The upswing has been impressive as PET's clinical utility continues to earn more widespread recognition. And the merger of PET and CT is increasing PET's functionality with radiologists, making the images easier to interpret in a familiar format.

Procedure volume is also increasing due to approvals of indications such as breast imaging, and expanded use of PET in diagnosing lung cancer, colon cancer, lymphoma, and melanoma. And although the dominant focus of PET is still in oncology, cardiology applications are expanding in diagnosing myocardial viability and follow-up to equivocal SPECT studies. Procedure volume is also being stimulated by the availability of PET/CT with multislice configurations suitable for cardiac imaging.

In addition, PET is becoming more accessible to clinicians and patients, expanding the referral base. The increased accessibility is boosting sales of FDG while reducing the cost per dose. FDG sales of $193.2 million in 2003 were up 14% from $169.4 million in 2002. Sales should reach $521.8 million by 2010, even though the price per dose is diminishing. These estimates are conservative, and based on present utilization. New indications, such as Alzheimer's disease, will likely further stimulate the market for PET and FDG.

PET reimbursement has been favorable as well, with an average rate close to $2,000 per procedure in outpatient facilities and about $1,750 in hospitals. The diminishing price of FDG has allowed more revenue to be used for technical and professional costs of the procedure. Most PET users can now purchase FDG for less than $300 per dose, and volume users can negotiate prices closer to $200 per dose. Comparatively, FDG was priced in the range of $600-$700 per dose not too long ago.

Notwithstanding these positive effects on PET procedure volume, there is still excess capacity and stubbornly low utilization of available scanners. Furthermore, the rapid acceptance of PET/CT has increased the financial pressure on PET service providers, as they try to offset the high capital investment with billable procedures. This has created heated competition for PET referrals.

The excess capacity and need to increase utilization of existing scanners has produced a marked slowdown in orders for new PET scanners, which has also limited the expansion of new FDG distribution centers. Although supply and demand will eventually balance, the sudden downturn has caused concern among scanner manufacturers and PET service providers.

Impact of Alzheimer's reimbursement

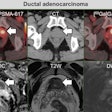

The recent decision by the U.S. Centers for Medicare and Medicaid Services (CMS) to approve PET reimbursement for Alzheimer's disease is a major breakthrough. There are 4.5 million Alzheimer's patients in the U.S., and public support has been growing for early diagnosis with PET.

Several studies have recently used PET to show notable changes in the brains of Alzheimer's patients. As a result, clinicians have been utilizing PET to identify patients in the earliest stages of the disease in time to slow its progression with available drugs. PET has also been used to show how well the drugs have been working. Therefore, CMS approval of PET imaging for suspected Alzheimer's patients is certain to have a major impact, and should dramatically bolster brain imaging volume.

Researchers are working to identify the buildup of protein clumps (amyloid plaque) in the brains of Alzheimer's patients, in an attempt to limit the destructive process. Many promising new drugs are in development to target the plaque buildup. Also in development are vaccines that prime the body to resist the accumulation of amyloid plaque.

In addition, researchers are exploring the use of embryonic stem cells to slow the degeneration rate in Alzheimer's patients. Predicting who will get Alzheimer's before symptoms appear is a key research goal. Because the disease develops over many years, much damage already has been done by the time the condition is diagnosed. Early diagnosis and treatment may help many patients.

Clinicians also want to track the progress of the disease in patients being treated, in order to quickly determine the most effective treatments. The challenge is educating neurologists on the benefits of PET so that they can obtain the highest confidence level in diagnosing their patients. The process is gradual, to be sure, but should contribute to expanded use of PET in neurology within the near future.

Sales trends for PET scanners

In 2003, 295 PET scanners were sold in the U.S., and 450 scanners sold worldwide. U.S. sales were $477.5 million, and worldwide sales were $723.5 million, an increase from the previous year of 18.6% and 32.8%, respectively. This reflects a slowdown in PET orders in the U.S. as users attempt to utilize existing capacity more efficiently. International sales have increased recently with growth rates higher than the U.S., reflecting a growing awareness of PET and expanded reimbursement, particularly in Japan.

PET/CT has been adopted very rapidly both in the U.S. and internationally. In 2003, PET/CT comprised 79% of total billings. This should increase to 91% in 2004. By 2010, U.S. bookings will increase to 620 units with sales of $1.094 billion. Worldwide bookings will reach 1,053 units and $1.969 billion in sales volume.

