Royal Philips Electronics served notice today that it intends to aggressively grow its medical systems division. Just days after announcing a $426 million bid for nuclear medicine and radiation therapy firm ADAC Laboratories, the Dutch conglomerate announced an agreement to buy Agilent Technologies Healthcare Solutions Group for $1.7 billion.

Philips Medical Systems says the deal will allow the company to broaden its scope and expand into new market segments, such as automatic external defibrillators and home care technology, which would enable remote diagnostics. The vendor also believes its brand position with hospitals and healthcare institutions will be strengthened, both worldwide and in North America.

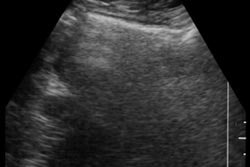

The acquisition will have immense ramifications in ultrasound, a modality whose competitive dynamics have shifted dramatically in 2000, thanks to Siemens Medical Systems’ blockbuster acquisition of Acuson a few months ago. Andover, MA-based Agilent is one of the top ultrasound vendors in the world, with a particularly strong presence in cardiac imaging.

The acquisition would culminate a huge investment in ultrasound by Philips in the last few years. In mid-1998, Philips purchased ATL Ultrasound of Bothell, WA, for $800 million after coming up short in its own efforts at building a sizeable ultrasound market presence.

If the acquisition is completed, Philips' ultrasound holdings would make it the world's largest ultrasound vendor, according to Harvey Klein, president of Klein Biomedical Consultants in New York City. Siemens/Acuson would be second, followed by GE Medical Systems in the number three slot, he said.

"Consolidation in the ultrasound industry is not surprising," Klein said. "Bigger is better, and there are advantages of being part of a full-line company. It’s very important to offer products across the board in all ultrasound markets."

Upon completion, Agilent’s ultrasound activities will be consolidated within ATL’s business, according to Ben Geerts, a Philips corporate spokesperson. Philips believes both companies' products are largely complementary; there are no plans at this time to dispose of any overlapping technology, Geerts said. In ultrasound, Agilent’s experience in 3-D imaging and imaging information technology (via its EnConcert system) is quite attractive to Philips, Geerts said.

Philips and Agilent are familiar with each other, having worked together in the past, said Philips Medical Systems president and CEO Hans Barella. Via OEM agreements, Agilent and its predecessor company, Hewlett-Packard, have provided high-end general ultrasound imaging technology, as well as an R&D contract in MRI, to Philips, Geerts said.

The news comes a year after Agilent was spun off from HP. Agilent realized that it needed to offer a broader range of solutions to meet customer needs in today’s healthcare marketplace, and decided to sell to a company with a complementary business rather than invest in expansion on its own, according to Agilent president and CEO Ned Barnholt. The agreement also underscores Agilent’s commitment to focus on the communications and life sciences markets, Barnholt said.

In addition to its ultrasound business, Agilent HSG sells more than 400 products related to patient monitoring, resuscitation, information management, and other services and supplies used in many healthcare areas. The group has annual sales of $1.5 billion. The transaction is expected to close in the next several months, and is subject to customary regulatory approvals and other closing conditions.

By Erik L. RidleyAuntMinnie.com staff writer

November 17, 2000

Related Reading

Philips to re-enter nuclear medicine market with bid to buy ADAC, November 13, 2000

Siemens expands ultrasound efforts with bid to acquire Acuson, September 27, 2000

Agilent plans restructuring, layoffs, August 14, 2000

Philips to move North America HQ to Seattle, August 7, 2000

Click here to post your comments about this story.

Copyright © 2000 AuntMinnie.com