You can't fight the Food and Drug Administration. That may be the take-home message after ultrasound contrast developer Sonus Pharmaceuticals announced yesterday that it is giving up the quest for regulatory approval of its EchoGen contrast agent.

The Bothell, WA, company said it was pulling EchoGen's new drug application (NDA) after the FDA told the firm that the filing needed a significant amount of work before it could be approved. The company said it will refocus its operations on the drug delivery and blood substitute products it is developing.

The announcement was a stunning setback, both for Sonus and for the nascent ultrasound contrast market, which has fallen far short of expectations. Sonus reportedly was expecting to receive final regulatory approval for EchoGen this month.

In a conference call, Sonus president Michael Martino said that recent communications with the FDA had led the company to believe that the agency has concerns both about EchoGen specifically and about the efficacy of all agents designed to improve heart imaging through endocardial border delineation and left ventricular opacification.

Studies with agents other than EchoGen have failed to show a correlation between improved endocardial border definition and the calculation of ejection fraction, an important measure of cardiac function, according to Martino. Sonus, however, believes that its research has shown that EchoGen clearly improves the accuracy of ejection fraction measurements, Martino said.

More important, however, were the agency's concerns specific to EchoGen's hypobaric activation process, when sonographers activate microbubbles in EchoGen prior to injection.

"The FDA is concerned that the activation procedure could create bubbles that are too large, which could potentially cause pulmonary embolism," Martino said. "We continue to believe that Sonus has addressed these concerns in clinical trials of over 3,000 patients, where there have been no evidence of clinically significant embolism, but the FDA continues to have concerns over the procedure."

Yesterday's news was the latest in a string of disappointments in the company's efforts to get EchoGen approved. Sonus was formed by Dr. Steven Quay, who helped invent the MRI contrast agent Omniscan in the 1980s while working for Salutar. Omniscan is now marketed by Nycomed Amersham.

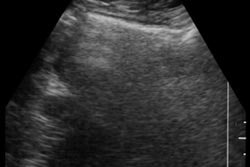

Quay, along with many other contrast pioneers, believed that ultrasound could ultimately be as large a market for contrast media -- if not larger -- than any other imaging modality. The goal was to develop a product that could improve the grainy resolution of ultrasound studies and lead the modality into new applications, particularly in cardiac imaging of left ventricular assessment and endocardial border delineation.

The reality hasn't been so easy. Sonographers have been reluctant to embrace contrast media, due to usability and reimbursement concerns. A series of ongoing patent and regulatory lawsuits, resolved only recently, have kept many contrast developers preoccupied. Finally, the FDA has been slow to grant approval for important cardiac applications.

Sonus developed EchoGen primarily for echocardiography and perfusion applications. The product is based on a perfluorocarbon liquid emulsion that becomes gaseous at body temperatures, creating tiny bubbles that reflect ultrasound signals when imaged.

A regulatory nightmare

The company's regulatory nightmare began in 1997, when it participated in a lawsuit against the FDA over the agency's regulation of ultrasound contrast agents, specifically Optison, a product developed by Sonus' arch-rival Molecular Biosystems of San Diego. Sonus and the other plaintiffs ultimately won the battle, but may have lost the war.

The following years saw Sonus stumble over one regulatory hurdle after another. In early 1998, the agency issued a non-approvable letter for EchoGen, saying it needed additional data before it could approve the product. Soon an agonizing pattern developed, as Sonus would comply with FDA requests for more data, only to be told that its filings were deficient.

In the meantime, Sonus suffered through shareholder lawsuits, the decline of its stock price, and the demise of business relationships with EchoGen's marketing partners. It lost years of competitive advantage to MBI, which was able to get Optison on the market following approval in late 1997.

MBI's victory proved to be pyrrhic, however. Despite initial optimism, physicians have not warmed to ultrasound contrast media. Optison sales have been sluggish, and MBI has been forced to restructure operations and look for a corporate partner. Ironically, MBI announced its agreement to be acquired by Alliance Pharmaceutical on the same day Sonus revealed its withdrawal from medical imaging.

Sonus hopes it will be more successful in its new markets, the development of therapeutic drug delivery products and blood substitutes. Sonus says it is using its Tocosol emulsion technology to formulate therapeutic drugs that are highly insoluble in water, and therefore less toxic. The firm has filed an investigative new drug application in the U.S. for its first drug delivery product, S-8184, for the treatment of breast, ovarian, and lung cancer.

The company's lead blood substitute product, S-9156, is being developed as an oxygen carrier for use in situations like emergency trauma settings, where blood typing and cross-matching are time-consuming. The product could also find use in surgeries involving a high loss of blood. Sonus hopes to complete pre-clinical trials in early 2001 and file an IND.

Sonus believes it's on good footing to bring these products to market. The company had $15.3 million in cash and marketable securities as of September 3, the end of its third quarter.

Concurrent with the EchoGen announcement, Sonus reported third-quarter financial results that show the company's net loss increasing due to a drop in licensing revenue. Sonus posted a net loss for the period of $2.2 million, compared with net income of $6.9 million in the same period the year before.

By Brian CaseyAuntMinnie.com staff writer

October 13, 2000

Related Reading

Alliance eyes bigger slice of ultrasound contrast market in bid for MBI, October 12, 2000.

Sonus reports profitable Q2 despite revenue shortfall, July 13, 2000.

FDA accepts Sonus response to EchoGen action letter, May 24, 2000.

Sonus takes over EchoGen rights, April 5, 2000.

Sonus gets another FDA action letter, March 14, 2000.

Sonus revises contrast deal with Abbott, February 17, 2000.

Nycomed payment buoys Sonus results, January 31, 2000.

Let AuntMinnie.com know what you think about this story.

Copyright © 2000 AuntMinnie.com