More long-term managed service deals, along with increased activity in the artificial intelligence (AI) sector and a strong performance in ultrasound, have contributed to revenue growth at Philips during the first three months of 2018, according to Frans van Houten, CEO of parent company Royal Philips.

For the period to the end of March, the vendor achieved sales of 3.94 billion euros ($4.76 billion U.S.) after currency adjustments, representing a 5% increase compared with the first quarter of 2017. Medical imaging and treatment accounted for around 40% of the total business, and a highlight was eight new strategic partnership agreements.

Frans van Houten has worked as CEO of Philips for the past seven years. All images courtesy of Philips Healthcare.

Frans van Houten has worked as CEO of Philips for the past seven years. All images courtesy of Philips Healthcare."The landscape is changing in healthcare technology," Frans van Houten told AuntMinnieEurope.com in an interview. "Multivendor approaches, with their tendency to pick and choose, were of historic appeal to many IDNs [integrated delivery networks, or large healthcare delivery organizations], but they can lead to a hotchpotch of different systems and quite a chaotic environment."

Philips now has more than 100 strategic partnerships, accounting for around 30% of total worldwide professional healthcare revenue and 40% in North America. The model is proving popular because it leads to higher productivity and efficiency gains, and it helps connect radiologists with other clinical staff because they are working with common IT packages, he noted.

Recent examples include a 15-year partnership with ZorgSaam Hospital in Terneuzen, the Netherlands, covering imaging and image-guided therapy systems and healthcare informatics, and an 11-year deal with the Wye Valley National Health Service Trust in the U.K.

During the first quarter of 2018, Philips achieved growth across all product areas, while Europe only saw moderate growth. The most rapid progress occurred in China and North America, said van Houten, who has worked as the CEO since April 2011.

Order uptake for equipment rose significantly across the main modalities, largely because of product enhancements and introductions, such as the Ingenia Elition 3-tesla MRI system, launched at ECR 2018, he added. Another breakthrough was receiving U.S. Food and Drug Administration (FDA) 510(k) clearance to market ProxiDiagnost N90, a new digital radiography system.

Philips signed a 15-year partnership with the ZorgSaam Hospital in late March.

Philips signed a 15-year partnership with the ZorgSaam Hospital in late March.Overall, net income from continuing operations was 94 million euros ($114.8 million), which included higher restructuring and acquisition-related charges and bond redemption costs of 52 million euros ($63.5 million), against 128 million euros ($156.4 million) in the first quarter of 2017.

On the flip side, the connected care and healthcare informatics segment was almost flat. An order intake growth rate of only 1% was achieved, although this figure includes Philips' defibrillator business. If this were excluded, an increase of nearer 5% was recorded, according to van Houten.

"I would expect higher growth in IT compared to modality hardware, but maybe this situation is due to seasonal factors, such as capital budget allocation, and the result of pent-up demand for modality imaging," said Steve Holloway, principal analyst at Signify Research in Cranfield, U.K. "Overall, total company growth in 2017 was around 2%, so a hike in sales revenue of 9% for diagnosis and treatment is a bit surprising to me. It certainly shows the robustness of the diagnostic imaging hardware market today."

Ultrasound and AI

The expansion of the ultrasound business beyond its core strength in cardiac imaging continues to be successful, van Houten added. For instance, the ob/gyn ultrasound innovations that Philips introduced in 2017 for its Epiq and Affiniti systems helped to drive performance, and improvements in transducer design have occurred too.

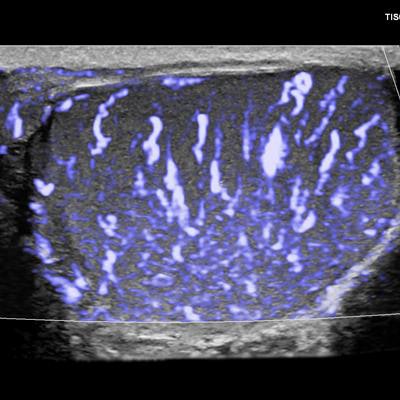

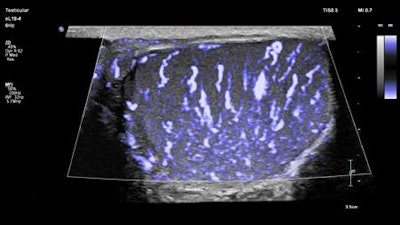

High-resolution image of the testicle using ultrabroadband PureWave eL18-4 transducer from Philips demonstrates subtle vascular flow with MicroFlow Imaging.

High-resolution image of the testicle using ultrabroadband PureWave eL18-4 transducer from Philips demonstrates subtle vascular flow with MicroFlow Imaging.AI and workflow improvements can simplify ultrasound, especially for more routine cases, freeing radiologists to focus their time on the most complex cases, according to the vendor. Philips' AI breast product is an example of this, making breast ultrasound easier and helping clinicians have more confidence in their diagnosis.

Looking to the future, the spread of analytics looks set to continue to transform radiology, and the company is determined to develop its operational and workflow analytics and smart fleet management in a bid to make hospitals more efficient with the same number or even fewer radiologists, he said.

Philips spends around 9.5% of its revenues on research and development, and the company employs 500 data scientists in North America, Europe, and India to work on the applications of AI and big data, van Houten added.

Brexit is having some impact on the firm's business, largely because of the devaluation of the U.K. pound during the 18 months after the European Union referendum.

"The exact shape and form of Brexit remains to be seen, but the important aspect is that Europe remains strong," he said.