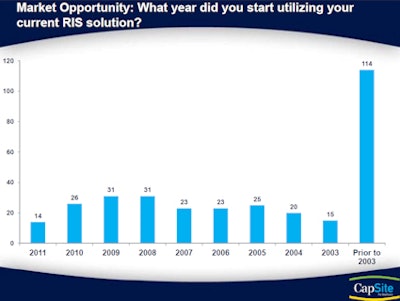

The combination of an installed base with rapidly aging software and a push to meet U.S. IT meaningful use requirements bodes well for the U.S. RIS market, according to a new report from healthcare technology research and advisory firm CapSite.

In the company's 2011 Radiology Information System (RIS) survey of more than 350 U.S. hospitals, more than half of institutions reported using a RIS that's older than 5 years. And the largest proportion of users in the study had systems that were more than 6 years old.

"As organizations start to make progress with stage 1 meaningful use and specifically around their [electronic health record (EHR)] plans, we believe they will start to look at other areas within their organization that have not been a primary focus," said Gino Johnson, CapSite senior vice president and general manager. "And whether that's PACS, or in this case, RIS, there would seem to be some of these systems that are getting long in the tooth and may be overdue for a replacement."

CapSite received responses from 363 U.S. hospitals. The hospitals included 206 with fewer than 200 beds, 107 with 200 to 400 beds, and 50 with more than 400 beds. Radiology directors made up the majority of participants. The sample size is statistically large enough to be extrapolated to the U.S. hospital market as a whole, Johnson said.

Of the respondents, 90% employed a RIS and 10% did not. More than half of the RIS users had a system older than 5 years.

|

| All images courtesy of CapSite. |

CapSite queried the respondents on how they used their RIS. Order entry, management reporting, and scheduling functions were the most popular, with 272, 254, and 198 users, respectively, reporting using those capabilities. Dictation/transcription (168), mammography tracking (147), and business analytics/data mining (125) followed, with referring physician access/portal (117), emergency department (ED)/technologist discrepancy reporting (73), radiologist peer review (58), capture and tracking of patient x-ray dose (56), automated critical results notification (52), and marketing tools (17) not being used as often.

CapSite also asked users which functions were being provided by a vendor other than the RIS:

- Radiologist peer review (159)

- Dictation/transcription (153)

- Mammography tracking (121)

- Referring physician access/portal (112)

- ED/technologist discrepancy reporting (110)

- Automated critical results notification (99)

- Scheduling (95)

- Marketing tools (80)

- Capture and tracking of patient x-ray dose (63)

- Order entry (54)

- Business analytics and data mining (54)

- Management reporting (37)

Purchasing activity

In describing their recent RIS purchase, 53% purchased their RIS as part of a broader enterprise clinical system, such as EHRs, while 24% purchased it in combination with a PACS and 23% bought a standalone RIS.

The majority of systems being purchased as part of a broader enterprise clinical system reflects the market emphasis on meaningful use, according to Johnson.

In response to what approach they prefer when purchasing a RIS, 39% would rather acquire a RIS as part of an enterprise clinical system (EHR), 28% would like to buy a RIS in combination with a hospital information system (HIS), 17% had no preference, 12% would prefer a RIS purchased in combination with PACS, and only 4% would buy a standalone RIS, according to the report.

When asked if they planned to purchase a new RIS or upgrade their current one, 55% had no plans to do so, 23% were upgrading their current system, and 22% are planning to purchase a new RIS.

"[The purchasing/upgrading plans are] positive and [indicate] that there will be continued investment or activity within the RIS market," Johnson said.

The time frame for purchasing or upgrading the RIS was as follows:

- Within the next six months (52)

- Within the next seven to 12 months (32)

- Within the next 13 to 24 months (30)

- Within the next 24+ months (27)

For those without a RIS, 47% were planning to purchase one and 53% were not.

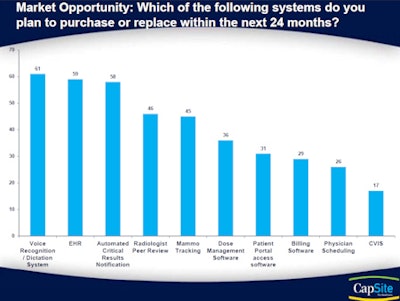

When asked what other systems they were planning to repurchase or replace within the next 24 months, voice recognition/dictation system, an EHR, and automated critical results notification topped the list, according to CapSite.

|

Meaningful use

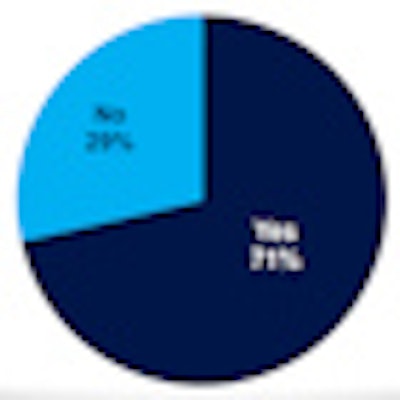

CapSite also asked respondents if they were aware that the meaningful use incentive payments now apply to radiologists as eligible physicians under the U.S. Health Information Technology for Economic and Clinical Health (HITECH) Act: 71% said yes, while 29% said no.

The company also asked participants to select what best describes their facility or organization's strategy to achieve and document meaningful use with their RIS/PACS:

- "We are working with our current RIS/PACS vendor to optimize the use of our current RIS/PACS solution." (61%)

- "We have already engaged with a consultant to assist us in optimizing the use of our current RIS/PACS solution." (11%)

- "We are in the process of evaluating vendors for a new RIS/PACS solution." (9%)

- "We expect to initiate a search process for a new RIS/PACS solution." (5%)

- "We expect to engage with a consultant to assist us in optimizing the use of our current RIS/PACS solution." (5%)

- "Achieving/documenting meaningful use is not a primary concern for our organization." (5%)

- "We have achieved meaningful use and have already received stimulus money from the government." (4%)

When asked if they will apply for meaningful use incentives, 46% said they were unsure, 31% said they would apply in the near future, 19% said they already had, and 4% said no, according to CapSite.

Of those who will apply in the future, 45 said they will apply within the next seven to 12 months, 32 said they will apply within the next six months, 21 plan to apply within the next 13 to 24 months, and two expect to apply within the next 24+ months.