The global COVID-19 pandemic has created an unprecedented shock to medical imaging and healthcare markets. Predicting the rate of recovery today is complex, given the nuances of regional lockdown restrictions, healthcare funding models, purchasing cycles, and predominant business model of each product sector.

Based on ongoing research, what are the key trends? What risks can be identified, and how much uncertainty lies ahead?

Near-term dip in equipment market

Across the market, a "swoosh-shaped" recovery (sharp decline followed by a gradual recovery) is anticipated for imaging equipment. The speed of recovery will be closely tied to the recovery of imaging volumes and how each health system reacts to substantial budgetary pressures in the wake of the pandemic.

The imaging equipment market will never be quite the same again ...

The imaging equipment market will never be quite the same again ...Analysis of the financials of leading vendors and discussions with industry sources make us think there will be a negative market impact on products such as ultrasound and x-ray, with these markets down by a range of 7% to 15% for 2020, though this remains an early preliminary forecast; big-iron modalities have fared worse, given the limitations of access for onsite implementation, leading to a backlog of orders. A few product segments have seen unprecedented demand, especially mobile x-ray systems and portable ultrasound equipment.

While few if any imaging equipment orders have been canceled so far, many will be delayed, putting significant pressure on vendor margins throughout 2020 at least.

There is, however, a more positive outlook into 2021, as we expect to see a recovery of imaging volumes as healthcare systems move toward normal levels of elective imaging and screening programs restart. The green shoots of this recovery have already been identified in the last few weeks of May from a number of European and U.S. healthcare providers, though we would not expect to see a return to global market growth until the latter part of 2021 or 2022.

Software and service markets have seen less drastic near-term impact, with a substantial proportion of the market tied to recurring revenue from software licenses and maintenance for imaging IT platforms. However, COVID-19 is likely to affect the market over a longer period in comparison to medical imaging hardware due to the lag between the implementation of contracts signed prepandemic and the "refilling" of new deal pipelines.

Large IT PACS or enterprise imaging regional tenders in Europe and major imaging IT acute hospital deals in the U.S. have also slowed, with healthcare provider executives shifting resources and focus toward COVID-19 response and tackling new initiatives such as telehealth adoption in the near term. This could also lead to further delays or downgrading of more complex enterprise imaging platform deals as budgets tighten and other initiatives take precedence.

The pandemic has also spurred some bright-spots for imaging informatics, with strong demand for home-reporting workstations, operational workflow tools (triage, case-load balancing), and specific advanced visualization toolsets for COVID-19 analysis.

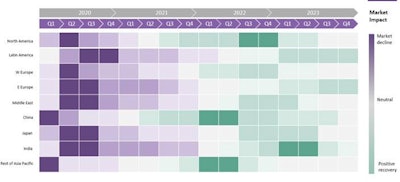

Market impact and recovery for medical imaging and healthcare technology is going to be very regionalized, creating an operational and strategic challenge for imaging vendors. Courtesy of Signify Research.

Market impact and recovery for medical imaging and healthcare technology is going to be very regionalized, creating an operational and strategic challenge for imaging vendors. Courtesy of Signify Research.Reshaping of imaging services

The threat of a second wave of COVID-19, pent-up demand for imaging services, and severe budgetary pressure on health systems will reshape how imaging is delivered to patients. While it is too soon to accurately predict how each provider and region will tackle the substantial challenge of returning to prepandemic levels, three key areas of change are evident:

- Stronger focus on system utilization: With high demand, radiology practices and departments will be pushed to deliver more scans while juggling operational challenges such as equipment sterilization between exams. This could lead to the following:

- Review and potential revision of imaging protocols for advanced imaging equipment to lower scan time, potential restriction of specific advanced scan types in order entry

- Adoption of radiology department analytics and real-time operational tracking software

- Use of "remote" fleet management command center tools, enabling remote administration of modality fleets with fewer or more junior staff

- Use of "virtual" waiting rooms limiting patient potential exposure in departments and clinics

- Increased use of mobile advanced scanners (e.g. in the back of a truck) to support short-term spikes in demand

- Imaging service location will be challenged: Patient sentiment over attending routine imaging will be closely tied to the rate of imaging volume recovery. For many, the risks associated with attending imaging at acute hospital sites while still dealing with patients who have COVID-19 could lead to substantial patient no-shows. To counter this, many healthcare providers will increasingly look to use outpatient imaging centers or mobile imaging solutions near term wherever possible. After the substantial drop in imaging volumes, the outpatient imaging sector could also be very different, with rapid consolidation and clustering of imaging facilities and reading groups.

