Of course, broad product portfolios and strong distribution partners won’t mean much to Alliance unless ultrasound contrast technology gains broader market acceptance.

MBI was the first company to net Food and Drug Administration clearance for an ultrasound contrast agent when its Albunex product was approved in 1994. Sales of Albunex never amounted to much, however, due to the agent's short persistence time in the blood stream.

MBI subsequently developed Optison, a second-generation ultrasound agent marketed by Mallinckrodt in the U.S. and Europe. Optison was approved by the FDA in late 1998, and was supposed to succeed where Albunex had failed. Despite the high hopes, Optison sales since the product's approval have chugged along at a steady but unspectacular pace.

Alliance executives remain convinced, however, of the market potential of ultrasound contrast, owing to ultrasound’s status as a widely available, widely used, and low-cost imaging modality.

"We feel the market potential for ultrasound contrast should be, in the future, greater than the current sales of existing contrast agents for other modalities, which in some cases now exceeds several billion dollars," Roth said. "While it hasn’t happened yet, everything fundamentally is there, and it should happen. If we can work out all of the details about when it’s used, when to test, reimbursement issues, and all of the things that we’re working on now, we think it’s going to be a great opportunity down the road."

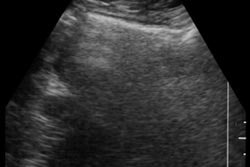

Use of ultrasound contrast has picked up in some applications, particularly in stress-echo studies. But new applications, particularly for evaluating myocardial perfusion, also show considerable promise, according to Dr. Howard Dittrich, MBI executive vice president.

"The Holy Grail is to evaluate perfusion or blood flow within the heart muscle itself, and determine whether a patient has ischemic heart disease or not, or coronary artery disease," Dittrich said. "Great progress has been made in this area, but there is still work ahead. There have been multiple phase II studies on this using Optison, as well as other agents, and what we’re seeing is that this will grow as (ultrasound scanner) technology continues to improve. We see new generations of ultrasound equipment on almost a monthly basis that continue to improve imaging for perfusion with ultrasound contrast."

Radiology applications for ultrasound contrast also show strong potential, according to Dittrich. In fact, MBI’s partner Chugai Pharmaceuticals believes the predominant ultrasound contrast application in Japan will be for radiology indications, Dittrich said.

"One advantage that we have (in radiology) is that radiologists and sonographers in that arena are much more used to using contrast media, so we think adoption through education will ultimately be quicker," Dittrich said. "Areas where it can be used are for imaging liver tumors or masses in the kidney, and for differentiating benign from malignant liver lesions. Other potential areas include improvement of visualization of vasculature throughout the body."

Alliance will acquire all shares of MBI for 770,000 shares of Alliance stock, subject to adjustment downward under certain conditions. The firms hope to complete the deal within two to three months. As of June 30, MBI’s total assets (consisting primarily of cash and marketable securities), less its liabilities, stood at about $8.7 million. Based on preliminary estimates, Alliance anticipates that MBI's total assets (consisting primarily of cash and marketable securities), less its liabilities, will be approximately $5 to $7 million at the close of the purchase.

AuntMinnie.com staff writer

October 12, 2000

Related Reading

MBI revenues climb in first quarter, July 27, 2000

Nycomed and Mallinckrodt settle patent disputes, May 8, 2000

MBI cuts staff by 58%, shifts focus to Optison, March 30, 2000

MBI’s Optison agent begins radiology testing, March 28, 2000

Merger between contrast firms MBI and Palatin Technologies collapses, March 14, 2000

Let AuntMinnie.com know what you think about this story.

1 2Copyright © 2000 AuntMinnie.com