Alliance Pharmaceutical has finalized its acquisition of ultrasound contrast developer Molecular Biosystems in a consolidation of two San Diego-based contrast firms.

Alliance made the purchase by exchanging 770,000 shares of its stock for MBI's outstanding shares. At the close of the deal on Dec. 29, Alliance's shares were valued at $8.63 a share. MBI shareholders received 0.04 shares of Alliance stock for each share of MBI they held.

Alliance essentially is acquiring a shell company whose major assets are cash and future royalty payments. MBI cut its staff dramatically in 2000 as it prepared to be acquired, and at the time of the deal had only two employees remaining. Both of those employees will join Alliance, a spokesperson for the company said.

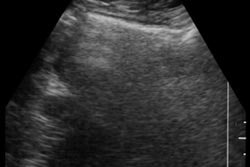

MBI's primary product was ultrasound contrast agent Optison, which hasn't generated the high sales predicted when the agent was approved in 1998. Optison will be sold by Mallinckrodt and Nycomed Amersham, with Alliance receiving a 5% royalty on net sales in the U.S. and Europe.

In Asia, Optison is being brought to market by Chugai Pharmaceuticals of Tokyo, which has rights to the product in Japan, South Korea, and Taiwan. Alliance could receive up to $16 million in payments from Chugai if Optison hits certain regulatory filing and approval milestones.

Alliance does not plan to further develop Optison on its own, according to the spokesperson. The company is developing its own ultrasound contrast agent, Imavist, in conjunction with German pharmaceutical company Schering. The companies hope to receive marketing approval for the product this year.

By AuntMinnie.com staff writersJanuary 3, 2001

Related Reading

Alliance eyes bigger slice of ultrasound contrast market in bid for MBI, October 12, 2000

MBI revenues climb in first quarter, July 27, 2000

Nycomed and Mallinckrodt settle patent disputes, May 8, 2000

MBI cuts staff by 58%, shifts focus to Optison, March 30, 2000

Copyright © 2001 AuntMinnie.com