- Growing use of different models of teleradiology: Increased comfort with remote working practices and the need for additional reading capacity should lead to healthcare providers more aggressively exploring and implementing the use of teleradiology services. While it is early in this progression, the use of teleradiology outsourcing for out-of-hours reading, for specialist consultations, and for periods of internal reading "overspill" should become more widespread. However, imaging service providers will need to overcome the additional workflow challenges presented by teleradiology use to maximize the efficiency and potential cost savings. Radiologist home-reporting practices are also quite likely to become the new normal, raising long-term questions over healthcare provider bandwidth, security, and virtual peer and patient consultation.

Double-edged sword for AI adoption

In general, the fundamental drivers of artificial intelligence (AI) adoption look set to remain robust despite the impact of the pandemic; while some deals will have been delayed, we expect the impact to only be short term. Reduced budgets for AI projects, especially those that are not directly related to COVID-19, such as neurology, liver, prostate and musculoskeletal applications, could likely be felt in 2021, as 2020 revenues will be somewhat supported by projects that were initiated pre-COVID.

Several vendors have rushed to market with AI-based clinical applications for the triage and diagnosis of COVID-19. As the year progresses, the anticipated backlog of imaging studies will put additional pressure on radiology departments, and this will drive increased interest in AI tools that help to maximize productivity and to prioritize cases. However, the robustness of some of these solutions is questionable. If health providers have a poor experience with these tools, it may set back the more widespread adoption of AI-based clinical applications. This could have a substantial impact on healthcare provider trust in AI solutions and willingness to further invest in innovative AI-based systems in the midterm future.

Greatest risk: Emerging growth markets

The rate of imaging market recovery will also occur very differently by geography, creating a further logistical and operational challenge for vendors. For example, markets in Oceania and China are already returning to normal, as the pandemic has been contained and restrictions are lifted. The largest markets of North America and Europe are also moving in the right direction, with the initial signs of market recovery apparent in recent weeks. However, given the unprecedented level of financial stimulus, recession, and near-term economic uncertainty facing markets, it is highly unlikely healthcare budgets will emerge unscathed over the next two years. Also, the ongoing risk of a "second peak" of the pandemic remains an underlying risk.

Most concerning for global market recovery, though, are emerging markets such as Brazil, Mexico, India, and Russia. These countries have become substantial contributors to overall market growth for imaging equipment and services in the last decade, behind only China in terms of growth trajectory, but they are also four of the five worst affected regions by COVID-19 (along with the U.S.) at the time of writing and have yet to reach the peak of the pandemic. Further, their health systems are generally inadequate to handle the unprecedented stress that COVID-19 places on resources. We see the highest risk and volatility in terms of market recovery for these regions, with a real risk of demand plummeting in the second half of 2020 and 2021 as the full force of the pandemic hits.

To conclude, the impact of COVID-19 on the medical imaging industry has been far-reaching and unprecedented. It is also fraught with further uncertainty and risk. The predictions in this article are based on evidence and research from the initial spread of the virus across global markets. We must concede that it is almost impossible to forecast even the near-term market impact with any great confidence, such is the volatility and complexity of the global market response to COVID-19.

One thing is for sure though: The market will never be quite the same again.

Steve Holloway of Signify Research.

Steve Holloway of Signify Research.The full white paper analysis can be downloaded from Signify Research.

Steve Holloway is principal analyst and company director at Signify Research, a health tech, market-intelligence firm based in Cranfield, U.K. Competing interests: None declared.

The comments and observations expressed herein do not necessarily reflect the opinions of AuntMinnie.com or AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.