Continuing its aggressive push for global growth, South Korean artificial intelligence (AI) software developer Lunit has inked a deal to acquire breast and lung imaging AI software firm Volpara Health Technologies for approximately $292 million Australian dollars ($193 million U.S.).

For Lunit, the acquisition would bring access to Volpara’s installed base in the U.S. market; Volpara’s mammography AI software is currently in use at over 2,000 U.S. sites, according to the vendors. In addition, Lunit hopes to utilize Volpara’s repository of over 100 million mammography images to develop new AI capabilities.

“Combining Volpara’s established presence in the U.S. with Lunit’s complementing global footprint and AI expertise will create a compelling portfolio of advanced AI-enabled solutions for radiology and for other healthcare specialties," said Lunit CEO Brandon Suh in a statement.

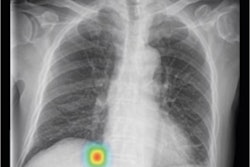

The deal follows on recent U.S. Food and Drug Administration (FDA) clearance for Lunit’s Insight DBT AI software for analysis of digital breast tomosynthesis (DBT) exams. Lunit’s CXR Triage software for triage of emergency x-ray cases garnered FDA clearance in November 2021.

Lunit has been actively pursuing global expansion, including participation in Saudi Arabia’s Saudi Vision 2030 Healthcare Sandbox and forming a partnership to help develop Saudi Arabia’s national cancer screening program. It has also formed a collaboration with a Swedish hospital for use of its Insight MMG AI software as an independent reader of screening mammography images and has received the CE Mark for Insight DBT.

Based in New Zealand, Volpara is perhaps best known for its AI-based breast density assessment software. Its Breast Health software also includes tools for patient communication, risk assessment, screening program analytics, and automated scoring of mammography and DBT exams. Additionally, Volpara has developed Volpara Lung, a software application for lung cancer screening programs.

Although Lunit’s and Volpara’s software share some similarities, each have unique aspects and the acquisition represents a strategic move aimed at capitalizing on their synergies, according to Jaewhan Lee, global PR manager for Lunit.

For example, Lunit’s flagship software, Insight MMG, focuses on breast cancer detection on mammography exams, while Volpara’s Scorecard software provides breast density analysis to help radiologists in patient classification, Lee said. Meanwhile, Volpara’s Pathways tool identifies and monitors high-risk patients.

“The collaboration aims to combine these distinct strengths, thereby providing a comprehensive end-to-end AI-driven breast cancer diagnosis journey,” Lee told AuntMinnie.com. “By combining Lunit’s and Volpara's technologies, we anticipate delivering enhanced diagnostic accuracy and refining patient care.”

For Volpara, the deal would provide risk-adjusted value and certainty for shareholders, according to chairman Paul Reid.

“In considering options for Volpara, including continuing to implement the Company’s growth strategy as a publicly-listed company, the Board adopted a long-term view of the risks and rewards of various alternatives,” Reid said in a statement. “While the Board remains confident in the future of Volpara, the transaction would accelerate a capital return to shareholders and mitigates the risks that would otherwise be involved in delivering the opportunities from executing Volpara’s strategic plan over time.”

Volpara also highlighted the potential of the combined company to develop new AI offerings.

Under the terms of the deal, Lunit will pay $1.15 Australian per share, a 47.4% premium to Volpara’s closing price of $0.78 Australian per share on December 13, for 254 million shares. The deal is subject to approval by Volpara shareholders and New Zealand High Court, as well as regulatory clearances by the New Zealand Overseas Investment Office and fulfilment of other customary closing conditions.

In addition, Volpara’s board can engage with other bidders on competing proposals and, when necessary, respond to any such proposals to fulfill statutory or fiduciary obligations, according to the firms. Lunit will be able to match any superior proposal.

Lunit expects to complete the acquisition by the end of the second quarter of 2024.

Once the deal is completed, Volpara would continue as a standalone company for now, according to Lee.

“The business operations will continue as usual, with a primary focus on the U.S. market,” Lee said. “Additionally, there are no immediate plans to change the brand name or product offerings within the first year post-acquisition.”

Volpara’s executive team will also stay on after the deal is completed, Lee said.