The market for interventional radiology (IR) has experienced unprecedented growth over the last few years, but this growth was interrupted by the COVID-19 pandemic. Nevertheless, the IR market is forecast to resume its growth in 2021.

Minimally invasive procedures have evolved from limb-saving angioplasties in the 1960s to over 50 therapeutic procedures today. However, interventional radiology in 2020 faced significant challenges due to the novel coronavirus pandemic.

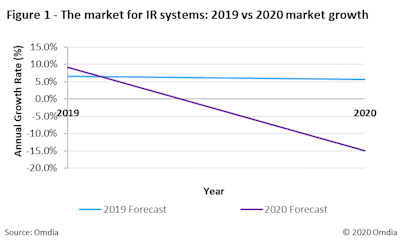

Procedural volumes have plummeted, resulting in depressed demand for systems (Figure 1), and hospital spending was diverted to critical care equipment. Nevertheless, following 2020, the market is forecast to return to growth for the next five years as the clinical benefits of minimally invasive procedures over traditional procedures drive increased demand.

Overcoming the COVID-19 hurdle in interventional cardiology

Interventional radiology is rapidly evolving, as there have been major developments in system integration tools, clinical applications for procedure guidance, dose management, and an increased understanding of optimal treatment methods. Procedure length and complexity have increased year-over-year and manufacturers are swiftly developing new tools and software capabilities to support clinicians.

Demand for general coronary and structural heart lab systems continued to rise, and over 45% of all interventional systems shipped in 2020 were within the interventional cardiology segment. Procedural volumes also rose year-over-year. There were approximately 80,500 procedures for transcatheter heart valve management (TAVR) in the U.S. market in 2019, and the procedure is projected to increase at a compound annual growth rate (CAGR) of over 10% between 2019 to 2023.

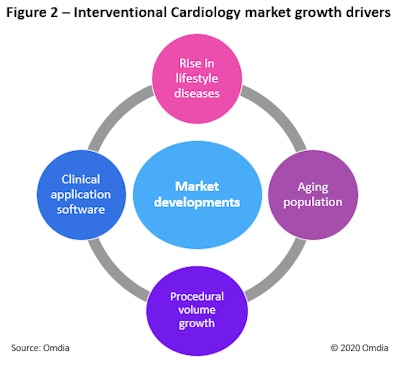

Early studies have shown the wider implications of COVID-19 on the heart. COVID-19 in conjunction with lifestyle diseases and aging populations are major market drivers (figure 2). Other market drivers include changes in systems preference that are placing increased focus on incorporation of robotic gantries, quick lab turnaround time, dose management, and image quality optimization.

Continued demand for hybrid operating rooms

In 2019 the market for hybrid operating rooms grew by over 10% as the total numbers of hybrid operating rooms being installed worldwide continued to grow. The systems aim to meet the changing treatment demands and sterility and image quality requirements. However, hybrid rooms are more expensive than traditional operating rooms due to inventory, construction, personnel costs, and utilization rate.

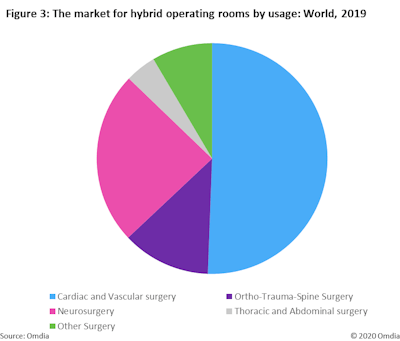

Despite the high cost, hybrid rooms enhance the surgical space by combining a conventional operating room with advanced medical imaging devices, and these rooms saw increased utilization in 2020. Cardiac and vascular surgery usage accounted for the largest percentage of systems shipped in 2019, due to high rates of cardiovascular disease (CVD), and the category is forecast to grow due to rising procedure volumes (figure 3). Rising procedure volumes also drove an increase of neurosurgeries and orthopedic-trauma-spine surgeries in 2019.

While the market for hybrid operating room systems declined in 2020 due to COVID-19, demand for the rooms is forecast at over a 5% CAGR from 2019-2024. There is an increased market focus in implementing the next generation of innovations such as artificial intelligence (AI), parameter adjustments, and robotics, which are forecast to drive strong global market growth.

2020 and beyond

The global market for interventional radiology systems has not been immune to the wider implications of COVID-19. Although minimally invasive surgeries have shown improved short-term outcomes in patients and are associated with faster recovery, less bleeding, etc., concerns have been raised about the use of minimally invasive surgery for patients potentially infected by COVID-19.

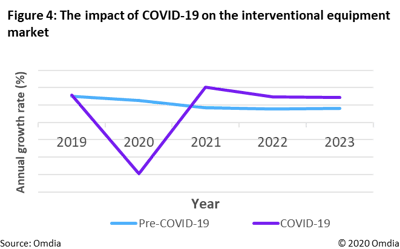

In 2020, procedure volumes for interventional radiology dropped sharply as hospitals took countermeasures to limit the spread of the virus, including suspending system installations and other nonessential work. These measures are forecast to drive a significant decline in unit shipments in 2020 (figure 4). To combat the challenges associated with COVID-19, manufacturers have improved their customer service by offering fast and responsive remote support and equipment servicing when possible.

Beginning in 2021, the interventional radiology market is expected to return to strong growth for the next five years, as demand for minimally invasive procedures, such as angioplasty/percutaneous transluminal angioplasty (PTA), peripheral atherectomy, transcatheter aortic valve replacement (TAVR), and transcatheter mitral valve repair (TMVRep), grows.

Omdia's Healthcare team recently published the Interventional, Mobile & Mini C-arm X-ray equipment market 2020 report, which provides a deep dive into the market dynamics for 12 types of systems: general vascular angiography, oncology/body, neurology, interventional gastrointestinal/multipurpose, general coronary, general coronary, and structural heart lab, electrophysiology, hybrid operating room systems, image intensifier C-arms, 2D flat-panel detector (FPD) C-arms, 3D FPD C-arm, and mini C-arms, with market size and forecasts from 2019-2024. The report is based on the collection of primary data from system manufacturers.

The comments and observations expressed are those of the author and do not necessarily reflect the opinions of AuntMinnie.com.