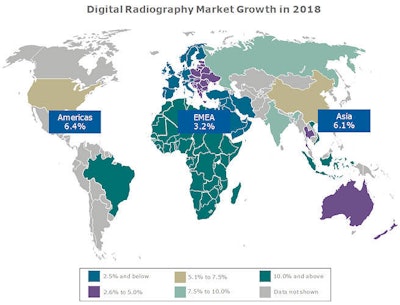

The world market for digital radiography (DR), comprising fixed and mobile systems and DR retrofit kits, grew by approximately 5% in 2017 and is forecast to increase by a similar amount in 2018. The market has been buoyed in recent years by the transition from analog and computed radiography (CR) to fully digital systems, but in the mature markets such as Western Europe, Japan, and the U.S., this trend has largely run its course, and DR's growth rate is set to slow down to a near standstill in the coming years.

The main regional growth trends for digital radiography are discussed below.

Image courtesy of Simon Harris.

Image courtesy of Simon Harris.U.S.: Legislation kills the analog x-ray and CR markets

In the U.S., the Consolidated Appropriations Act of 2016 has increased the purchasing of DR systems due to cuts in Medicare reimbursement for x-rays acquired with analog and CR systems. This has encouraged many of the remaining users of CR systems to make the switch to DR.

Simon Harris from Signify Research.

Simon Harris from Signify Research.While some sites invested in new DR systems, many elected for a more affordable pathway to transition to DR and upgraded their existing systems with DR retrofit kits. The market for DR retrofit kits has grown strongly over the past two years, but it is forecast to decline from 2019 now that most sites have converted to DR.

The U.S. market for complete DR systems is forecast to continue growing in the coming years, albeit at a gradually reducing single-digit annual growth rate, as customers replace older systems to take advantage of the latest radiation dose management and workflow efficiency technologies and as mobile DR systems are increasingly used in bedside imaging applications. Moreover, customers who invested in DR retrofit kits to meet legal requirements are likely to upgrade to DR systems over the coming years, as capital expenditure budgets become available.

The price of DR systems will continue to fall due to fierce competition between makers of flat-panel digital detectors and between the system OEMs, and this trend will act as a brake on revenue growth. The average price of fixed DR systems in the U.S. market is forecast to fall by around 4% in 2018.

Brazil: Return to growth after several years of decline

Brazil is forecast to be one of the fastest-growing markets for digital radiography in 2018, with growth fueled by pent-up demand following the deep recession between 2015 and 2017. There is also a large installed base of outdated analog systems that will gradually be replaced by DR.

That said, the transition to DR will take many more years due to the price-sensitive nature of the Brazilian market and the lack of supporting infrastructure, such as imaging IT systems, in the more rural parts of the country. The annual growth rate for the DR market is expected to peak in 2018 at around 15% and then cool in the following years, as the recent surge in healthcare investment returns to baseline.

Western Europe: Slight uptick, but low growth continues

The Western European market has mostly transitioned to DR, and the outlook is for low single-digit growth. Much like the U.S. market, radiation dose management, cost of ownership, and workflow productivity will be the main growth drivers in 2018, with advanced artificial intelligence-driven tools, both for operational and clinical applications, becoming more important in the coming years.

Economic growth in the European Union (EU) beat expectations in 2017 to reach a 10-year high at 2.4%. Growth is set to remain relatively strong in 2018 and ease slightly in the following years. As such, we expect to see peak growth for the DR market in 2018, at around 2.5%, with the prospect of anemic growth, at best, in the following years.

Eastern Europe: EU funding continues to drive growth, but will it last?

The Eastern European DR market is heavily influenced by the availability of EU development funds for healthcare projects. The high level of funding in recent years has set a high baseline for the DR market, but recent announcements from Brussels that EU funding is to be shifted away from Central and Eastern Europe to the countries worse hit by the financial crisis, such as Spain and Greece, cast a shadow of doubt over the longer-term growth prospects for the region.

On the plus side, the economic situation in many Eastern European countries is improving, but the net effect of the expected cuts to EU funding is expected to result in slower growth for the DR market.

Russia: Rising energy prices drive growth, but geopolitical risks remain

The Russian DR market is in recovery mode after large declines in the past few years, with the recovery driven by increased government spending on the back of rising oil and gas prices and an expanding private sector. The market is forecast to grow at a high single-digit rate this year.

However, tough sanctions, worldwide political isolation, and a shrinking population represent major challenges to the Russian economy, and there is a high risk that the current strong demand for medical imaging equipment will be relatively short lived.

Middle East: Turkish delight may turn sour

In 2015 and 2016, low oil prices and political instability across the Middle East region led to a massive reduction in spending on healthcare. The Middle East market for DR returned to growth in 2018, largely on the back of improving oil prices. Assuming oil prices continue to strengthen, so, too, will the recovery in the DR market.

Turkey continues to represent a growth opportunity in the region, with growth driven by the Turkish government's major reform initiative to transform its healthcare system into a universal health coverage model. However, the recent plunge in the value of the Turkish lira, which lost 17% of its value against the dollar between January and mid-May, will drive up the cost of imported healthcare technology, such as Dr.

Africa: Price and market readiness continue to hold back DR

Outside of South Africa, there remains limited demand for DR systems in most African countries, and analog and CR systems continue to outsell their DR counterparts. The higher price of DR systems is a major factor, alongside the "readiness" of many African countries to make the switch to digital.

The shortage of trained technicians and clinicians and a lack of digital infrastructure to support DR systems remain key barriers to DR market growth. The transition to DR is expected to be long and gradual, with analog and CR retaining the lion's share of the general radiography market for several years to come.

India: The world's fastest-growing economy, but not yet ready for DR

India is on track to be the world's fastest-growing major economy in 2018, and increased government and private investment in healthcare has resulted in a flourishing market for healthcare technology. However, it is also one of the most price-sensitive markets. Moreover, rural parts of the country (around two-thirds of the population live in rural areas) lack the infrastructure to convert from analog to DR.

CR remains the preferred option for customers looking to upgrade their analog systems to digital, but the Indian healthcare market is developing at a fast pace and the shift to DR will accelerate in the coming years, particularly as dose management becomes a higher priority and DR systems become more affordable. In the short term, higher growth is forecast for DR retrofit kits than for DR systems, due to the ease of upgrade and lower cost.

China: DR market growth starting slowdown

China is the biggest market for DR in the Asia region, and the market has grown rapidly in recent years, partly due to the availability of lower-cost DR systems from local Chinese manufacturers. The market is forecast to see continued growth in the coming years but at a slowing rate as the market matures. The Chinese DR market is expected to grow by around 7% in 2018, with mobile DR systems seeing the strongest demand, particularly in the larger cities.

Conclusion

In a market environment of slowing growth and increasing competition, vendors need to innovate to protect their margins and market share. Image quality and dose management are now seen as a "given" by most customers, offering little opportunity for differentiation.

In the short term, workflow, productivity, and operational efficiency will be focus areas for product development, with vendors offering enhanced analytics capabilities to help radiology departments measure and improve their asset management, operational performance, quality assurance, and practice management.

Moving forward, more advanced machine learning and artificial intelligence (AI) capabilities will be embedded in DR systems, with an initial focus on tools that improve workflow and productivity by offloading routine tasks and supporting high-volume cases. DR vendors are encouraged to implement a coherent strategy for AI or risk facing a "race to the bottom" price war.

Simon Harris is managing director and principal analyst at Signify Research, a health technology market intelligence firm based in Cranfield, U.K. He can be reached at [email protected].

The comments and observations expressed do not necessarily reflect the opinions of AuntMinnie.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.