A new report on healthcare utilization at private U.S. insurance companies indicates that radiology use is declining while many other healthcare services are growing. The drop mirrors similar findings in the Medicare system, leading radiology backers to repeat charges that imaging is being singled out unfairly for cuts.

The report by the Health Care Cost Institute (HCCI), titled "Health Care Cost and Utilization Report: 2010," found that radiology procedure volume fell 5.4% in 2010 compared to 2009 among the three private payors that contributed data to the survey: Aetna, Humana, and UnitedHealthcare. The payors reported 1,185 radiology procedures per 1,000 insured individuals in 2010, compared with 1,253 procedures per 1,000 insured individuals in 2009.

The only other survey category that also declined was office visits to primary care providers, down 5.2% in 2010 compared to 2009. All other services posted increases, from 0.4% growth for visits to preventive care specialists to 3.9% growth for two categories: office visits to specialists and preventive visits to primary care providers.

Radiology was also the only loser in outpatient procedure volume, which decreased by 2.7%, from 400 procedures per 1,000 insured in 2009 to 389 in 2010. Meanwhile, the use of diagnostic testing (i.e., laboratory and pathology services) actually increased by 2.4%, ancillary services grew 0.6%, and the survey's "other categories" segment grew 5.9%.

Some of the losses in utilization appear to have been offset by price increases, however. Radiology experienced the highest growth in price per outpatient procedure during the time period, at 3.9%, HCCI found. The average price for a radiology procedure was $438 in 2009, compared with $455 in 2010. Price increases for other procedures ranged from 3.8% growth for lab/pathology procedures to 0.3% for "other categories."

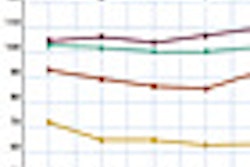

On the other hand, the institute found that radiology's price per professional procedure grew more modestly, rising only 1.1%, from $117 per procedure in 2009 to $118 per procedure in 2010. This growth rate was the lowest of all the medical services surveyed.

Price per professional procedure

|

HCCI is a newly formed independent healthcare research firm created last year to provide data on the causes of rising healthcare costs in the U.S. For its report, it gathered claims data from U.S. insurers Aetna, Humana, and UnitedHealthcare to determine what influences the utilization and costs of healthcare services among the privately insured, younger-than-65 population. Future reports from HCCI will include data from Kaiser Permanente, HCCI said.

"For years, health services researchers, actuaries, and economists relied heavily on Medicare data from the Centers for Medicare and Medicaid Services as it was one of the few sources of healthcare insurance claims data available," HCCI said in a statement. "Private claims data provide a different view of what drives healthcare spending in the United States."

Disturbing trend

HCCI's data reflect a disturbing trend, according to Gail Rodriguez, executive director of the Medical Imaging and Technology Alliance (MITA), but the findings are consistent with MITA's analysis of Medicare claims data, which found that imaging utilization per beneficiary declined by 3% in 2010.

"It's unsettling to see downward trends in the use of medical imaging services when research continues to underscore the tremendous value of imaging and radiation therapy technology in improving outcomes and reducing costs for patients and the healthcare system," Rodriguez told AuntMinnie.com. "Earlier this year, the Medicare Payment Advisory Commission confirmed a similarly alarming decline in the utilization of medical imaging services in the Medicare population in its annual report to Congress."

Medicare data already confirm that imaging use is down since 2008 and that Medicare spending on imaging is the same as it was in 2003; in addition, imaging is among the slowest growing physician service expenditures, said Cynthia Moran, the American College of Radiology's assistant executive director for government relations and health policy.

"Imaging is not a primary driver of healthcare costs, but it is a primary tool for saving and extending lives," Moran told AuntMinnie.com. "Imaging scans generally cost less than surgeries they replace and are a major factor in declining cancer death rates. Imaging exams reduce the number of invasive surgeries, unnecessary hospital admissions, and length of hospital stays, which, according to this latest HCCI report, continue to climb in price. Lawmakers need to reconsider their approach to imaging and embrace the fact that imaging is the future of medicine."