Procedure volume for noncardiac angiography applications in the U.S. has grown at a steady single-digit rate over the past four years as interventional radiologists find new applications for the technology, according to a new market research report by IMV Medical Information Division of Des Plaines, IL.

The procedure growth comes as the slowdown in medical capital equipment purchasing also affects the noncardiac angiography market, according to the report, which found that more hospitals are postponing future purchases. Still, those facilities planning acquisitions are budgeting more for the technology, as flat-panel digital systems increasingly replace units with analog image intensifiers.

IMV's "2008/09 Interventional Angiography Lab Market Summary Report" describes trends in procedures, angiography x-ray systems, contrast media utilization, power injectors for angio contrast, capital and contrast media budgets, and site operations characteristics.

Rising volume

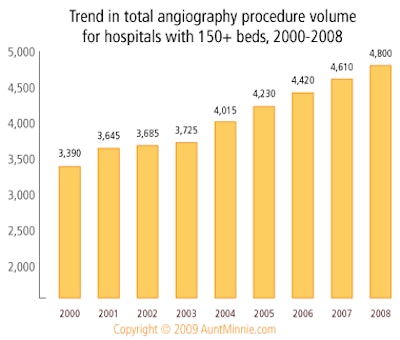

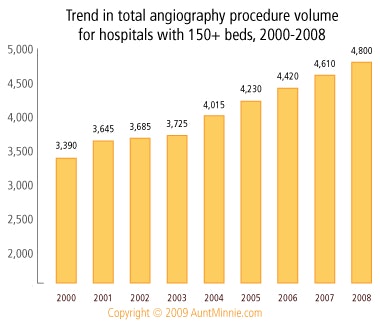

Based on a census conducted from October 2008 to May 2009 of 1,720 hospitals with 150-plus beds, angiography experienced an average annual growth rate of 4% to 5% in the period. The total number of procedures performed at angiography labs grew 20%, from 4 million in 2004 to 4.8 million in 2008.

"Angio lab procedure volume has grown steadily as the procedure mix has broadened to include a variety of peripheral vascular and other noncoronary angiographic procedures," said Lorna Young, senior director of market research at IMV.

|

The growth is in contrast to cardiac cath-based angiography systems, where procedure volume has fallen 11% over the past two years, according to an IMV market report released in May. Young hypothesized that the cardiac cath market has been affected by the rise of new technologies such as CT angiography, while interventional radiologists have been successful in developing new uses for their angiography systems for noncardiac applications.

These include procedures such as minimally invasive techniques to access veins and arteries to introduce drugs and place stents, placing peripherally inserted central catheter (PICC) lines, and performing vertebroplasties, biopsies, and tumor ablations.

"What appears to be happening is that interventional radiology labs are doing other procedures, very practical things and very inventive things, like PICC lines," Young said.

Besides interventional radiologists and angiographers who use the angio suite, the census showed that more than half of angio labs surveyed have nonradiologists who use the suite at least some of the time. Of that physician group, vascular surgeons are among those most likely to use the technology for diagnostic and therapeutic procedures.

From analog to digital

The switch from analog image intensifiers to flat-panel digital detectors accounts for most of the growth in the angio market.

"Between 2003 and 2008, the annual purchase of flat panels versus the analog image intensifiers literally flip-flopped from 85% in 2003 being image intensifiers," Young explained. "Now, 85% of the purchases [are] flat panels."

Survey results also show the average replacement time for angio technology to be 11.5 years, longer than other imaging modalities. Typically, CT or MR replacement is seven or eight years.

Despite a slowdown over the past year for angio labs, more than one-third of the hospitals with 150-plus beds are planning to purchase labs from 2009 to 2011 and beyond. IMV found that 90% of the planned angio lab purchases will have flat-panel digital detectors, as hospitals look to retool their older angio labs.

"A good proportion of the purchase activity is replacement," Young said. "In fact, replacement will be over half of the activity, and additional units, meaning a second or third unit, will be about 40%. The 400-plus-bed hospitals are more likely to be replacing their systems than the smaller hospitals."

Although the general outlook for future angio lab purchases is positive, the near-term market is still challenged by a marked slowdown in capital spending at U.S. hospitals, which is being experienced throughout most of the diagnostic imaging marketplace. The proportion of angio sites with zero dollars budgeted has increased from 59% for 2009 capital budgets for angiography equipment to 65% in 2010.

But on the positive side, those hospitals that have budgeted for new purchases in 2010 report allocating an average of $1.2 million toward future purchases, compared to an average of $1.1 million for those who were planning future purchases in 2009.

The market going forward

IMV's new report includes three market forecast scenarios going to 2013. Each scenario includes overall unit market increase per year and the average units annually, as well as annual installed base growth.

In addition, the report details census data on contrast agent budgets and utilization, power injectors for angio contrast, and angiography lab operations characteristics.

The average contrast budget per angiography site in 2009 is $125,000, a 4% decrease compared to 2008. Compared to 2004 budgets, the overall average decreased more than 10% in five years, from $144,000 in 2004, for an average annual decline of 2% to 3%.

Compared to prior census studies, the proportion of angio lab sites planning to purchase angio power injectors over the next three years has increased from 22% to the current 30% of angio labs. The average number of power injectors is 1.9 per angio site, which is consistent with the number of angio labs per site.

Among the hospital angiography sites with 150-plus beds, the average volume of procedures per angio x-ray system as of the 2008-2009 census was 1,510, a 2% decline in the overall average since the 2004-2005 census study.

"Angio, like every modality, has experienced downturns last year and this year in terms of actual sales," Young said. "But ... the outlook is still pretty robust for [angiography]."

By Lin Muschlitz

AuntMinnie.com contributing writer

July 21, 2009

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.

Related Reading

Cardiac cath lab procedures fall 11% over past 2 years, May 26, 2009

Mammography procedure volume drops 16% since 2000, March 17, 2009

Growth rate for PET procedure volume slows to single digits, February 17, 2009

CT installed base triples in cardiology practices, December 23, 2008

IMV: Nuclear med procedures up in 2007, November 11, 2008

Copyright © 2009 AuntMinnie.com