed prior to the appointment; the patient is well educated about the particular scan performed; patients are clear about when they and their doctor can expect results.

- Marketing. Materials are high quality and readily available; center has a dedicated Web site with a variety of educational links and materials.

"What use to be 'nice to have' in an imaging center has become 'the cost of doing business,' " Foreman said.

Public policy tempest will worsen before improving

Although the effects of President Obama's health plan on outpatient imaging are currently unknown, we do know that President Obama plans to address what he calls "skyrocketing" healthcare costs and to provide insurance coverage for those Americans currently not covered, Foreman said.

"Provider-based outpatient imaging will continue to be an obvious target for reimbursement cuts," he said. "But adding over 45 million Americans to our healthcare system will also release pent-up demand for outpatient imaging. If providers are proactive, outpatient imaging could play an important role in disease prevention and public health."

By Kate Madden Yee

AuntMinnie.com staff writer

March 30, 2009

Related Reading

Imaging and the economic crisis: Part 2 -- Recovery and reform, March 24, 2009

Imaging and the economic crisis: Part 1 -- Sudden impact, March 19, 2009

Report: Hospitals hit by capital crunch, February 2, 2009

Survey forecasts drop in capital purchasing, December 18, 2008

Copyright © 2009 AuntMinnie.com