The number of CT procedures being performed in the U.S. has declined at an average annual rate of 5.5% over the past two years, reversing years of steady growth in volume, according to a new report by market research firm IMV Medical Information Division.

The findings appear to dovetail with other studies that have shown an overall slowdown in utilization of advanced imaging technologies throughout the U.S. But while CT use has fallen over the past couple of years, the report indicates that the age of the CT installed based has climbed significantly, generating hope that scanner sales could pick up steam as sites look to replace aging systems and upgrade to new technology.

CT use peaked in 2011

The report is based on a survey that IMV performed in September 2013 of managers of 424 imaging facilities in the U.S. Results were extrapolated to the universe of more than 8,500 CT facilities across the country.

IMV found that CT procedure volume peaked at 85.3 million studies performed in the U.S. in 2011. That number fell 5.5% to 80.6 million studies in 2012, and volume declined another 5.5% to 76 million examinations in 2013.

What is behind the decline? It could be due to several factors, according to Gail Prochaska, IMV vice president of sales:

- The increased focus on radiation exposure, which has raised awareness among both patients and healthcare providers that CT scans should only be performed when clinically appropriate

- The rise of scan precertification requirements by insurance payors, giving referring physicians another chance to pause and consider the merits of a CT order

- A change in how CT procedures are counted, spurred by new Medicare rules on contiguous scans that bundle multiple CT scans performed in a single visit into a single billing code

"We think that has changed how respondents report procedures to us," Prochaska said in a Google Hangout on the new report (below).

In that vein, the report demonstrates how the mix of CT procedures has changed by anatomical region. While the number of scans performed in most regions changed by only a few percentage points, the number of pelvic and abdominal scans dropped from 31% of the total in 2003 to 24% in 2013 -- perhaps due to the new Medicare rules. At the same time, the number of CT angiography studies rose from 4% in 2003 to 10% most recently, reflecting strong interest in this relatively new exam.

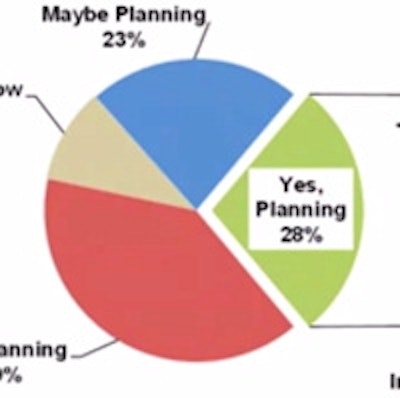

The survey also assessed the sentiment of imaging managers, revealing some bright spots. While fewer managers in 2013 felt that procedure volume would increase in the future (49% in 2013, compared with 58% in 2012 and 48% in 2011), more managers felt that their overall revenue would increase, with 35% answering affirmatively in 2013, compared with 31% in 2012 and 25% in 2011.

What explains the difference?

"They are still working hard, patients are coming in through a variety of doors ... so there's a spirit of optimism there," said Lorna Young, senior director of market research at IMV, in the Hangout.

Future priorities

What are the major priorities of CT managers in the near future? The most cited issues were satisfying the needs of referring physicians and improving their ability to reduce radiation dose to patients, the survey found. At the bottom of the list were managing preauthorization requirements and keeping the department up to date with state-of-the-art technology -- although Young pointed out that the latter two issues were still rated highly.

The survey also asked respondents to rate the issues that will affect their future outlook for CT procedures at their facility. Unsurprisingly, reduced Medicare and third-party insurance reimbursement was a top concern, followed immediately by the fact that most managers felt their current CT capacity was sufficient to meet anticipated patient volume over the next two to three years. And, of course, respondents agreed highly with the statement that uncertainty over healthcare reform had prompted them to slow capital equipment spending.

But another silver lining in the new data concerns the average age of the CT installed base. Eight or nine years ago, that average age was about 6.7 years, Young said. Now, it's closer to 8.9 or 9 years because sites have postponed purchases.

"Because the heyday of purchases was in 2005 and 2006, and you add nine years to that, we're coming into a time when replacements are starting to be a big factor," Young said. "It's not totally doom and gloom; [scanner] replacements and activity is out there."

Disclosure notice: AuntMinnie.com is a subsidiary of IMV Ltd.