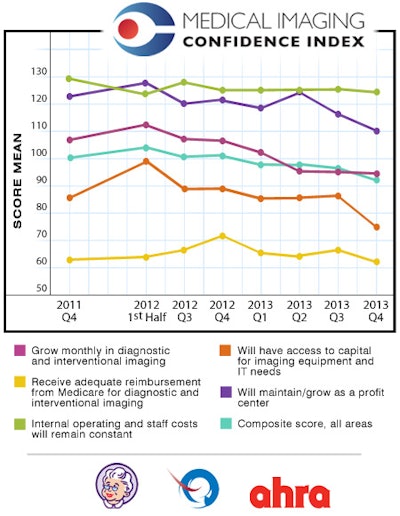

If you were hoping for good news on a comeback in radiology before this year's RSNA meeting, you may have to wait a little longer. Radiology administrators continue to have a pessimistic outlook for the fourth quarter of 2013, according to new data from the Medical Imaging Confidence Index (MICI).

Radiology administrators have hit rock bottom on one element of the index: their confidence that they will get access to capital for equipment purchasing in the fourth quarter of 2013, according to Christian Renaudin, CEO and founder of the MarkeTech Group, which conducted the survey of imaging directors and managers who are members of AHRA, the association for medical imaging management.

"Access to capital ... is significantly lower and at the lowest point since we created the index," Renaudin said in a Google Hangout discussing the numbers. "There is some concern about being able to get the capital budget."

The concerns were echoed by AHRA CEO Ed Cronin, who said in the Hangout that while the numbers were disappointing, he wasn't necessarily surprised.

"A lot of [our members] have been locked in a room for the month of October doing budgets, and this may be an indication that budgets are done and capital purchases are not being expected in the next year," he said. "Personally, I don't think it's a surprise [due to] the uncertainty with the whole healthcare debate, and with the way hospitals are going to get paid in the future. CFOs are being cautious."

Behind the MICI numbers

The forward-looking index surveyed 137 imaging directors and hospital managers, asking their opinions of five key trends typically encountered by radiology administrators.

MICI gathered survey participants from across the U.S., with 13% based in the Pacific region, 9% in the Mountain region, 12% in the West North Central region, 16% in the East North Central region, 10% in the Mid-Atlantic region, 17% in the South Atlantic region, 11% in the East South Central region, and 11% in the West South Central region.

Participants were asked to rate their optimism about five topics, and a single composite score including all five categories was also tabulated. Scores range from 0 to 200 and can be interpreted as follows:

- < 50 = extremely low confidence

- 50 to 69 = very low confidence

- 70 to 89 = low confidence

- 90 to 110 = an ambivalent score (neutral)

- 111 to 130 = high confidence

- 131 to 150 = very high confidence

- > 150 = extremely high confidence

As noted by Renaudin and Cronin, there was a statistically significant drop in administrators' confidence that they would have access to capital, with a score of 75 in the current survey, compared with 87 in the third-quarter figures. For point of reference, the category's score in the first-half 2012 MICI survey was 99.

Other MICI numbers showed statistically significant drops compared to past surveys. For example, when asked about whether they would maintain or grow as a profit center, administrators reported a score of 112 in the current survey; by comparison, their score in the first-half 2012 MICI survey was 128, a statistically significant decline.

The fourth-quarter MICI numbers are the subject of the Google Hangout below between Cronin, Renaudin, and Brian Casey, AuntMinnie.com's editor in chief.

As RSNA 2013 approaches, Renuadin believes the Q4 MICI numbers could be a sign to vendors that they might need to change the approach that's worked so well in the past in terms of introducing new technology into the radiology market.

"This index shows that vendors should not forget economic reality," he said in the Hangout. "When you bring innovation to market, you attempt to charge a premium for it, but unfortunately the market may not have the capacity to pay for the innovation that it used to."