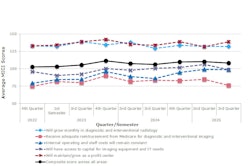

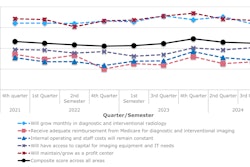

Radiology administrators express very high confidence that imaging will grow as a profit center in coming months, according to The MarkeTech Group's Medical Imaging Confidence Index (MICI) report for the second quarter of 2025.

They also have very high confidence that diagnostic and interventional radiology volumes will grow monthly, with a ranking similar to Q4 2024 results. But as in the company's last survey, administrators' confidence that their departments will receive adequate Medicare reimbursement for exams is low, and they are neutral when it comes to confidence that internal operating expenses and staff costs will remain constant and that they will have access to capital for imaging equipment and IT needs.

The MarkeTech Group produces the MICI report using survey response information contributed by radiology administrators and business managers who are members of its imagePRO panel. The document is made up of responses to questions about trends radiology administrators face in the coming year.

This second-quarter report included feedback from 113 imaging directors and managers across the following U.S. geographic areas: 18% in the West North Central region, 9% in the East North Central region, 11% in the Mid-Atlantic region, 14% in the South Atlantic region, 13% in the East South Central region, 17% in the West South Central region, 13% in the Pacific region, and 5% in the Mountain region.

As for hospital/facility size, 65% of survey respondents reported 100 beds or less, 14% reported 100 to 299 beds, and 21% reported 300 beds or more.

Respondents ranked their confidence on five topics, and The MarkeTech Group calculated a single composite score. Scores ranged from 0 to 200 and can be interpreted according to the parameters listed below:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- 150 = extremely high confidence

For the second quarter of 2025, the report found the following:

| MICI Q2 2025 confidence scores by topic | ||||

|---|---|---|---|---|

| Topic | Mean score Q4 2024 | Interpretation | Mean score Q2 2025 | Interpretation |

| Will maintain/grow as a profit center | 139 | Very high confidence | 132 | Very high confidence |

| Will grow monthly in diagnostic and interventional radiology | 134 | Very high confidence | 132 | Very high confidence |

| Will have access to capital for imaging equipment and IT needs | 102 | Neutral | 106 | Neutral |

| Internal operating and staff costs will remain constant | 95 | Neutral | 99 | Neutral |

| Will have adequate reimbursement from Medicare for diagnostic and interventional imaging | 83 | Low confidence | 85 | Low confidence |

| Composite score across all areas | 110 | Neutral | 110 | Neutral |

Respondents from all hospital bed sizes reported high to very high confidence that their departments will grow as a profit center but neutral or low confidence that they will receive adequate reimbursement. By U.S. region, however, results were more mixed:

- West North Central and Mountain regions reported low confidence about staff costs remaining constant; South Atlantic and Pacific regions reported high confidence.

- All regions except the Mid-Atlantic, South Atlantic, and Mountain had low confidence about receiving adequate reimbursement.

- All regions except East North Central reported high or very high confidence in their department's growth as a profit center; East North Central was neutral on this topic.

- Half of the regions (East North Central, West North Central, West South Central, and Pacific) had neutral overall confidence in their department's growth as a profit center, while Mid-Atlantic, South Atlantic, East South Central, and Mountain expressed high confidence.

Graph courtesy of The MarkeTech Group.

Graph courtesy of The MarkeTech Group.

The survey also includes a free-response section where participants may comment on the five topics. Free responses included in this report mainly addressed topics for which respondents' confidence was low.

Regarding study volume increases and planned growth, respondents said the following:

- "January was our busiest month ever. We hope that means the following months will be just as good."

- "Currently we are in the process of marketing for interventional radiology, MRI, and CT. With adding new state-of-the-art equipment, our expectation is to grow an additional 30% to 50% more volume."

- "[We've built] a new interventional radiology lab [and expanded] bays. We installed a new state-of-the-art MRI, [which has reduced] scan times and [increased] volumes."

Regarding healthcare policy and Medicare reimbursement, respondents expressed concern, stating the following:

- "Huge pause in capital strategies due to uncertainty of current political environment and international relationships."

- "Ebbs and flows. Currently only emergency capital being approved. Radiologist group is short-staffed, which is causing interventional radiology procedures to be limited."

- "Between the clearinghouses hired by insurance companies to do prior authorizations and the upheaval with the federal government, I think there is going to be a downturn in imaging."

- "Not sure what lies ahead with new government administration spending or reimbursement for Medicaid or Medicare. Our facility is on hold until the smoke clears for spending."

- "Capital funding is slowly becoming available, but with very little available for the last five or so years, our end of life/end of service equipment needs far outweigh available capital."

- "We are being crushed by the increased cost of professional and technical services. As a result, there is little funding available for capital or general expenses. Contract labor and temporary staffing firms are destroying hospitals' ability to recruit permanent staff."

Finally, regarding internal operations and staffing, survey participants noted:

- "Supply cost keeps going up and we are facing cost increases related to radiologist coverage that have never been seen before."

- "Staff expenses continue to increase due to a shortage of qualified staff and the need to contract labor to staff the department."

- "Staffing shortages will require either agency [help] or overtime from current staff, which will increase labor costs. This is a national crisis that will only get worse."

The Medical Imaging Confidence Index (MICI) is produced by market research firm The MarkeTech Group using data from its imagePRO panel of radiology administrators and business managers.