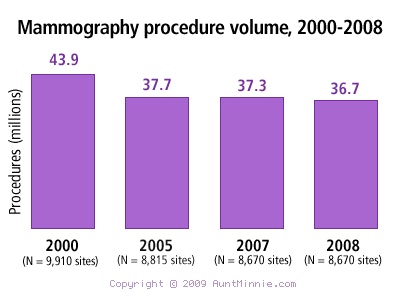

Mammography procedure volume in the U.S. has dropped 16% since 2000, confirming recent studies indicating that fewer women are complying with screening mammography recommendations, according to a new report by market research firm IMV Medical Information Division of Des Plaines, IL.

The study finds that screening mammography volume has been dropping at a 2% annual rate since 2000, and the number of sites performing mammography has also been falling. But the report isn't all bad news: Women are finding it easier to schedule mammograms, a growing number of breast care centers are offering more tailored services to women, and many mammography sites are still planning to upgrade to digital technology, despite the economic slowdown.

IMV's 2008 Mammography Center Study of 1,076 locations with breast imaging equipment was conducted via telephone interviews with imaging administrators, and is IMV's third mammography marketplace study (prior reports were released in 2000 and 2005).

The report comes at a critical juncture in mammography's history: Despite a downturn in procedure volume and concern over higher co-pays, uninsured patients, and malpractice risk, novel technologies and delivery models in breast imaging are blossoming.

Fewer procedures, shorter lead times

Evidence has been building of a drop in mammography volume. A recent American Journal of Roentgenology article (February 2009, Vol. 192:2, pp. 370-378) reported fewer women being screened, with mammography use dropping from a range of 0.3% to 5.3% in 34 states that were examined. The study also predicted an impending shortage of those who perform and read mammography studies.

That downturn was echoed in the IMV findings: A projected total of 36.7 million mammograms were performed by 8,670 sites in 2008, down 2% from 37.3 million procedures in 2007. While volume has stayed at a steady state since 2005, last year's procedure volume is 16% less than the 43.9 million procedures done in 2000.

|

The IMV study surmises that the decline may be due in part to a 13% reduction in the number of Mammography Quality Standards Act (MQSA)-certified sites, from 9,910 in 2000 to 8,670 in 2007.

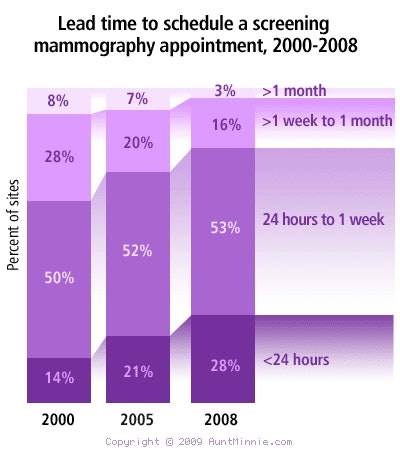

Interestingly, the IMV report states that patients are waiting less time to get screening mammograms: In 2008, 81% of sites could schedule patients within a week, up from 64% in 2000. That, too, could indicate slightly more supply than demand for mammography services, according to Lorna Young, senior director of market research for IMV.

|

"This implies that there's capacity available to take care of mammography screening," she said. "One service that centers provide to help encourage women to have their routine mammograms is to send out annual reminders. Surprisingly, not all centers do this, as 78% of the sites indicated that their facility routinely sends out reminders."

Nor did the IMV study reveal a shortage of professionals available to conduct or read mammograms. Nearly 90% of all sites have input from radiologists at their location; among these, an average of five radiologists are involved, essentially unchanged from 2005. Radiologists in dedicated breast care centers read more studies (1,945 per year) than those in the small hospital radiology departments (510 per year).

The rise of integrated breast centers

Among the positive trends in the report is the rise of integrated breast care centers. Such centers offer cutting-edge imaging, alternative therapies (think yoga, music, art, and nutrition), and a multidisciplinary clinical team.

"With increasing evidence that earlier screening and treatment of breast cancer improves survival rates, many mammography centers have responded by providing a full-service approach," Young said. "Mammography is primarily an outpatient procedure, and providers are seeking to make the screening experience pleasant and easy for women. Breast care centers try to bring all the modalities together for diagnosis and treatment."

