The CT slice wars continued unabated in 2004. Last year's RSNA meeting saw the unveiling of the first 64-slice CT scanner, and as 2004 wore on every major CT vendor eventually added a 64-slice model to their portfolios.

CT vendors are positioning the 64-slice scanners as finally offering the horsepower needed to realize CT's potential in cardiac scanning (notwithstanding electron-beam CT, which remains a single-vendor niche market).

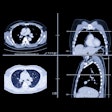

As the first 64-slice systems are being installed, clinicians are reporting breathtaking images of previously hard-to-image anatomy like the coronary arteries. Indeed, multimodality vendor GE Healthcare sees interest in cardiac scanning being one of the primary drivers behind 64-slice purchasing, according to Brian Duchinsky, general manager for global CT at the Waukesha, WI-based company.

But the new 64-slice models don't appear to be leading to a huge surge in the overall CT market. By most accounts, the CT market in 2004 should turn in growth in the low single digits, and some vendors see continued activity at lower product segments. For example, the purchase of 16-slice scanners represents some 80% of CT scanner acquisitions, according to Doug Ryan, director of the CT business unit at Toshiba America Medical Systems of Tustin, CA.

Compare premium multislice CT systems instantly. Click here |

Still, vendors appear to be pleasantly surprised with the level of purchasing in the super-premium 64-slice segment. While the conventional wisdom would indicate that 64-slice technology would only generate interest at luminary sites like large academic centers, one vendor reported that it recently sold a 64-slice system to a 100-bed community hospital.

What does the future hold for multislice CT? Will the slice wars continue, with 128-slice and even 256-slice models on the near horizon? Not likely, according to most vendors. The market will probably stabilize at 64 slices and 40 mm of coverage for the foreseeable future, according to Jim Green, general manager of the CT division at Philips Medical Systems of Andover, MA.

In any event, a number of things need to happen before the market is capable of digesting a 128-channel machine on any sort of clinically useful basis. For one, vendors and healthcare providers need to figure out how to deal with "slice pollution," the almost geometric explosion in the number of images being produced per study.

As it's no longer practical to review every image in a 3,600-slice study, radiologists will have to make a paradigm shift in their diagnostic reading techniques, and rely more on reviewing volume reconstructions rather than individual axial images, according to Bappa Choudhury, vice president of CT at Siemens Medical Solutions of Malvern, PA. This shift should be facilitated by the isotropic resolution of the new crop of scanners, which reduces reconstruction artifacts like partial-volume effects.

At this year's RSNA show, look for vendors to show real clinical images from 64-slice systems that were just whispered about at last year's meeting. Most companies will present workflow solutions for clearing up the slice-pollution issue, while hot clinical applications will include cardiovascular scanning and virtual colonoscopy. Dedicated scanners for radiation oncology applications will also be hot as vendors try to cash in on a market estimated to produce some $100 million in sales per year.