As ultrasound technology becomes increasingly comparable, vendors continue to seek ways to distinguish themselves from competitors. AI has become one such way to do this. Many vendors are putting the volume of AI features on the device at the forefront of their marketing strategies.

This risks commoditization of these features, highlighting the importance of AI vendors to have clear strategic plans for product evolution and diversification. This insight article discusses the key trends impacting the ultrasound AI market.

Consolidated capital: Scaling up investments

The number of ultrasound AI investment deals remains low, but as the market matures, investment sizes have increased, with the average 2025 funding raising around $15 million, up from around $6 million in 2024. Increased investor scrutiny has led to a decline in investment deals, but mature vendors with a more established return on investment can attract larger investment volumes, underscoring the need to generate evidence.

As the market matures and perceived early winners lay the groundwork for reimbursement pathways, the number of self-sustaining independent software vendors (ISVs) is increasing. As expected, we have begun to see more vendors looking to exit the market or be acquired as funding runways start to run out. However, M&A activity has slowed; most original equipment manufacturers (OEMs) have developed strong internal development teams and thus favor partnerships with third parties to fill gaps in their natively developed portfolios.

Unlocking scale through reimbursement

Reimbursement is currently the main driver for AI adoption in many regions. As a reimbursable clinical service, it directly influences provider purchasing decisions, payer confidence, and investor sentiment. However, in many regions and across clinical segments, reimbursement policies are unconsolidated and uneven.

Ultrasound AI remains under-reimbursed compared to the broader imaging AI market. Some niches, such as breast cancer and fractional flow reserve CT (FFR-CT), have stable coverage compared to other areas that rely more on private pay structures. For many vendors, reimbursement is a necessity for scalable growth and market longevity, and a clear strategy for evidence generation is needed from the start.

Evolving sales strategies for a maturing market

As the ultrasound AI market matures and the number of clinically validated tools increases, prioritizing diversification of sales channels and outlining a clear sales strategy is imperative. Buyer expectations have also evolved as the market has become increasingly commoditized by OEMs, with device AI features included as standard.

Many providers are making decisions based on IT department requirements for cohesive solutions that align with their service lines and infrastructure. The increased expectations from buyers for OEMs to provide enhanced AI features on devices mean it isn’t only ISVs who need to outline a long-term commercialization strategy; OEMs will also need to do the same to maintain margins as more AI features are added to their portfolios.

Beyond single solutions: Building holistic portfolios for market longevity

Most market entrants begin with a single-solution offering, such as cardiac measurement tools or lesion detection. As the ultrasound AI market matures, it’s becoming increasingly imperative for vendors to have a clear product evolution strategy to maintain market visibility and secure longevity.

Source: Signify Research

Source: Signify Research

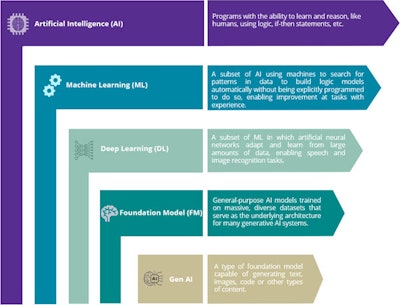

Foundation models and beyond: Accelerating development with generative AI

Traction surrounding generative AI models has increased as vendors strive to be at the forefront of market innovation. On-prem solutions typically work better due to deeper integrations, enabling real-time analysis whilst maintaining clinician workflows.

The larger size of foundation models means they require more processing power. As such, housing them within the system whilst maintaining their cloud connection is a significant development challenge, and there is little guidance on regulatory approval.

The majority of vendors are leveraging foundation models during the development of ML models. They can reduce development time and effort by enabling rapid fine-tuning with synthetic data, lowering R&D costs, and decreasing overall build, test, and validation timelines.

The Signify View

As the ultrasound AI market matures, success will hinge on more than technological innovation alone. AI vendors must balance tighter funding environments with the opportunities presented by growing regulatory approvals and evolving reimbursement frameworks.

Those who prioritize evidence generation, diversify product portfolios, and embrace strategic partnerships, such as those for generative AI, will be best positioned to thrive. The next phase of growth will not be defined by isolated solutions but by integrated strategies that deliver clinical value, operational efficiency, and long-term sustainability.

Related research

The third edition of this report provides a qualitative assessment of the market opportunity for artificial intelligence in ultrasound. It provides a comprehensive review of the market trends and recent innovations, and forecasts the future development of the market. Based on in-depth interviews, the report reviews the market activities and strategies of both AI startups, scale-ups, and ultrasound system OEMs.

Aiyana Amess is a market analyst and Mustafa Hassan, PhD, is a senior market analyst on the Medical Imaging Team at Signify Research.

The comments and observations expressed do not necessarily reflect the opinions of AuntMinnie.com or AuntMinnieEurope.com, nor should they be construed as an endorsement or admonishment of any particular vendor, analyst, industry consultant, or consulting group.