The U.S. diagnostic imaging industry generated $9.616 billion in product revenues in 2002, a compound annual growth rate (CAGR) of 9.8% from the $8.76 billion in sales recorded in 2001, according to market research firm Frost & Sullivan. The outlook for 2003 remains positive as well, with revenues projected to climb 9.3% to $10.511 billion, according to the San Jose, CA-based company.

The U.S. equipment services market climbed 3.4% from $3.48 billion in 2001 to $3.6 billion last year. The imaging industry turned in $18.5 billion in product revenues globally (not including radiopharmaceuticals and contrast agents) in 2002, up from $17 billion in 2001, said Monali Patel, Frost medical imaging industry manager, in an industry briefing last week.

Although 2002 generally was characterized by a lull in new product launches and innovation, there were a number of notable developments, Patel said.

In ultrasound, the first "live" 3-D echocardiography system was introduced, while CT witnessed the debut of the first 10-slice scanner. The first flat-panel digital angiography systems were a highlight in x-ray, while the nuclear medicine sector saw the first hybrid PET/CT systems equipped with 16-slice CT capability, Patel said.

Improvements in MR technology allowing for ultrafast exams drew attention, while the mammography sector was characterized by greater market penetration of full-field digital units, she said.

Imaging expansion

In 2003, Frost predicts that imaging will continue to expand beyond the radiology department. For example, PET/CT will see an expanding role in radiation therapy planning, Patel said.

"The combined structural and functional image created by PET/CT is very useful in producing a clear image of the tumor, along with its exact location, which allows for more precise simulation and delivery of radiation," she said.

Frost also projects increased use of nuclear medicine modalities and tracers for novel neurological applications, such as Parkinson's disease, attention deficit-hyperactivity disorder (ADHD), and Alzheimer's disease.

"The use of PET in Alzheimer's is expected to be closely watched in 2003, as it's expected that the Centers for Medicare and Medicaid Services (CMS) may reach some conclusion on the creation of reimbursement for this procedure," she said. "While it's not expected that CMS would allow broad coverage of the procedures, some believe that limited coverage may be approved."

In orthopedics, the use of low-field MRI and specialized products such as stand-up MRI will expand. And as this growth trend continues beyond the realm of radiology, the creation of additional sales channels will help pave the way for revitalization of mature modality markets, she said.

The impact of consumerism

In 2003, Frost also expects an increased emphasis on early detection coupled with vigilant healthcare consumerism. This will drive the use of imaging for screening applications, Patel said.

"Contrary to prior years, a greater number of community hospitals will also offer imaging screening services," she said. "While the majority of them have shied away from controversial screening such as whole-body (exams), a growing number have responded to consumer demand and are beginning to offer tests such as virtual colonoscopy and calcium scoring."

This trend will also be boosted by continued adoption of multislice CT systems -- such as 16-slice units -- as well as development of computer-aided detection (CAD) systems for virtual colonoscopy and lung nodule assessment, she said.

This year will also feature continued development of functional and molecular imaging, including high growth for PET and even stronger growth for hybrid PET/CT systems, Patel said. New introductions will feature configurations such as four-slice to 16-slice CT scanners, as well as mobile PET/CT units.

"PET/CT will continue to be instrumental in the future development of functional imaging, and will help to refine cancer diagnosis," she said.

This sector will also see the development of advanced crystal detector materials, and possibly, new radiotracers, she said. Frost also expects the formation of strategic alliances and stabilization of PET reimbursement.

The firm also envisions additional strategic alliances between synergistic medical disciplines such as therapeutics companies, modality manufacturers, and diagnostic contrast vendors.

"These alliances are likely to occur within the functional imaging sector," Patel said. "Companies understand that bringing a diagnostic product to market is fruitless unless therapeutic solutions are also available for the disease in question. Furthermore, (alliances) are becoming more important as applications that can be performed using imaging modalities broaden."

Convergence

In another 2003 trend, Frost views imaging as a common platform in the convergence of medical and information technology. Although it's unlikely that only PACS will be used as a central platform for this convergence, PACS is shaping up as one of the most important platforms within the electronic medical record and other patient monitoring technology, she said.

This market dynamic requires PACS technology to feature robust integration and workflow benefits, she said. The movement towards an integrated RIS/PACS will likely continue in 2003.

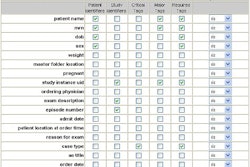

"Additionally, manufacturers of all sizes are beginning to integrate PACS into a single information solution by expanding the imaging platform to also include back-office functions such as scheduling of patients and billing," she said.

Stronger bonds between PACS and IT vendors are on tap for 2003, Patel said.

Now that the frenzy has peaked and most modalities are available in a digital configuration, the next steps in the digitization of the imaging industry will emphasize perfecting technologies and creating economies of scale to drive down costs, she said. Vendors will also work to educate physicians and institutions on the merits of digital imaging.

Frost also predicts standardization of software platforms to facilitate streamlined communication between imaging and information systems.

As for the competitive landscape in 2003, the firm foresees a continued slowdown in merger and acquisition activity, as large vendors are being pressured to demonstrate organic growth. More attention will be given to research and development and targeted customer needs.

"However, the quest to provide total solutions, including the integration of information systems, has not diminished," she said.

By Erik L. RidleyAuntMinnie.com staff writer

February 13, 2003

Related Reading

F & S sees larger North America mobile imaging market, December 12, 2002

HIPAA will squeeze budgets, generate software spending, October 22, 2002

F & S releases European contrast market analysis, October 8, 2002

Frost report says contrast media markets primed for growth, September 9, 2002

PACS in Latin America: Opportunities and challenges, August 13, 2002

Copyright © 2003 AuntMinnie.com