After a boom reminiscent of the California Gold Rush, the U.S. outpatient imaging market is now contracting, in response not only to oversaturation of imaging centers but also to the federal government's efforts to curb medical imaging costs.

It's no doubt that outpatient imaging reimbursement is in flux, according to Shay Pratt, managing director of the Imaging Performance Partnership at the Advisory Board in Washington, DC. At the annual Radiology Business Management Association (RBMA) meeting in Orlando, FL, Pratt outlined five trends to watch for on the outpatient imaging reimbursement front.

Trend #1: Yes, the market is contracting, but relative to other healthcare services, outpatient imaging is still posting some growth. As it slows further, competition will only increase.

|

| Images and table courtesy of the Advisory Board's Imaging Performance Partnership. |

"As there is less and less volume to go around, the fight for market share for outpatient imaging will intensify," Pratt said.

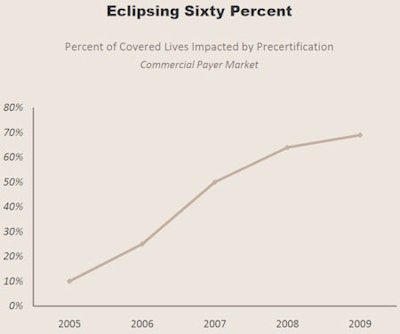

Trend #2: Utilization management is becoming increasingly entrenched, with payors and radiology benefits management (RBM) firms using precertification to control costs.

Last year, the U.S. Government Accountability Office (GAO) recommended that the Centers for Medicare and Medicaid Services (CMS) adopt precertification as a utilization management tool. Imaging industry advocates cried foul, claiming that the GAO didn't use up-to-date data, reference medical guidelines, or look at trends in which providers and payors are adopting appropriateness and accreditation criteria to address the issue of proper utilization of imaging services.

RBMs have been driving precertification; now providers are trying to take a more active role in the precertification acquisition process, using some of the following -- perhaps legally questionable -- tactics, according to Pratt:

Precertification initiation service: The provider's staff contacts an RBM on behalf of the referring physician to begin the process; that physician must then contact the RBM to get the precertification number.

Precertification acquisition service: The provider's staff contacts an RBM on behalf of the referring physician to get the precertification number; the ordering physician provides information the staff needs to complete the request.

Third-party precertification acquisition: A third party submits and processes precertification requests; providers pay a fee per order.

|

Decision-support models for managing imaging use are gaining momentum, but the trajectory is slow, Pratt said.

"To see greater adoption of decision support, the market needs a catalyst," Pratt said. "Payors need to be confident that the technology would provide a good alternative to preauthorization, and providers need to be certain that payors are willing to accept decision support. In places where we have seen adoption, an external factor has contributed. For example, in Minnesota, a state law paved the way for payor and provider acceptance."

Such a catalyst may come from Congress, Pratt said. The Senate Finance Committee is currently considering a proposal to measure physician ordering behavior and appropriateness, for which it would likely need the help of decision support; the pay-for-performance model would be implemented over the next four years, with a rollout of appropriateness criteria for imaging orders by 2011. CMS would implement by 2013 a plan to vary payments to physicians based on their track records in ordering appropriate imaging.

Trend #3: Payors are trying to redirect their members to cheaper providers.

Private payors have been trying to establish tools that allow their users to compare imaging facility quality and cost within a chosen radius. Providers go through a registration process and are assigned quality scores based on data they provide. Some RBMs are taking a direct approach, calling patients to help direct them to lower-cost providers.

Redirection is a scary concept, especially for more costly imaging providers. But the good news is that it's not a top threat right now, according to Pratt.

"These models have not yet proliferated widely," Pratt said. "Not many payors and RBMs offer transparency tools like this, and the number of consumers in high-deductible plans is still low, so the price-sensitive healthcare consumer is still rare."

Trend #4: Medicare payment policies are still favoring hospitals -- for now.

"Medicare payment policy reform has been much more seismic for the physician fee schedule," Pratt said, "with only marginal reforms to hospital outpatient imaging in the past few years, like bundling and composite APCs [ambulatory payment classification groups]."

And some of the more damaging reforms, like RBM-assisted redirection and Medicare precertification, are showing slower implementation.

|

|||

| Market shock | Adoption | Advantage | Assessment |

|

|||

| Deficit Reduction Act technical payment cap | Fully implemented | Hospitals | Early results show DRA reducing spending, utilization per Medicare beneficiary |

|

|||

| Private payor precertification | More than 60% of payors | Neutral | Rapid adoption of utilization management dampening volumes for all providers |

|

|||

| Medicare precertification | Proposed | Neutral | Uncertainty whether Congress will favor RBMs or decision-support vendors |

|

|||

| Equipment utilization factor adjustment | Proposed | Hospitals | MedPAC estimates savings of $900 million over four years |

|

|||

| Self-referral reform | Leasing, space-sharing restrictions in effect October 2009 | Hospitals | Restrictions could have greater than expected impact due to prevalence of leasing arrangements |

|

|||

| RBM-assisted redirection | 5% of payors | Imaging centers | Payors have yet to fully operationalize redirection strategies even though precert programs provide natural mechanism |

|

|||

| Price transparency | Less than 5% of payors | Imaging centers | Payors have historically struggled to maximize utilization of price comparison portals |

|

|||

| Quality transparency | Less than 5% of payors | Hospitals | Quality of imaging providers difficult to assess, even more difficult to broadcast |

|

|||

| Source: Imaging Performance Partnership interviews and analysis. | |||

Trend #5: Self-referral regulation impact will be greater than anticipated.

Although CMS has been criticized for what some believe is a weak response to the practice of physician self-referral, Pratt thinks the Stark law revisions that will go into effect October 1 will have greater effects on curbing the practice than it might seem.

The revisions include a per-click leasing provision that forbids all unit-of-service leasing arrangements and expands upon an originally proposed measure. The revisions also include an "under arrangements" provision, which makes it more difficult for hospitals to purchase services from, and bill on behalf of, the physician that performed the "designated health service," Pratt said.

By Kate Madden Yee

AuntMinnie.com staff writer

June 10, 2009

Related Reading

Senate questions HHS nominee on medical imaging, April 17, 2009

Inclusive Obama healthcare approach invites a fight, March 6, 2009

Health spending takes rising share of U.S. economy, February 25, 2009

Proposal envisions new U.S. health insurance program, February 20, 2009

Obama stimulus package allocates $20 billion to healthcare IT, February 19, 2009

Copyright © 2009 AuntMinnie.com