Vendor-neutral archives (VNAs) have been adopted by just one-third of the U.S. hospital market, according to a new report by healthcare technology and consulting firm CapSite. The many facilities that have not yet adopted the technology create a prime target for vendors in the imaging IT sector.

"There's been good progress [in customer adoption of VNAs], but there's also still significant opportunity for further penetration and investment in VNAs going forward," said Gino Johnson, senior vice president and general manager.

For its 2012 Imaging IT Study, CapSite surveyed 416 U.S. hospitals on their imaging IT activities in areas such as VNAs, advanced visualization, and mobile imaging devices.

For the purposes of the study, CapSite defined a VNA as a "software solution that acts as a middleware application between one or many clinical workflow applications, and various storage platforms and IT strategies." Furthermore, a "VNA will support one or many clinical viewing applications, a standards-based environment, storage virtualization strategies, robust business continuity deployments, and virtual environments."

In a notable trend since CapSite first studied the VNA market in 2010, major imaging IT vendors have made progress in getting into the VNA space, Johnson said.

"It's not surprising that the established vendors saw the opportunity," Johnson said. "They saw the early movers create their solution and have taken steps to try and offer similar solutions and keep that [customer] investment within their own organizations."

CapSite found three main drivers behind purchasing interest in VNAs, based on survey responses (an "other" category earned 11%):

- To achieve economies of scale across multiple service areas such as radiology, cardiology, etc. -- 33%

- The need for additional storage independent of a PACS vendor to have flexibility of access and the ability to change PACS vendors in the future without affecting data -- 30%

- A plan to implement a VNA as part of a broader IT strategy, such as the implementation of an electronic medical record (EMR) -- 26%

Nineteen percent said they plan to purchase a new VNA within the next two years, while 81% said they did not. Fifty-five percent of those not purchasing a new VNA said they do not have a need for it at this time, while 22% had already purchased a VNA that met their needs. "Other" reasons were cited by 14%, while 9% pointed to cost.

In other findings, 52% said they were unsure if they would be interested in a VNA as a hosted, cloud-based solution, while 30% said they are not interested, according to CapSite. Eighteen percent said they would be interested.

One of the drivers for the VNA sector, as well as the imaging IT market as a whole, is stage 2 of the U.S. government's meaningful use program to promote healthcare IT adoption, Johnson said.

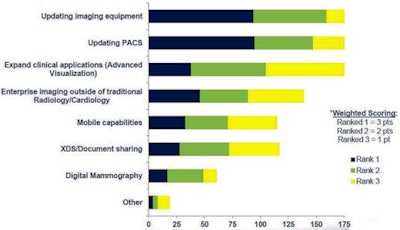

|

| Survey participants were asked to rank the top three imaging priorities for their organization, as related to meaningful use stage 2 criteria. All images courtesy of CapSite. |

When asked how confident they were on a scale from 1 (no confidence) to 10 (complete confidence) that their primary imaging IT solution provider would be able to meet stage 2 meaningful user criteria, respondents gave their current vendor an average score of 8.432.

"This is generally a positive picture, but clearly there is still more work that needs to be done by those imaging IT vendors to instill greater confidence as they move toward stage 2," Johnson said.

Advanced visualization

CapSite also queried survey participants on their use of and plans for advanced visualization technology. Forty-two percent said they have purchased an advanced visualization system, while 58% have not purchased one yet.

When asked if they plan to purchase a new advanced visualization system or upgrade their current system within the next two years, 53% did not have any plans. Thirty-four percent plan on upgrading their current system, while 13% are targeting a new system purchase.

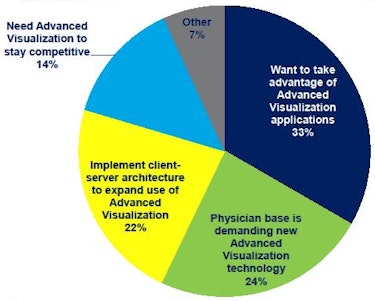

|

| Survey participants were asked to identify the most important driver for their advanced visualization purchase. |

CapSite also asked participants about their mobile imaging plans. Twenty-seven percent indicated that they plan to incorporate a mobile imaging strategy across their organization, while 32% said they do not have plans. Forty-one percent were unsure, according to the company.