The proportion of international sales will continue to rise from 34% in 2003 to 45% or higher by 2010. In 2003, 24% of all PET scanner sales were mobile units, comprising $116.4 million in sales. This level of activity should continue, with mobile sales providing an important underpinning to the PET market.

Market consolidation in the U.S.

Scanner manufacturers had geared up for higher shipments in the U.S., expecting double-digit sales growth consistent with previous years. The dilemma has been in determining whether the market consolidation is temporary, or whether growth can be expected to resume in the near future. A lot of capacity is unused at present, with most fixed sites performing about three procedures per day, and mobile units performing four to five procedures per day.

Although the cost of PET scanners has diminished to an average price of $1.8 million to $1.9 million per scanner, the rapid acceptance of PET/CT has offset the cost reduction. Because many PET units are leased over a five-year period, the average monthly lease cost hasn't varied much from one five-year period to another. At the end of the lease period, the user can generally upgrade to the next level of technology without a significant increase in lease cost.

The performance of modern scanners has also improved measurably in terms of more rapid image acquisition and patient throughput. Using CT for attenuation correction, previously one of the slowest parts of the imaging sequence, has facilitated the improved performance. The use of CT has also reduced the procedure time from an hour to 30 minutes, substantially increasing the capacity of current scanners.

Effect of the learning curve for PET

Before CMS began paying for the modality, PET was primarily a research technology with very limited clinical base. Having crossed that boundary, advocates of PET expected sustained high-level growth in both PET procedures and scanner sales.

However, they did not take proper account of the normal learning curve. It is notable that CT and MR were initially used sparingly when they were introduced. Procedure volume and scanner sales progressed from one threshold to another as older imaging modalities were replaced or augmented. Eventually, the new imaging modalities became dominant in the diagnostic workup of patients, with rapid growth of referrals.

PET certainly has the potential for this kind of growth if used earlier in the diagnostic workup of many patients, requiring its adoption as a primary imaging modality rather than as a confirmatory methodology for other imaging procedures.

For PET to be applied more widely, however, it must offer users greater choice in terms of lower-cost scanners that are more compatible with medium-size hospitals with smaller imaging budgets. Availability of FDG must also continue to improve, providing a low-cost and ready supply of the radiopharmaceutical to any facility prepared to pursue PET imaging.

Equipment manufacturers and suppliers of FDG face the dilemma of being unable to independently drive the market and generate demand for their products without the growth of procedure volume to justify these sales. They can make the equipment more cost-effective and easier to utilize, which is certainly a positive trend, but users and patient-advocate groups have to be stimulated to move demand forward. To this extent, PET has the potential to be utilized in a broader spectrum of procedures, and be merged more effectively with CT and MR, avoiding duplication.

As PET moves into the frontline of imaging, procedure volume will continue to increase. At the same time, whatever synergy PET is able to establish with other modalities will be a primary factor in its adoption rate. Although prices will diminish, the growing markets generated by expanded procedure volume will more than offset reductions in pricing. In the final analysis, both manufacturers and patients will benefit from the broader availability of PET as it is integrated more effectively with other modalities.

By Marvin Burns

AuntMinnie.com contributing writer

September 30, 2004

Burns is president of Bio-Tech Systems, a Las Vegas-based healthcare market research services company founded in 1980. The firm specializes in medical imaging and radioisotope products covering a broad range of diagnostic and therapeutic applications for strategic planning, market research, and development of new business opportunities. For further details and information, Bio-Tech can be reached at 702-456-7608 or via its Web site, www.biotechsystems.com.

Bibliography

Growing Demand for PET Procedures, August 30, 2004

Impact of PET Reimbursement for Alzheimer's, August 23, 2004

Bio-Tech PET Report, June 21, 2004

Bio-Tech Radiopharmaceutical Reports, August 1, 2003

Related Reading

CMS proposals slash PET reimbursement for hospitals, September 24, 2004

CMS to cover PET for Alzheimer's, September 17, 2004

PET/CT shows potential for coronary artery disease assessment, August 13, 2004

Radiologists install PET/CT despite community opposition, July 22, 2004

PET procedure volume to surge, July 21, 2004

Copyright © 2004 Bio-Tech Systems