The U.S. healthcare transcription services market is an active one, with nearly 43% of survey respondents purchasing a system in 2009 and 2010, according to a new report from healthcare technology research and advisory firm CapSite.

In addition, 24% of respondents plan to purchase a new transcription service within the next 18 to 24 months, said Gino Johnson, CapSite vice president. CapSite surveyed 256 institutions in the U.S. for the report.

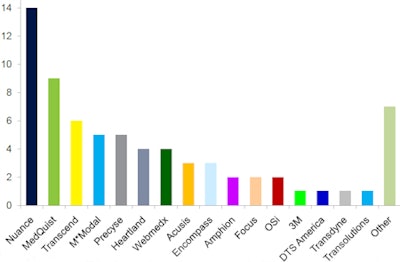

While nearly 50% of the transcription services market is currently held by MedQuist and Nuance Communications, institutions are still considering a wide range of vendors for their next purchase, Johnson said.

"Other companies are in the mix beyond just those two main players," he said.

|

| Considered vendors for transcription services. All images courtesy of CapSite. |

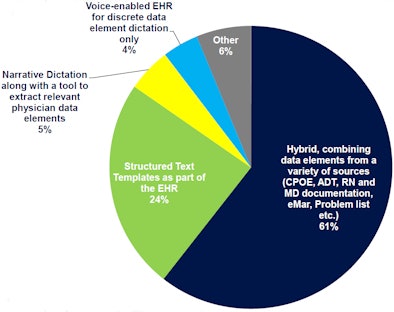

In addition to asking about current transcription service purchasing plans, CapSite also surveyed organizations about the effects of meaningful use provisions under the U.S. government's healthcare IT stimulus program. In terms of current and planned approaches for capturing physician documentation to meet meaningful use requirements, a hybrid method that combines data elements from a variety of sources was conclusively the most popular, Johnson said.

|

| Organizations' planned or current approach for capturing physician documentation to meet meaningful use requirements. |

CapSite also queried organizations on the relevance of supporting health information exchanges by tagging transcribed documents following the Clinical Document Architecture (CDA) standard. On a scale of 1 (not relevant) to 10 (highly relevant), the average rating was 7.202.

In other survey results, 79% of respondents said that quality management (for example, the ability to identify all patients with signs of a hospital-acquired infection) was their most important reporting category to meet the reporting needs of the Health Information Technology for Economic and Clinical Health (HITECH) Act. Thirteen percent cited risk management (e.g., the ability to identify all patients who fell last time they were in the hospital) and 8% pointed to case management (e.g., the ability to identify all patients with a particular drug combination).

CapSite also asked respondents to rate the importance of a tool that allows quality measure and core measure reporting based on data extracted and analyzed from transcribed documents. On a scale of 1 (not important) to 10 (highly important), the average rating was 8.253.

When asked to rate five categories on the most important capabilities of a clinical data analysis tool, respondents ranked validating patient information for medication reconciliation the highest, followed closely by identifying potential adverse advents with algorithms. In third place was automatically identifying CPT and ICD codes for billing, with automated population of clinical registries and patient identification for clinical trials as the lowest rated categories.

In other results, 53% of respondents said they would consider their current transcription vendor for their data extraction and analysis needs, while 47% said they would not.

For more information on CapSite's 2011 transcription services report, click here.