Cardiovascular software developer HeartFlow plans to go public through a merger with an already-public firm in a special-purpose acquisition (SPAC) deal.

HeartFlow plans to merge with Longview Acquisition Corp. II, an affiliate of investment firm Glenview Capital Management. The value of the combined company will be $2.4 billion; the company will have about $400 million in cash after the closing of the deal.

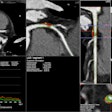

HeartFlow's software takes conventional coronary CT angiogram (CCTA) exams and creates personalized 3D models of the heart, providing fractional flow reserve (FFR) CT values along the coronary arteries. It's an alternative to more invasive methods for calculating FFR that involve directing a guidewire into the coronary arteries to make direct measurements.

Upon the conclusion of the deal, HeartFlow's stock will trade on the New York Stock Exchange under the symbol "HFLO."