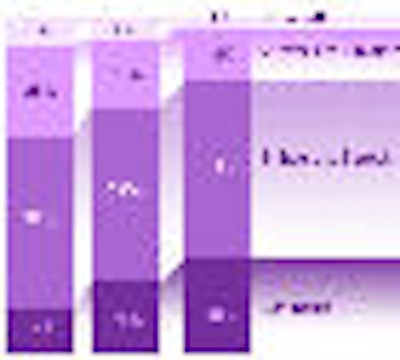

Of the 48% (4,125 sites) of mammography locations that are outside of hospitals, 35% are imaging centers, 33% are outpatient clinics, 19% are physician's offices, and 10% are breast care or women's healthcare centers. Descriptions for the remaining 3% include "women's prison," "corporate location," "medical clinic," "public health nurse setting," and "offsite location in department store."

While they represent only about 10% of all sites offering mammography services in the U.S., the IMV report found that breast care centers in hospital or nonhospital settings have higher productivity than other hospital departments that perform mammography studies, such as radiology departments (where mammography is primarily provided in hospitals with fewer than 200 beds), and nonhospital settings such as outpatient clinics and physician offices, according to the study.

"One of the things I've found that is very interesting is that breast care centers appear to have both higher volumes of procedures and higher productivity," Young said. "They have more FTEs [full-time equivalent employees], but also more productivity in terms of images per FTE."

Dedicated breast care centers located in hospitals had the highest average of 2,120 procedures per FTE technologist, as did nonhospital breast centers, with an average of 1,900 procedures per technologist. Standalone and hospital-based breast centers also had more mammography units installed than other locations (2.5 compared to the overall average of 1.4) and performed more mammography procedures per unit.

CR gets rolling, breast MRI booms

Until recently, mammography's transition to digital was comparatively slow, as the modality struggled to replicate the film-screen gold standard. "The level of detail necessary to detect microcalcifications in the breast was so fine that in order to do that the full-field digital machines (FFDM) have been quite expensive -- two or three times higher than a film-screen mammography machine," Young explained.

But the U.S. Food and Drug Administration's approval in 2006 of the first computed radiography (CR) digital mammography system, and growing demand for FFDM in both CR and flat-panel forms, augur a wave of planned purchasing, according to the IMV report. Some 39% of those surveyed in the report said they planned to buy new or replacement mammography equipment over the next two to three years, up from 30% in 2000.

Digital adoption varies according to hospital size, the IMV report said. Hospitals with fewer than 300 beds were more likely to retrofit their current x-ray mammography machines with CR mammography than to buy a brand-new flat-panel FFDM system.

But these sites represent a minority in the current market: 10% of those who purchased mammography systems in 2008 bought CR, about 10% bought film-screen, and about 80% bought flat-panel FFDM. "None of the people we talked to in 300-plus bed hospitals had CR. If they had digital, it was flat-panel," Young said.

One technology that is on the utilization fast track is breast MRI, indicated for high-risk patients and those with dense breasts. The number of breast MRI scans grew 73% from 2005 to 2007 and a whopping 81% from 2007 to 2008, when more than 500,000 breast MRI procedures were conducted. However, the use of MRI scanners for breast imaging is still rare, representing just 2% of all MRI studies done in the U.S.

In 2008, 19% of mammography sites performed breast MRI within their facility. Once again, breast and women's care centers took the lead in breast MRI, with 40% to 51% performing offering the technique as opposed to 17% of radiology departments (which tend to be the mammography providers in smaller hospitals).

The growing numbers have caused researchers like Young to take notice, however. There may be even more demand in the future: The American College of Radiology in Reston, VA, has issued practice guidelines recommending that breast MRI be used as a screening modality for women with a 20% to 25% lifetime risk of breast cancer, as well as for the assessment of local extent of disease, evaluation of treatment response, and guidance for biopsy and localization.

With the arsenal of diagnosis and treatment options now available for breast cancer and related diseases, Young concluded that now is a promising time for the integrated breast care approach to women's health.

"I just was amazed at how the breast care centers had more of all the breast care equipment and services, such as a higher use of computer-aided detection software (CAD), mammography RIS, biopsy capabilities, risk assessment tools, and personnel, and that model seems to be working," Young said. "Women's healthcare centers are doing very well too, but breast care centers are more likely across the board to have the tools, the processes, and the clinical teams. It would say to me that if I had breast cancer, I'd look for a breast center to manage my patient care."

By Alexandra Weber Morales

AuntMinnie.com contributing writer

March 17, 2009

Disclosure notice: AuntMinnie.com is owned by IMV, Ltd.

Related Reading

Growth rate for PET procedure volume slows to single digits, February 17, 2009

CT installed base triples in cardiology practices, December 23, 2008

IMV: Nuclear med procedures up in 2007, November 11, 2008

Radiation oncology procedure volume edges up, report states, August 28, 2008

MRI procedure growth rate slows, study shows, June 5, 2008

Copyright © 2009 AuntMinnie.com